Swiss Franc The Euro has fallen by 0.22% to 1.0942 EUR/CHF and USD/CHF, September 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Oil prices surged in the initial reaction to the unprecedented drone attack on Saudi Arabia facilities. Saudi Arabia may be able to restore around half of the lost production in a few days. Saudi Arabia and other countries, including the US, prepared to tap strategic reserves, oil...

Read More »FX Daily, July 11: Powell Spurs Equity and Bond Market Rally, While the Greenback Falls Out of Favor

Swiss Franc The Euro has fallen by 0.06% at 1.1123 EUR/CHF and USD/CHF, July 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Fed’s Powell confirmed a Fed rate cut at the end of this month by warning that uncertainties since the June FOMC had “dimmed the outlook” and that muted price pressures may be more persistent. It ignited an equity and bond market rally...

Read More »Emerging Markets: Preview of the Week Ahead

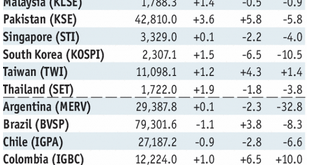

Stock Markets EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned. With US rates pushing higher, we think the...

Read More »Emerging Markets: What has Changed

Summary Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly. Moody’s cut its 2018...

Read More »Emerging Market Week Ahead Preview

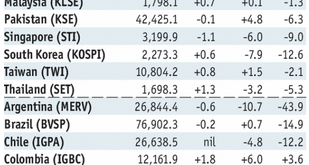

Stock Markets EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday. Stock Markets Emerging Markets, August 29 - Click to enlarge Korea Korea reports August CPI Tuesday, which is expected to rise 1.4% y/y...

Read More »As Emerging Market Currencies Collapse, Gold is being Mobilized

In recent weeks, global financial markets have been increasingly spooked by an intensifying crisis in emerging market currencies including those of Turkey and Argentina. Add to this the ongoing currency crisis in Venezuela and the currency problems of Iran. While all of these countries have economy specific reasons that explain at least some of their currency weakness, there are some common themes such as a stronger US...

Read More »FX Weekly Preview: Macroeconomic Considerations

The force that had pushed the US 10-year Treasury yield to 3% and the dollar above JPY113 at the start of the month, and the euro to $1.13 a couple of weeks ago has dissipated. The 10-year yield is near 2.80%. The dollar was near two-month lows against the yen a week ago, and the euro was back toward the middle of its previous $1.15-$1.18 trading range. Even the Australian dollar, the worst performing of the major...

Read More »Emerging Markets: Week Ahead Preview

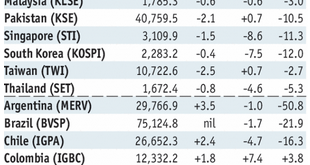

Stock Markets EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM. Stock Markets Emerging Markets, August 22 - Click to...

Read More »Emerging Markets: Preview of the Week Ahead

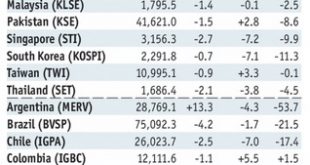

Stock Markets EM FX stabilized last week as the situation in Turkey calmed somewhat. Reports Friday that the US and China are hoping to resolve the trade dispute also helped EM FX ahead of the weekend. However, TRY remains vulnerable as the US threatens more sanctions due to the pastor. Both S&P and Moody’s downgraded it ahead of the weekend and our own ratings model points to further downgrades ahead. Turkish...

Read More »Emerging Markets: Preview of the Week Ahead

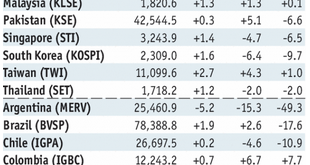

Stock Markets EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW. Stock Markets Emerging Markets, August 01 - Click...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org