Swiss Franc The Euro has risen by 0.08% to 1.0521 EUR/CHF and USD/CHF, May 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Another late sell-off in US shares, this one perhaps related to the sobering assessment by the leading medical adviser for the Trump Administration about the risks of opening too early, failed to deter investors in the Asia Pacific region. Although Japanese shares slipped, most other...

Read More »FX Daily, May 7: China Reports an Unexpected Jump in Exports, While Norway Surprises with a Rate Cut

Swiss Franc The Euro has risen by 0.10% to 1.0532 EUR/CHF and USD/CHF, May 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is a sense of indecision in the air today. There have been several developments, but investors seem mostly reluctant to extend positions. China reported a surge in exports in April and an increase in the value of reserves. Australia reported a rise in exports in March. The Bank of...

Read More »FX Daily, May 6: The Euro is Knocked Back Further

Overview: The late sell-off in US stocks yesterday has not prevented gains in Asia and Europe. Most of the equity markets, including the re-opening of China, gain more than 1%. Australia was a notable exception, falling about 0.4%, and Taiwan was virtually flat. European bourses opened higher but made little headway before some profit-taking set in, while US shares are trading higher. Benchmark 10-year yields are firmer, and the US Treasury yield is near 67 bp...

Read More »FX Daily, April 27: Equities Rally and the Dollar Eases to Start the Week

Swiss Franc The Euro has risen by 0.42% to 1.0572 EUR/CHF and USD/CHF, April 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are beginning the new week on an upbeat note. All the markets in the Asia Pacific region rallied, led by more than 2% gains in the Nikkei and Taiwan. European bourses are higher. All the industry groups are participating and financials and consumer discretionary...

Read More »An International Puppet Show

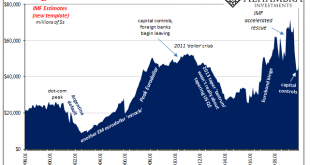

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount. Very reassuring. The IMF is becoming like the Federal...

Read More »FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

Swiss Franc The Euro has fallen by 0.26% to 1.056 EUR/CHF and USD/CHF, March 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today....

Read More »FX Daily, March 18: Bonds Join Equities in the Carnage

Swiss Franc The Euro has fallen by 0.27% to 1.0537 EUR/CHF and USD/CHF, March 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A new phase of the market turmoil is at hand. Bonds are no longer proving to be the safe haven for investors fleeing stocks. The tremendous fiscal and monetary efforts, with more likely to come, have sparked a dramatic rise in yields. Meanwhile, equities are getting crushed again....

Read More »Is GFC2 Over?

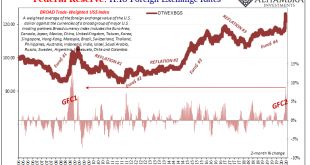

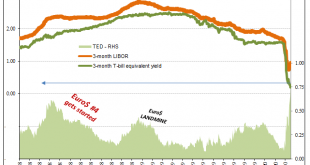

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either. Stocks rebounded because of “major helicopter stimulus” or because that’s just what stocks do during times like these. Some of the biggest up days have followed, and are often found in between, the greatest...

Read More »Time Again For Triple Digit Dollar

Being a member of the institutional “elite” means never having to say you’re sorry; or even admit that you have no idea what you are doing. For Christine Lagarde, Mario Draghi’s retirement from the European Central Bank could not have come at a more opportune moment. Fresh off the Argentina debacle, she failed herself upward to an even better gig. Lagarde had staked a lot on the organization’s largest ever rescue plan. It was a show of force meant to shore up...

Read More »You Shouldn’t Miss The Cupom

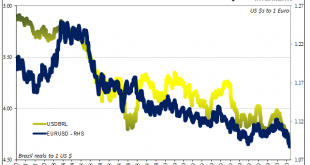

I actually wanted to focus on this yesterday but confirmation wasn’t forthcoming until today. So, it ended up being a broader note on the dollar which only included some mention of Brazil in passing. Still a worthwhile couple of minutes. There were rumors that Banco (central) do Brasil was intervening or was going to intervene in its local currency markets, which may be an important signal. More of swaps that aren’t really currency swaps (which you can read about...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org