Swiss Franc The Euro has fallen by 0.07% to 1.0754 EUR/CHF and USD/CHF, January 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The animal spirits are on the march today. Equities are mostly higher, peripheral European bonds are firm, and the dollar is mostly softer. After posting the first back-to-back decline this year, the MSCI Asia Pacific Index bounced back today, led by a 2.7% gain in Hong Kong...

Read More »FX Daily, December 15: The Bulls are Emboldened

Swiss Franc The Euro has risen by 0.12% to 1.0775 EUR/CHF and USD/CHF, December 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P fell for the fourth consecutive session yesterday, the longest losing streak of the quarter, and this seemed to encourage profit-taking in the Asia Pacific region today. The MSCI Asia Pacific Index slipped for the second consecutive session, and even confirmation of the...

Read More »FX Daily, December 9: Hope Burns Eternal

Swiss Franc The Euro has fallen by 0.05% to 1.0753 EUR/CHF and USD/CHF, December 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The market is hopeful today. The Johnson-von der Leyen dinner is seen as evidence that both sides see one more opportunity, and sterling is among the strongest currencies today. Hopes of a $900 bln+ fiscal stimulus package in the US helped stir animal spirits and lift US stocks to...

Read More »FX Daily, November 24: Diverging PMIs Fail to Give the Dollar Lasting Support

Swiss Franc The Euro has risen by 0.04% to 1.0808 EUR/CHF and USD/CHF, November 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The contrast between the eurozone and US preliminary PMI readings caught the short-term market leaning the wrong way, and the dollar snapped back after extending its recent losses. However, today the US dollar is back on its heels and returning to yesterday’s lows against most major...

Read More »FX Daily, October 28: Animal Spirits Called in Sick

Swiss Franc The Euro has fallen by 0.34% to 1.068 EUR/CHF and USD/CHF, October 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Sickened by the surging virus, animal spirits are bed-ridden today. Several European countries are experiencing the most fatalities and illnesses in several months, and policymakers are responded with national restrictions. In 32 US states, hospitalizations have surged by over 10% in...

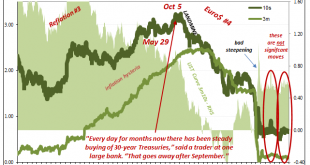

Read More »Why Aren’t Bond Yields Flyin’ Upward? Bidin’ Bond Time Trumps Jay

It’s always something. There’s forever some mystery factor standing in the way. On the topic of inflation, for years it was one “transitory” issue after another. The media, on behalf of the central bankers it holds up as a technocratic ideal, would report these at face value. The more obvious explanation, the argument with all the evidence, just couldn’t be true otherwise it’d collapse the technocracy right down to the ground. And so it was also in the bond market....

Read More »FX Daily, September 17: Powell Lets Steam Out of Equities and Spurs Dollar Short-Covering

Swiss Franc The Euro has risen by 0.02% to 1.0743 EUR/CHF and USD/CHF, September 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Profit-taking after the FOMC meeting saw US equities and gold sell-off. The high degree of uncertainty without fresh stimulus did not win investors’ confidence. The Fed signaled rates would likely not be hiked for the next three years, and without additional measures, that appears...

Read More »FX Daily, July 1: Second Verse Can’t be Worse than the First, Can it?

Swiss Franc The Euro has risen by 0.04% to 1.0641 EUR/CHF and USD/CHF, July 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The resurgence of the contagion in the US has stopped or reversed an estimated 40% of the re-openings, but the appetite for risk has begun the second half on a firm note, helped by manufacturing PMIs that were above preliminary estimates or better than expected. Except for Tokyo and...

Read More »FX Daily, May 20: Fed Funds Futures No Longer Imply Negative Rates

Swiss Franc The Euro has fallen by 0.13% to 1.0592 EUR/CHF and USD/CHF, May 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Another late sell-off of US equities, ostensibly on questions over Moderna’s progress on a vaccine, failed to deter equity gains in the Asia Pacific region. China was a notable exception, but the MSCI Asia Pacific Index rose for the fourth consecutive session. European shares are little...

Read More »FX Daily, May 18: Yuan Slumps as US-Chinese Tensions Rise

Swiss Franc The Euro has risen by 0.18% to 1.0525 EUR/CHF and USD/CHF, May 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Despite somber warnings that the US economic recovery can stretch to the end of next year, investors have begun the new week by taking on new risks. Most equity markets in the Asia Pacific region rose, with Australia leading the large bourses with a 1% gain. India was an outlier,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org