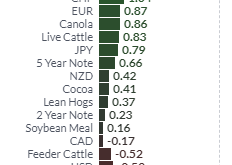

Close Gain/Loss On Week Gold $1248.40 +$10.10 +2.19% Silver $14.63 +$0.25 +3.25% XAU 67.94 +2.40% +5.40% HUI 153.93 +2.58% +6.13% GDM 560.05 +2.34% +5.32% JSE Gold 1201.13 -0.09 +9.31% USD 96.60 -0.14 -0.61% Euro 114.10 +0.24 +0.80% Yen 88.80 +0.01 +0.67% Oil $52.61 +$1.12 +3.30% 10-Year 2.856% -0.031 -4.86% Bond 143.90625 +0.34375 +2.27% Dow 24388.95 -2.24% -4.50% Nasdaq 6969.25 -3.05% -4.93% S&P 2633.08 -2.33%...

Read More »The Prodigal Parent, Report 9 Dec 2018

The Baby Boom generation may be the first generation to leave less to their children than they inherited. Or to leave nothing at all. We hear lots—often from Baby Boomers—about the propensities of their children’s generation. The millennials don’t have good jobs, don’t save, don’t buy houses in the same proportions as their parents, etc. We have no doubt that attitudes have changed. That the millennials’ financial...

Read More »Why Buy Gold Now? Because Of The “I Don’t Knows”…

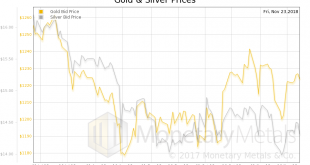

From 2000 through 2012, the price of gold increased every year, rising from around $280 an ounce to nearly $1,700. It was an unprecedented run. Then, in 2013, gold took a nose dive, losing over 27% of its value. It was widely reported that the Swiss National Bank, the former bastion of monetary conservatism, lost $10 billion that year just on its gold holdings. As you probably know, central banks hold a portion of their...

Read More »Inflation, Report 2 Dec 2018

What is inflation? Any layman can tell you—and nearly everyone uses it this way in informal speech—that inflation is rising prices. Some will say “due to devaluation of the money.” Economists will say, no it’s not rising prices per se. That is everywhere and always the effect. The cause, the inflation as such, is an increase in the quantity of money. Which is the same thing as saying devaluation. It is assumed that each...

Read More »A Golden Renaissance, Report 25 Nov 2018

A major theme of Keith’s work—and raison d’etre of Monetary Metals—is fighting to prevent collapse. Civilization is under assault on all fronts. The Battles for Civilization There is the freedom of speech battle, with the forces of darkness advancing all over. For example, in Pakistan, there are killings of journalists. Saudi Arabia apparently had journalist Khashoggi killed. New Zealand now can force travellers to...

Read More »The Ultimate Stablecoin, Report 18 Nov 2018

A long time ago in a galaxy far, far away we wrote a series of articles arguing that bitcoin is not money and is not sound. Bitcoin was skyrocketing at the time, as we wrote most of them between July 30 and Oct 1 last year. Back in those halcyon days, volatility was deemed to be a feature. That is, volatility in the upward direction was loved by everyone who said that bitcoin is money, in their desire to make money. In...

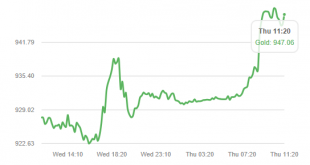

Read More »Pound Falls 2.5 percent Against Gold as UK Government in Turmoil Over Brexit

The pound plunged against the euro, the dollar, gold and all leading currencies today as Theresa May’s UK government appeared vulnerable to collapsing and political turmoil risked creating a hard Brexit. The pound has fallen 2.6% against gold in less than twenty four hours seeing gold rise from £923 to £947 per ounce in sterling terms. The pound slumped the most in more than 17 months as several U.K. ministers resigned...

Read More »The Failure of a Gold Refinery, Report 12 Nov 2018

So this happened: Republic Metals, a gold refiner, filed bankruptcy on November 2. The company had found a discrepancy in its inventory of around $90 million, while preparing its financial statements. We are not going to point the Finger of Blame at Republic or its management, as we do not know if this was honest error or theft. If it was theft, then we would not expect it to be a simple matter of employees or...

Read More »Wizard’s First Rule, Report 4 Nov 2018

Terry Goodkind wrote an epic fantasy series. The first book in the series is entitled Wizard’s First Rule. We recommend the book highly, if you’re into that sort of thing. However, for purposes of this essay, the important part is the rule itself: “Wizard’s First Rule: people are stupid.” “People are stupid; given proper motivation, almost anyone will believe almost anything. Because people are stupid, they will believe...

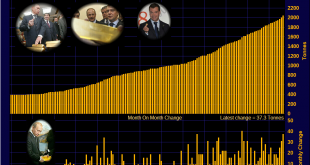

Read More »Does the recent spate of Central Bank gold buying impact demand and price?

There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org