The LBMA (London Bullion Market Association) annual forecast survey published last week shows that forecasters expect the average gold price to rise 11.5% in 2021 to US73.8 (forecasters’ average) from the actual average gold price in 2020 of US69.6, and for the silver price to rise 38.7% in 2021 to US.50 from the actual annual average of US.55 in 2020. These expected averages show silver might gain three times more percentage than that of gold in 2021. There was, of course, a wide range of views among forecasters with a US0 price difference between the highest forecast for the average price of gold for 2021 at US00 and the lowest at US50. And for silver the range was US with the highest annual average forecast at US and the lowest at

Topics:

Stephen Flood considers the following as important: 2021 Precious Metals Forecast Survey, 6a.) GoldCore, 6a) Gold & Bitcoin, Annual Market Review, Commentary, Featured, gold price forecast, Gold Price Forecast 2021, LBMA Forecast Survey Results 2021, newsletter, Silver Price Forecast 2021, Silver Price Forecast. LBMA Forecast Survey Results

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

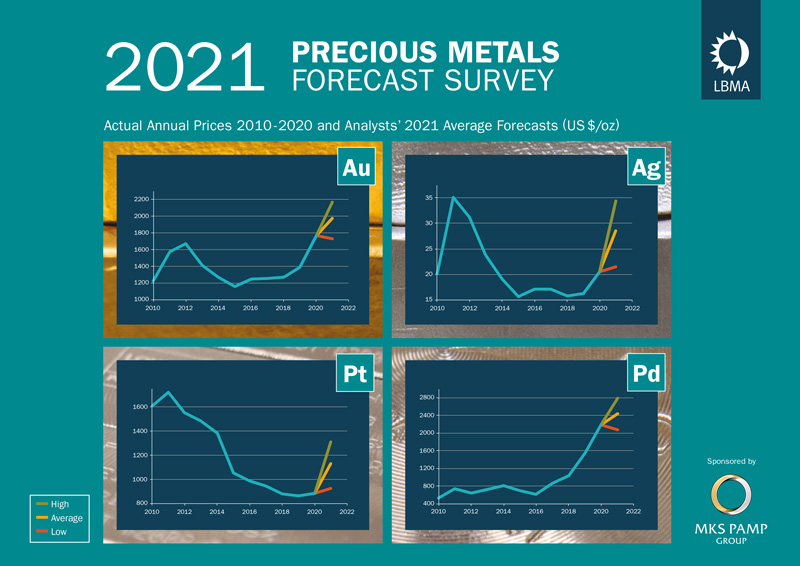

The LBMA (London Bullion Market Association) annual forecast survey published last week shows that forecasters expect the average gold price to rise 11.5% in 2021 to US$1973.8 (forecasters’ average) from the actual average gold price in 2020 of US$1769.6, and for the silver price to rise 38.7% in 2021 to US$28.50 from the actual annual average of US$20.55 in 2020. These expected averages show silver might gain three times more percentage than that of gold in 2021. There was, of course, a wide range of views among forecasters with a US$650 price difference between the highest forecast for the average price of gold for 2021 at US$2300 and the lowest at US$1650. And for silver the range was US$28 with the highest annual average forecast at US$47 and the lowest at US$19.00. The top three drivers for a higher gold price forecasters point to are:

Looking back at previous LBMA forecasts shows us that gold and silver price movements have surprised to the upside. We note that the forecasted annual average gold price for 2020 was an increase of 12% to US$1559 but the actual average price increased 27.0% to US$1770.19. The actual average silver price rose by 26.8% to US$20.55, and the forecasted rise was for only 12.4% to US$18.2. Remember that this discussion so far has been about the average annual price increases; which is distinct from any price move between New’s Year Day and the subsequent New Year’s Eve. For 2020 the New Year’s Day to New Year’s Eve gold price increased 25.3% and the silver price 46.8%. |

|

Watch Louis Gave on the Latest Episode of GoldCore TVFurthermore, we note that the gold price has risen more than the forecast average four out of the five years since the bull market started in 2016! The results for the silver price since 2016 have been more mixed since 2016. The average forecasted price for silver less than a dollar difference from actuality in two of the years. The forecasted price was well below the actual price in two of the years since 2016 and the actual price surprised to the upside in one year. |

|

In addition to the top three reasons for the gold price to rise that we noted above, forecasters gave a variety of additional reasons to remain bullish on the gold price, some of these are highlighted below:

Many of the arguments that forecasters cited for rising gold prices also apply to silver – at the increased price momentum of circa of 3 to 1 according to the increased average annual forecast price over 2020. Forecasters also cited specific arguments for the rise in the silver price to shine in 2020, which include:

|

|

What About the Bearish Factors?Of course, in any market there are also bearish factors that come into play. The bearish forecasters were a minority in the survey but some of the key reasons given that gold and silver prices could slide back in 2021 are:

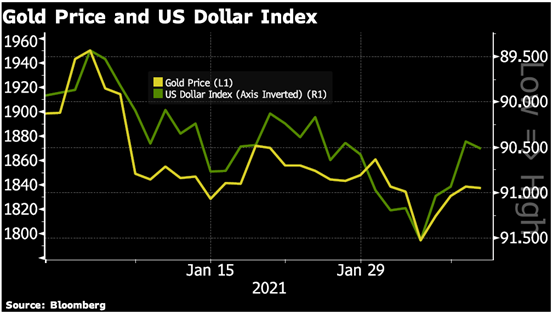

Some of these bearish factors have certainly taken hold of the gold price this year-to- date. The gold price has declined 5.33% in US dollar terms (from US$1943.20 to US$1839.60 through Feb 9) from the 2020 closing price. The gold price sluggishness is due to the higher US dollar, uncertainty regarding additional fiscal stimulus plans and central banks in wait-and-see mode. The challenges many countries are having with their vaccine roll-out programs and the delays in a return to ‘normal’ economic activity is not helping gold either. |

Gold Price and US Dollar Index, 2021 |

Tags: 2021 Precious Metals Forecast Survey,Annual Market Review,Commentary,Featured,gold price forecast,Gold Price Forecast 2021,LBMA Forecast Survey Results 2021,newsletter,Silver Price Forecast 2021,Silver Price Forecast. LBMA Forecast Survey Results