The German stock exchange has been experimenting with DLT solutions for some time. (Keystone / Arne Dedert) A consortium of Swiss firms has joined forces with Germany’s main stock exchange to create a distributed ledger technology (DLT) trading system that would rival one being built by the Swiss stock exchange. The alliance is between Deutsche Börse, Switzerland’s state-owned telecoms company Swisscom, budding Swiss...

Read More »The Duality of Money, Report 10 Mar

This is a pair of photographs taken by Keith Weiner, for a high school project. It seemed a fitting picture for the dual nature of money, the dual nature of wood both as logs to be consumed and dimensional lumber to be used to construct buildings. Last week, in Is Capital Creation Beating Capital Consumption, we asked an important question which is not asked nearly often enough. Perhaps that’s because few even...

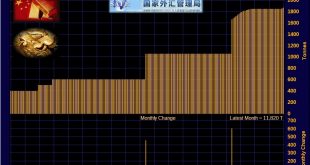

Read More »China Gold Reserves Rise To 60.26 Million Ounces Worth Just $79.5 Billion

China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning. The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces. The People’s Bank of China...

Read More »Bitcoin Bottom Building

Defending 3,800 and a Swing Trade Play For one week, bulls have been defending the 3,800 USD value area with success. But on March 4th they had to give way to the constant pressure. Prices fell quickly to the 3,700 USD level. These extended times of range bound trading are typical for Bitcoin Bottom Building in sideways ranges. This 60 minute chart of Bitcoin shows (represented by the yellow candlestick wicks) how the...

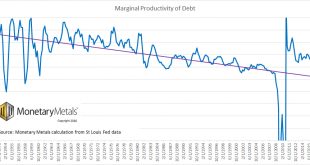

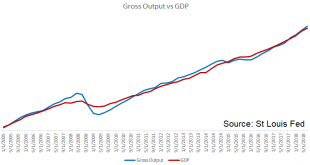

Read More »Is Capital Creation Beating Capital Consumption? Report 3 Mar

We have written numerous articles about capital consumption. Our monetary system has a falling interest rate, which causes both capital churn and conversion of one party’s wealth into another’s income. It also has too-low interest, which encourages borrowing to consume (which, as everyone knows, adds to Gross Domestic Product—GDP). What Is Capital At the same time, of course entrepreneurs are creating new capital. Keith...

Read More »The Gold Debate – Where Do Things Stand in the Gold Market?

A Recurring Pattern When the gold price recently spiked up to approach the resistance area even Aunt Hilda, Freddy the town drunk, and his blind dog know about by now, a recurring pattern played out. The move toward resistance fanned excitement among gold bugs (which was conspicuously lacking previously). This proved immediately self-defeating – prices pulled back right away, as they have done almost every time when...

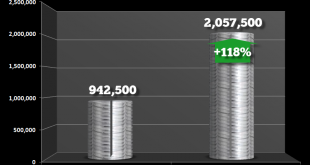

Read More »U.S. Mint Suspends Silver Bullion Coin Sales After Sales Double In February

U.S. Mint suspends silver bullion coin sales after sales double in February Silver investment demand for American Eagles (one ounce) silver bullion coins depletes West Point Mint inventories U.S. Mint suspended sales of American Eagle (1 oz) coins on Feb. 21 because it had no coins left to sell With increased investment demand, the Mint is experiencing a resurgence in steady demand with sustained purchases of the...

Read More »Swiss private banking giant dips toes into crypto scene

The 125-year-old Swiss private bank is ready for some crypto action. (© Keystone / Ennio Leanza) One of Switzerland’s largest banks, Julius Baer, has entered the cryptoassets world by announcing a partnership with budding crypto bank start-up SEBA. While other Swiss banks, such as Vontobel, Falcon and Swissquote, are already active in the space, Julius Baer’s entrance has attracted particular attention. The obvious...

Read More »What’s Up With Australia’s 80 Tonnes Of Gold At The Bank Of England?

Recently, news network RT.com asked for comments on the question of the 80 tonnes of the Reserve Bank of Australia’s (RBA) gold reserves and their supposed storage location at the Bank of England’s gold vaults in London. Based on some of those comments I made, RT has now published an article in its English language news website at www.rt.com about this Australian gold that the RBA claims is held in London. The RT.com...

Read More »Central Planning Is More than Just Friction, Report 17 February

It is easy to think of government interference into the economy like a kind of friction. If producers and traders were fully free, then they could improve our quality of life—with new technologies, better products, and lower prices—at a rate of X. But the more that the government does, the more it burdens them. So instead of X rate of progress, we get the same end result but 10% slower or 20% slower. Some would go so...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org