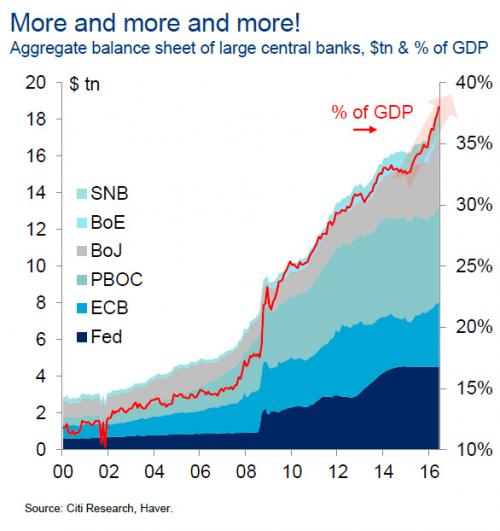

If the world’s economies still need central bank life support to survive, they aren’t healthy–they’re barely clinging to life. The “recovery”/Bull Market is in its 10th year, and yet central banks are still tiptoeing around as if the tiniest misstep will cause the whole shebang to shatter: what are they so afraid of? The cognitive dissonance / crazy-making is off the charts: On the one hand, central banks are still pursuing unprecedented stimulus via historically low interest rates, liquidity and easing the creation of credit on a vast scale. Some central banks continue to buy assets such as stocks and bonds to directly prop up the “market.” (If assets don’t actually trade freely, is it even a market?) On the other

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

If the economy is truly expanding organically, i.e. under its own power, then it doesn’t need the life-support of manipulated low interest rates, trillions of dollars in central bank asset purchases, trillions of dollars in backstopping, guarantees, credit swaps, etc.

If the economy were truly recovering, wouldn’t central banks have tapered their stimulus and intervention long ago? Instead, central bank stimulus skyrocketed to new highs in 2015-2017 as global markets took a slight wobble. That little slide triggered a massive central bank response, as if the patient had just suffered a cardiac arrest.

|

Central Bank Balance sheet |

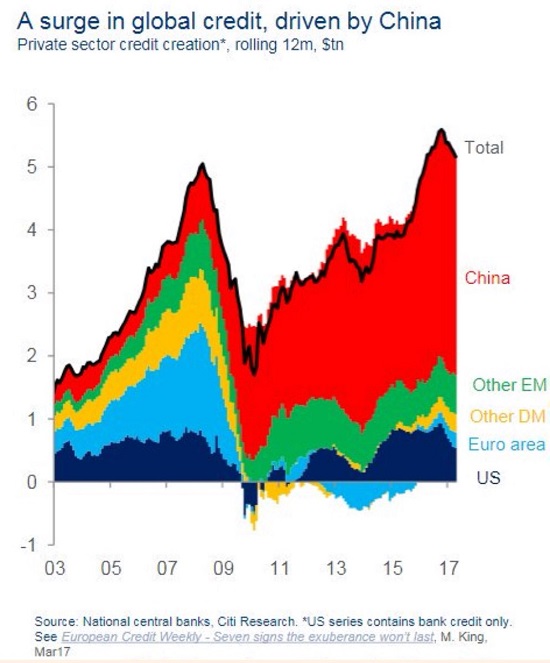

| As for China’s economy being so healthy–then why are Chinese authorities expanding credit in such manic desperation? Healthy economies growing organically don’t need authorities pumping trillions of yen, yuan, euros and dollars into credit and asset markets.

So what are central banks so afraid of? Why are they still tiptoeing around in fear after 10 years of unprecedented stimulus? The answer is as obvious as the emperor’s buck-naked body: central banks know the global economy is so brittle, so fragile and so dependent on cheap credit for its survival that the slightest contraction in credit will collapse the entire system.

If the world’s economies still need central bank life support to survive, they aren’t healthy–they’re barely clinging to life. The idea that central banks can wean a sick-unto-death global economy off life support is magical thinking, and central banks know it.

|

A surge in global credit, driven by China |

It’s one or the other: if the patient is healthy, then withdraw all stimulus and let interest rates go wherever market participants take them. If the patient is actually extremely ill, then maybe we should look beyond central banks propping up a rotten, corrupt, exploitive, venal, parasitic, predatory status quo to systemic transformation.

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the book's website.

Tags: Featured,newsletter