Swiss Franc The Euro has fallen by 0.13% at 1.14 EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) - Click to enlarge FX Rates Overview: There is one main story today, and that is the resumption of the slide in equities. It is having a ripple effect through the capital markets. Bond yields are tumbling. Gold is firm. The dollar is narrowly mixed, though the yen stands out with almost a 0.5%...

Read More »Cool Video: Bloomberg Discussion of Late US Cycle

An assessment of the US economy is an important input into the expectations of the dollar’s behavior in the foreign exchange market. As a currency strategist, my views of the US economy are often subsumed in discussions or talked about indirectly by talking about Fed policy. However, in this clip with Alix Steel and David Westin, I have an opportunity to sketch outlook for the US economy. I agree with those that do...

Read More »FX Daily, October 22: Collective Sigh of Relief?

Swiss Franc The Euro has fallen by 0.24% at 1.1435 EUR/CHF and USD/CHF, October 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US Dollar: After a slow start in Asia, the US dollar has turned better bid. The euro recovered from $1.1430 before the weekend to $1.1550 today, where an option for almost 525 mln euros expires today. There is another option (1.6 bln euros) at...

Read More »FX Weekly Preview: What Can Bite You This Week?

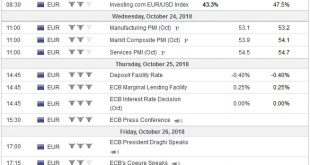

Several major central banks will meet next week, including the European Central Bank, but it is only the Bank of Canada that is expected to hike rates. The flash PMIs and the first official estimate of Q3 US GDP are among the data highlights. Beyond the events and data, the volatility from global equity markets from Shanghai to New York will continue to have a strong influence on other capital markets. Also, the...

Read More »FX Daily, October 18: China’s Angst Stays Local

Swiss Franc The Euro has fallen by 0.07% at 1.1436 EUR/CHF and USD/CHF, October 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asian equities were lower, led by a nearly 3% drop in Shanghai, while European shares shrugged it off and the Dow Jones Stoxx 600 is up about 0.4% in late morning turnover. The S&P 500 is off by about 0.25%. Global bond yields...

Read More »Brexit: Five FAQs

Q. The UK voted in s referendum to leave the EU in June 2016. It will happen at the end of March 2019. What is the status of the negotiations? A: It had been hoped that the two sides would be close enough to allow a special summit to be called next month to finalize an agreement. This seems a bit premature, but an agreement still seems likely shortly. There are two stumbling blocks. The first is the Irish border. The...

Read More »FX Daily, October 17: Greenback is Little Changed While Stocks Recover

Swiss Franc The Euro has fallen by 0.13% at 1.1449 EUR/CHF and USD/CHF, October 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Led by a dramatic recovery in US stocks, global equities are moving higher today. Before last week, decline, the US stock market lacked breadth, but not only did the S&P 500 and NASDAQ post their biggest advance in several...

Read More »Great Graphic: What is Happening to Global Equities?

The decline in the global equity market is the most serious since the February and March spill. In this Great Graphic, the white line is the S&P 500. With the setback, it is up a little more than 8% for the year. It managed to recover fully from the sell-off earlier in the year. The fuchsia line is the MSCI World Index of developed countries. It is up 1.25% year-to-date, and it never managed to take out the high set...

Read More »FX Daily, October 16: Semblance of Stability Returns

Swiss Franc The Euro has risen by 0.32% at 1.1461 EUR/CHF and USD/CHF, October 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Although the S&P 500 was unable to sustain early gains yesterday, the largely consolidative session was part of the stabilization of equities after last week’s jump in volatility. Asia and European stocks are also cautiously...

Read More »Macro Cheat Sheet

Key considerations and price for selected currencies distilled into four bullet points.US Dollar The dollar’s recovery ahead of the weekend was aided by the stabilization of the stock market, where the S&P 500 managed to close back above the psychologically important 200-day moving average. Interpolating from prices, the market does not expect the President’s criticism to alter the Fed’s course. US data highlights...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org