Several major central banks will meet next week, including the European Central Bank, but it is only the Bank of Canada that is expected to hike rates. The flash PMIs and the first official estimate of Q3 US GDP are among the data highlights. Beyond the events and data, the volatility from global equity markets from Shanghai to New York will continue to have a strong influence on other capital markets. Also, the escalating tension between the EC and Italy over 2019 fiscal issues poses another challenge. The bad loan burden at Italian banks, the indebtedness of the government, and what has been political paralysis makes for a poor backdrop for the current clash. The populist-nationalist government of the Five Star

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, CAD, Canada, ECB, EUR, Featured, Italy, newsletter, SPX, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Several major central banks will meet next week, including the European Central Bank, but it is only the Bank of Canada that is expected to hike rates. The flash PMIs and the first official estimate of Q3 US GDP are among the data highlights. Beyond the events and data, the volatility from global equity markets from Shanghai to New York will continue to have a strong influence on other capital markets. Also, the escalating tension between the EC and Italy over 2019 fiscal issues poses another challenge.

The bad loan burden at Italian banks, the indebtedness of the government, and what has been political paralysis makes for a poor backdrop for the current clash. The populist-nationalist government of the Five Star Movement and the League have made electoral promises that the country can ill-afford. For the northern business, the League has pushed for lower taxes and a liberal tax amnesty. As champion of the poor south, the Five Star Movement wants aid package and a limited tax holiday. Both parties want to roll back the pension reform. These type of policies repel rather than attract global savings, and Italian yields have jumped as has the premium over Germany, on the one hand, and Spain on the other.

The EC has formally requested an explanation for the budget and Italy has until October 22 to respond. It is difficult to imagine any explanation that would satisfy Brussels and hence the EC could announce that it is returning the budget proposals back to Italy for revisions. This would be unprecedented and reflects too the evolving institutional capacity of the EC.

It is in the EC may try to turn the conflict back within Italy itself. For example, Italy’s Parliamentary Budget Office watchdog refused to endorse the budget because of the optimistic budget assumptions. There also seems to be a dispute within the government about the extent of the tax amnesty.

The EU’s strategic interests may be best served by recognizing the electoral results and accept some changes in fiscal policy with some optimistic economic projections, but insist that the Italian government pledges remedial action next year if there is greater deterioration than it projects. This would also give the EU some leeway insist on no reversing structural changes, like unwinding pension reform.

Just before the weekend Moody’s made good on its review announced in May and became the first of the major rating agencies to reduce Italy’s rating from the equivalent of BBB. Moody’s now rates Italy Baa3 (=BBB-). It was seen as the rating agency most likely to cut Italy, but it returned to a stable outlook which eased the risk of losing its investment grade status. In the coming days, Moody’s can be expected to adjust the rating of other entities in which the government’s rating is the cap.

S&P will announce its decision on Italy’s credit rating at the end of next week. Recall that a year ago, it surprised the world by upgrading Italy’s credit rating. It is in no hurry to reverse itself. A cut in the outlook to negative would not be surprising, given the supply dynamics implied by the new projections, and as the ECB finishes its new net purchases at the end of the year. Remember for the ECB, the highest rating is most important not the lowest.

The ECB meets. It is going to indicate that the tapering of the asset purchases is taking place smoothly and that it still aims to complete the net new purchases at year-end. Also, Draghi can be expected to reaffirm that the ECB does not anticipate raising rates until after next summer.

Either Draghi will volunteer it, or reporters will try to drag out of him– an opinion about fiscal policy. It is not just Italy that seeks a larger deficit. France and Spain also proposed larger deficits, for example, and even what had previously been agreed allowed France to have a substantially larger deficit than Italy. Draghi will likely be more diplomatic than Bundesbank President Weidmann, whose star appears to have dimmed to succeed Draghi at the helm of the ECB. The euro has fallen on days the ECB met this year except last month. The harder Draghi is on Italy, where he previously was Governor of the central bank, the more likely the euro will return to its pattern.

In September, Draghi placed much emphasis on the improvement in the labor market (and implicitly the Phillips Curve). While labor market conditions have not changed much since the last ECB meeting, the sentiment surveys continue to soften. With the gradual exit from the extraordinary monetary measures underway, Draghi is under situational pressure to sound upbeat on the economy to justify the policy. While it is fair to say that the eurozone has slowed to a more sustainable pace, the issue is whether it will be sustained.

EurozoneIt does not look good. The eurozone cyclical peak was probably last year at 2.4% year-over-year growth. It may slow to a little less than 2% this year and more next year (1.5%?). In contrast, with the help of tax cuts, government spending increases, and deregulation, US growth remains robust. The economy grew 4.2% annualized in Q2 nearly double the Q1 pace of 2.2%. The first official look at Q3 GDP will be announced at the end of next week. The median forecast of the Bloomberg survey corresponds to the average of the Atlanta Fed’s GDPNow (3.9%), the New York Fed’s GDP tracker (2.1%), and the St. Louis Fed’s News Index Nowcast (4.4%) or 3.4%. Despite the only modest increase in real earnings, consumption likely remained strong (above 3%) fueled by the creation of 570,000 net new jobs and the rise in household credit. The GDP deflator and the quarterly core PCE deflator are probably eased markedly in Q3. This could see the curve flatten. It is unlikely, though, to change the markets’ conviction (80%+) that the Fed will hike again in December. The Beige Book (October 24) for the early November FOMC meeting will shed some light on economic activity in early Q4. There is unlikely to be much impact from the trade tensions. Investors may pay close attention to how the interest rate sensitive sectors, especially housing and autos, are faring. The central banks of Norway and Sweden will meet, and neither is expected to raise rates. The Bank of Canada, on the other hand, is most likely to hike rates next week as it continues to remove accommodation. The Bank of Canada hiked rates twice last year and has already raised rates twice this year to put the overnight rate at 1.5%. Among the major central banks, Canada is the closest to matching the Fed’s pace. The central bank is also trying to navigate through a weakening of the property market (bubble?) and high levels of household indebtedness. The weakness in retail sales reported before the weekend (-0.1%), and especially excluding autos (-0.4%) is a potential warning sign, but high-frequency data is subject to much volatility, though it bears monitoring. Currently, the market expects that the Bank of Canada will likely hike rates again n Q1 19. |

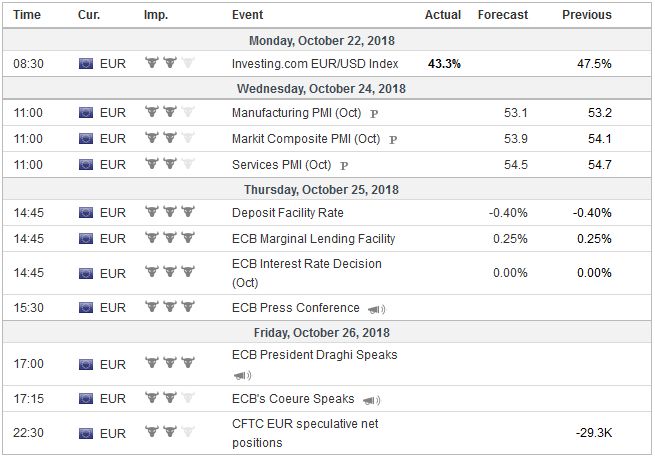

Economic Events: Eurozone, Week October 22 |

United StatesThe domestic economic and financial challenges seem largely independent of the trade tensions with the US. Even if Trump and Xi meet at the end of next month, trade tensions are likely to worsen. Not only is there another round of tariffs, but the 10% tariff on $200 bln of Chinese goods will rise to 25% at the start of 2019. Many, if not most, observers go from China will be hurt more than the US by a trade war to concluding that China will capitulate. What if it doesn’t? What if it sees that nothing short of abandoning its development strategy will appease the US? What if Made in China 2025 is essentially not different than America First? China may dig-in. It will strengthen the hardliners in China who think the US is trying to contain it. It reinforces a reluctance to rely on the US for anything. The real wall that may be going up is between the US and China, not the US and Mexico. While Trump may put his brand on it, the confrontation with China may be among the few issues that enjoy bipartisan support. |

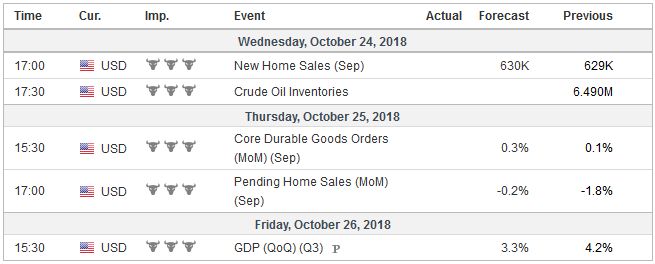

Economic Events: United States, Week October 22 |

Switzerland |

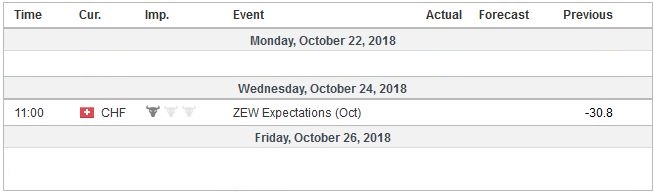

Economic Events: Switzerland, Week October 22 |

China

Chinese stocks staged a potential key reversal ahead of the weekend. After making new four-year lows, shares turned higher. Senior officials were paraded to attest to the soundness of economic and financial conditions but what appears to have turned it around was word began emerging that the national government and local governments were quietly stepping into the market, taking controlling interest in more than 30 companies, according to local press reports.

One of the many weak links of China’s financial system is the widespread use of corporate stock as collateral for bank loans. This is standard practice in China. Nearly all listed companies apparently do this. Falling stock valuations (the Shanghai Composite has lost a third of its valuation this year) spur a margin call of sorts. This, in turn, is exposing other vulnerabilities.

Much has changed since the dramatic drop in Chinese equities in August 2015, which sent shock waves around the world, and may have delayed the first Fed hike by three months. China’s yuan is part of the SDR, and its shares and debt have been included the international benchmark indices, like MSCI and FTSE. Some things remain the same. China’s economic and financial system seems fragile, and policy may not be evolving as much as lurching from one fire to another, like vaudeville character trying to plug holes in a leaky pipe, closing one only to see another water spout.

Tags: #USD,$CAD,$CNY,$EUR,Canada,ECB,Featured,Italy,newsletter,SPX