Major European stocks post modest losses on Wednesday. US Dollar Index clings to gains above 97.30. Coming up: Swiss National Bank’s (SNB) Quarterly Bulletin. The USD/CHF pair dropped to its lowest level since late August at 0.9798 on Wednesday but staged a technical recovery in the last hour. As of writing, the pair was up 0.05% on the day at 0.9808. After major Asian equity indexes closed the day in the negative territory on Wednesday, European stocks struggled to...

Read More »USD/CHF retreats to 0.9820 area as USD loses strength

US Dollar Index erases daily recovery gains ahead of American session. European equity indexes stay in the negative territory. Coming up: Building Permits, Housing Starts and Industrial Production data from US. The USD/CHF lost its traction in the last couple of hours and retraced its daily recovery gains pressured by the sour market mood and the broad USD weakness. As of writing, the pair was down 0.02% on the day at 0.9818. The USD recovery during the early trading...

Read More »USD/CHF Technical Analysis: Forms bearish flag on hourly chart

USD/CHF sellers await confirmation of the bearish technical pattern. 200-hour EMA limits immediate upside. Following its heavy declines on Monday, USD/CHF trades near 0.9880 while heading into the European session on Tuesday. The pair forms a bearish flag on the hourly chart while staying near the pattern support by the press time. With this, sellers will wait for a downside break of flag support, near 0.9870, to aim for the theoretical target of 0.9700. However,...

Read More »USD/CHF Technical Analysis: Sluggish below 100-DMA, 38.2 percent Fibonacci

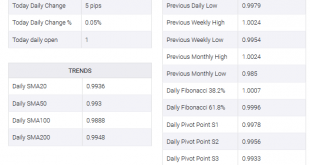

USD/CHF declines for the second consecutive day. 50% Fibonacci retracement, October low could challenge sellers. An upside break of 0.9890 highlights 200-DMA, 23.6% Fibonacci retracement. USD/CHF extends the recent pullback while flashing 0.9870 as a quote during early Friday. The pair recently pulled back from 100-Day Simple Moving Average (DMA) and 38.2% Fibonacci retracement of August-October rise. Prices are now likely declining towards 50% Fibonacci retracement...

Read More »USD/CHF Technical Analysis: 38.2 percent Fibonacci, 200-DMA doubt pullback from monthly low

USD/CHF recovers from four weeks’ low. 50% Fibonacci retracement level, October bottom restrict further downside. 200-DMA breakout will again highlight 1.0000 psychological magnet. USD/CHF seesaws around 0.9873 while heading into the European session on Wednesday. The quote dropped to the lowest since early November on Tuesday but pulls back off-late. The pair’s refrain to drop further below the latest bottom seems to prepare for a confrontation to 38.2% Fibonacci...

Read More »USD/CHF hammered down to sub-0.9900 levels, 2-week lows

USD/CHF lost some additional ground for the second straight session on Tuesday. A subdued USD demand, stability in equity markets did little to provide any respite. Trump’s latest remarks opened the room for a further intraday depreciating move. The USD/CHF pair witnessed some follow-through selling on Tuesday and dropped to near two-week lows, below the 0.9900 handle in the last hour. Having repeatedly failed to find acceptance above the parity mark, the pair came...

Read More »USD/CHF ignores doubts over phase-one deal, stays around two-month high

USD/CHF focuses more on China’s official PMI-led optimism that the US-China tussle. A few second-tier Swiss data can offer intermediate moves ahead of the US statistics. Trade/political news will continue driving the markets in the case of strong headlines. Technical Analysis October month high near 1.0030 can become immediate resistance ahead of May-end tops surrounding 1.0100. Alternatively, sellers will look for entry below November 08 high near 0.9980....

Read More »USD/CHF Technical Analysis: Sellers focused on spinning top near multi-week high

USD/CHF declines after registering a bearish candlestick formation the previous day. Buyers look for sustained trading beyond 1.0000 psychological magnet. 200-day SMA can please sellers during further downside. USD/CHF drops to 0.9985 during the early trading session on Friday. That said, the pair formed a bearish “Spinning Top” candlestick formation while taking a U-turn from 1.0000 round-figure. Considering the pair’s repeated failures to provide a sustained run-up...

Read More »USD/CHF holds on to recovery gains ahead of Swiss ZEW numbers

USD/CHF takes the bids around monthly high. Optimism surrounding the US-China trade deal, global economy confront nearness to data. The US data, trade/political headlines could drive markets afterward. USD/CHF respects the previous day’s Doji formation, coupled with upbeat fundamentals, while taking the bids to 0.9980 ahead of Wednesday’s European session. Comments from the United States (US) President Donald Trump have mostly done the job of spreading market...

Read More »USD/CHF Technical Analysis: 61.8 percent Fibo. on seller’s radar

USD/CHF declines from the highest in nearly six weeks. 61.8% of Fibonacci retracement acts as immediate support. Monthly trend line resistance limits nearby upside. USD/CHF takes U-turn from one-month-old resistance line while trading around 0.9965 amid the initial trading session on Tuesday. Given the gradual pullback in the 14-bar Relative Strength Index (RSI) from the overbought conditions, prices might witness additional downside. In doing so, 61.8% Fibonacci...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org