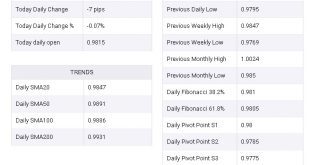

USD/CHF stays below the five-week-old falling trend line, 23.6% Fibonacci retracement. Bearish MACD increases the odds of the pair’s declines. Channel’s resistance, 50% Fibonacci retracement will question buyers during the recovery. USD/CHF registers modest changes while taking rounds to 0.9730 ahead of the European session on Monday. The pair recently reversed from a descending trend line since December 06 while also slipping beneath 23.6% Fibonacci retracement of...

Read More »USD/CHF Technical Analysis: Sellers hopeful on Doji formation below monthly trendline

USD/CHF portrays buyers’ exhaustion despite the absence of losses since Tuesday. December month low will be the key to watch. USD/CHF trades mostly unchanged around 0.9730 while heading into the European session on Friday. The pair formed a Doji candlestick on the daily (D1) chart by Thursday’s end after recovering for the two consecutive prior days. Considering the candlestick formation indicating the reversal of the previous trend, coupled with the pair’s sustained...

Read More »USD/CHF Technical Analysis: Weak below six-week-old falling trendline

USD/CHF recovers amid the recent risk reset. 200-bar SMA adds to the upside barrier, 2019 low holds the key to further declines. USD/CHF bounces off the intra-day low of 0.9665 to 0.9702 while heading into the European session on Wednesday. The pair benefits from the absence of immediate US-Iran war after Tehran hit US bases in Iraq. Even so, the pair stays well below the descending trend line since November 29, at 0.9730, which limits the near-term advances. Should...

Read More »USD/CHF Technical Analysis: Inside descending channel below 200-HMA

USD/CHF clings to 23.6% Fibonacci retracement of the pair’s downpour from Christmas to December 31. The falling channel, 200-HMA will challenge the Bullish MACD. The current month top will lure the buyers during further upside. The USD/CHF pair’s latest recovery seems to struggle around 0.9690 during early Tuesday. A short-term falling trend channel and prices below 200-Hour Moving Average (HMA) seem to question the recently bullish MACD. As a result, buyers will...

Read More »USD/CHF stalls three-day winning streak amid broad USD pullback

USD/CHF fails to hold onto recovery gains from multi-month lows. Doubts over Iran/Iraq’s capacity to retaliate the US might have shuffled the risk tone. Comments from the NY Fed, GT headlines add to the greenback’s weakness. USD/CHF refrains from extending the recent recovery while trading around 0.9700 during the pre-European session on Monday. The pair seems to portray the recent risk reshuffle and the US catalysts while stepping back from the weekly top. Risk...

Read More »USD/CHF Technical Analysis: Eyes on short-term rising trendline after US strikes in Baghdad

USD/CHF drops after the news broke that the key members of Iran have been killed in by the US attack near Baghdad airport. 200-hour EMA, resistance line of immediate rising channel guard adjacent upside. December month low adds to the support. USD/CHF declines to 0.9700 during the early Friday’s trading. The quote recently slipped as the Swiss Franc (CHF) strengthened, due to its safe-haven appeal, after the US-Middle East tensions are about to get worst. Read: US...

Read More »USD/CHF drops to fresh four-month low as greenback extends losses

USD/CHF remains week for the fifth consecutive week. Cautious optimism surrounding the phase-one, a lack of major data and positive performance of commodities seem to weigh on the USD. Second-tier data from the US and Switzerland will be watched closely for fresh impulse. USD/CHF declines to 0.9720 amid mildly active trading session on early Monday. The pair has been weighed down by the broad US Dollar (USD) losses off-late. With the increasing optimism surrounding...

Read More »USD/CHF: On the back foot below 10-day EMA amid greenback weakness

USD/CHF fails to hold on to previous gains as broad weakness of the USD joins risk reshuffle. US-China trade optimism confronts Brexit risk while Japan’s data-dump joins China’s Industrial Production data. Swiss ZEW Survey, trade/political updates will be in the spotlight. With the broad US Dollar (USD) weakness joining hands with mixed fundamental catalysts, USD/CHF drops to 0.9810 amid the initial Friday trading. The greenback seems to have lost its allure amid the...

Read More »USD/CHF Technical Analysis: Further recovery likely amid sustained break of 10-DMA

USD/CHF stays above 10-DMA for the first time in three weeks. 50% Fibonacci retracement can guard immediate upside ahead of 0.9885/90 resistance confluence. A downside break below 61.8% Fibonacci retracement can recall monthly low. Following its break of 10-Day Simple Moving Average (DMA) on Friday, USD/CHF trades around 0.9830 during early Monday. The pair remains positive above 61.8% Fibonacci retracement of August-October upside. In doing so, 50% Fibonacci...

Read More »USD/CHF Technical Analysis: Falling wedge on 4H, oversold RSI check further declines

USD/CHF trades near the multi-month low. A Bullish technical formation, oversold RSI conditions stop sellers. The further downside can look towards late-August month low. USD/CHF seesaws around 0.9800 during the pre-European session on Thursday. The pair forms a bullish technical pattern on the four-hour (4H) chart. Also supporting the hopeful buyers is oversold conditions of 14-bar Relative Strength Index (RSI). Even so, a sustained break of the bullish pattern’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org