USD/CHF lost some additional ground for the second straight session on Tuesday. A subdued USD demand, stability in equity markets did little to provide any respite. Trump’s latest remarks opened the room for a further intraday depreciating move. The USD/CHF pair witnessed some follow-through selling on Tuesday and dropped to near two-week lows, below the 0.9900 handle in the last hour. Having repeatedly failed to find acceptance above the parity mark, the pair came under some aggressive selling pressure on the first day of a new trading week and was being weighed down by a combination of negative forces. Trade uncertainty continues to exert pressure The US President Donald Trump’s decision to re-impose tariffs on steel and aluminium from Brazil and Argentina

Topics:

Haresh Menghani considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF lost some additional ground for the second straight session on Tuesday.

- A subdued USD demand, stability in equity markets did little to provide any respite.

- Trump’s latest remarks opened the room for a further intraday depreciating move.

The USD/CHF pair witnessed some follow-through selling on Tuesday and dropped to near two-week lows, below the 0.9900 handle in the last hour.

Having repeatedly failed to find acceptance above the parity mark, the pair came under some aggressive selling pressure on the first day of a new trading week and was being weighed down by a combination of negative forces.

Trade uncertainty continues to exert pressureThe US President Donald Trump’s decision to re-impose tariffs on steel and aluminium from Brazil and Argentina weighed on the global risk sentiment and provided a goodish lift to the Swiss franc’s perceived safe-haven status. Adding to this, the US Secretary of Commerce Wilbur Ross said that Trump is willing to increase tariffs on Chinese goods if there is no deal and further raised uncertainty over a potential trade deal between the world’s two largest economies. Apart from the latest trade-related developments, Monday’s disappointing US ISM Manufacturing PMI prompted some fresh US dollar selling and further collaborated to the pair’s sharp intraday downfall of nearly 100 pips. The bearish pressure remained unabated through the early European session on Tuesday on the back of a subdued USD demand and seemed rather unaffected by some signs of stability/slightly positive mood in the global equity markets. Meanwhile, Trump’s not so optimistic trade-related comments, saying that China deal may come after next year’s election, aggravated the selling pressure and seemed to have paved the way for a further intraday slide amid absent relevant market moving economic releases from the US. |

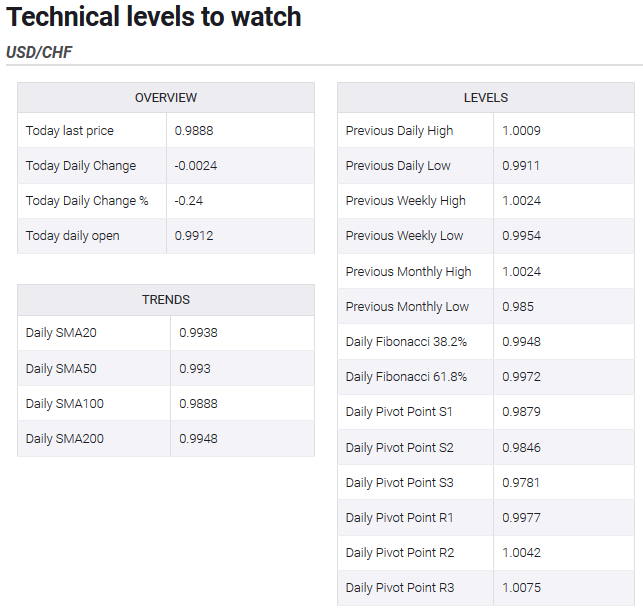

Technical levels to watch |

Tags: Featured,newsletter