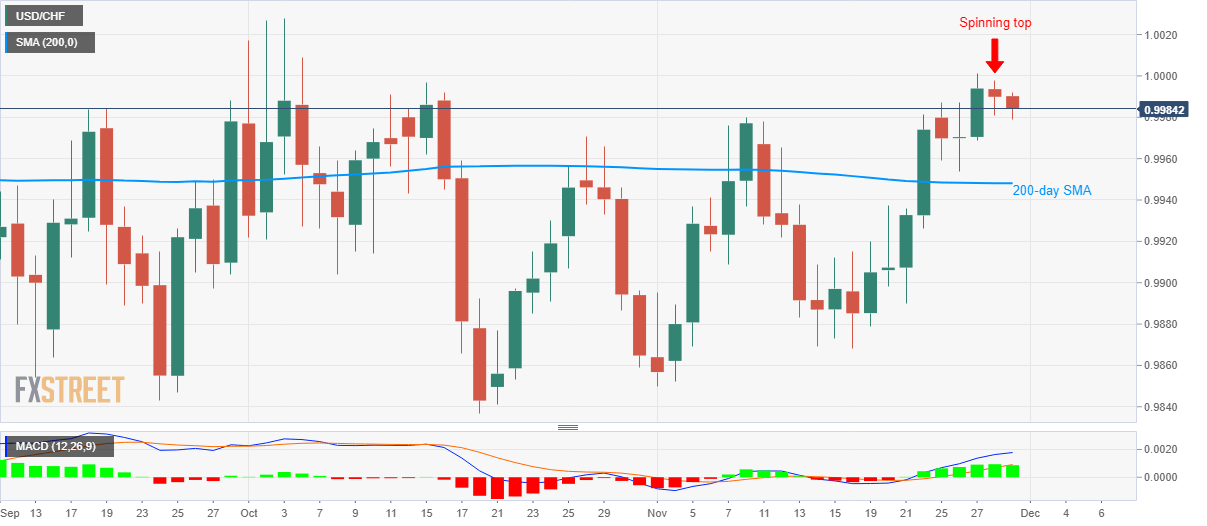

USD/CHF declines after registering a bearish candlestick formation the previous day. Buyers look for sustained trading beyond 1.0000 psychological magnet. 200-day SMA can please sellers during further downside. USD/CHF drops to 0.9985 during the early trading session on Friday. That said, the pair formed a bearish “Spinning Top” candlestick formation while taking a U-turn from 1.0000 round-figure. Considering the pair’s repeated failures to provide a sustained run-up beyond 1.0000, coupled with bearish candlestick pattern, prices are likely declining towards the 200-day Simple Moving Average (SMA) level of 0.9950. Though, late-October high close to 0.9970 can offer an intermediate halt during the declines. In a case where bears dominate below 200-day SMA,

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF declines after registering a bearish candlestick formation the previous day.

- Buyers look for sustained trading beyond 1.0000 psychological magnet.

- 200-day SMA can please sellers during further downside.

| USD/CHF drops to 0.9985 during the early trading session on Friday. That said, the pair formed a bearish “Spinning Top” candlestick formation while taking a U-turn from 1.0000 round-figure.

Considering the pair’s repeated failures to provide a sustained run-up beyond 1.0000, coupled with bearish candlestick pattern, prices are likely declining towards the 200-day Simple Moving Average (SMA) level of 0.9950. Though, late-October high close to 0.9970 can offer an intermediate halt during the declines. In a case where bears dominate below 200-day SMA, mid-November tops close to 0.9910 can return to the chart. Alternatively, the pair’s successful rise beyond 1.0000 could target October high around 1.0030 whereas late-May peak close of 1.0100 might lure bulls afterward. |

USD/CHF daily chart(see more posts on USD/CHF, ) |

Trend: Pullback expected

Tags: Featured,newsletter,USD/CHF