Why do Central Banks want higher inflation? The debt ceiling debate in U.S. Congress and related political nonsense brings even more to light the exponential growth in US federal government debt. US government debt has doubled in the 10 years since the last major debacle Congress created over raising the debt ceiling back 2011. The debate and Congress’s unwillingness to increase the limit back in August 2011 resulted in declining equity markets. It also resulted in Standard and Poor’s downgrading U.S. debt to AA+ from AAA! The Political Standoff The political standoff over raising this arbitrary restriction of how much debt the US can issue has become just another political lever in the dysfunctional Congress. As Secretary Yellen points out… Raising the debt

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Central Banks, Commentary, Debt Ceiling, Economics, Featured, inflation, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Why do Central Banks want higher inflation?

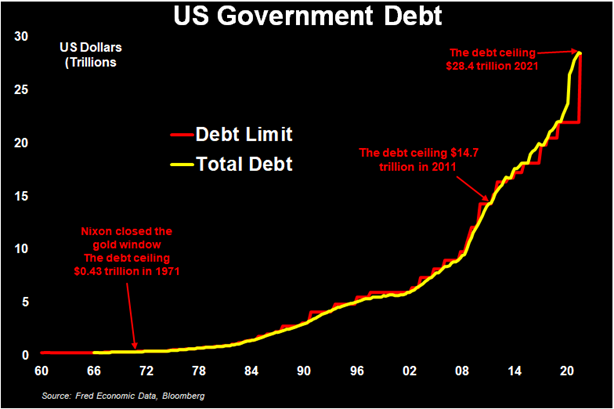

The debt ceiling debate in U.S. Congress and related political nonsense brings even more to light the exponential growth in US federal government debt. US government debt has doubled in the 10 years since the last major debacle Congress created over raising the debt ceiling back 2011. The debate and Congress’s unwillingness to increase the limit back in August 2011 resulted in declining equity markets. It also resulted in Standard and Poor’s downgrading U.S. debt to AA+ from AAA!

The Political Standoff

The political standoff over raising this arbitrary restriction of how much debt the US can issue has become just another political lever in the dysfunctional Congress. As Secretary Yellen points out…

Raising the debt ceiling doesn’t authorize additional spending of taxpayer dollars. Instead, when we raise the debt ceiling, we’re effectively agreeing to raise the country’s credit card balance, and in this case, 97% of that balance was incurred by past congresses and presidential administrations. Even if the Biden administration hadn’t authorized any spending, we would still need to address the debt ceiling now. Raising the debt limit was a regular occurrence – congress has either permanently or temporarily raised the debt limit 80 times since 1960. And before 2011, this was done generally with little debate as raising the debt ceiling does not approve new or additional spending but allows the government to borrow in order to pay already approved spending.

| That’s right it doesn’t authorize new spending it only allows for the U.S. Treasury to borrow enough to carry out the mandates of Congress for spending that has already been authorised. At least for now Congress approved enough of an increase to keep the U.S. government solvent until December 3. | |

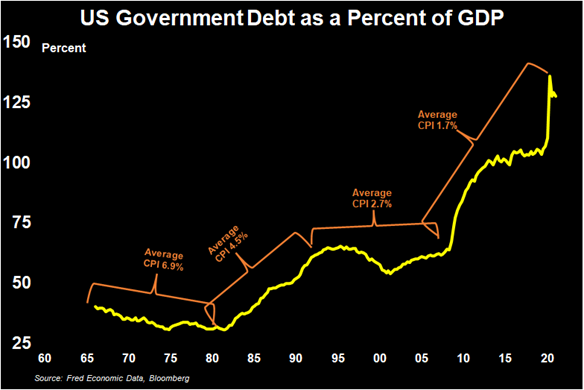

Borrowing Through The Good Times & Through BadThe chart below shows the debt ceiling limit (red bar) and the Total debt issued (yellow bar). The debt issued line runs right with the debt limit bar. Both have seen exponential growth, approximately doubling every 10 years over the last 40 years. Going back to Keynesian principles governments should borrow and increase spending during times of economic downturns (recessions) to help stabilize their economies. Then when the economy recovers the government can pay down the debt through increased revenues and less economic stabilizers – such as unemployment insurance, turning the deficit into a surplus. However, in recent times governments have increased debt levels in recessions and proceed to continue spending more than their revenues when the economy recovers. This leads to exponentially growing debt levels. As the chart below shows higher debt to GDP levels as debt grows faster than GDP. As the chart below shows – U.S. government debt has grown from 40% of GDP to over 125% of GDP. |

|

And here in one chart is why Central Banks want higher inflation!

After all the economist Milton Friedman did say…

It is challenging to read any newspaper, social media feed, or participate in a discussion forum without the topic of inflation coming up these days. And the extra money printed by central banks around the world for the last 40 years, which has also grown exponentially for the last 15 years is now creating that inflation. A country’s nominal GDP growth is a combination of real growth, meaning how much an economy increases output and then inflation added on top. On the chart below of US debt as a percent of GDP; we have added brackets of the average CPI (Consumer Price Inflation) rate for each of the changes in trend. Starting with the period of 1965 to 1980 CPI averaged 6.9% but has declined to average only 1.7% since 2010. Bottom line is that all else being equal, higher inflation will help reduce the massive government debt levels. |

We leave you with a quote on inflation:

When a business or an individual spends more than it makes, it goes bankrupt. When a government does it, it sends you the bill. And when government does it for 40 years, the bill comes in two ways: higher taxes and inflation. Make no mistake about it, inflation is a tax and not by accident.

Ronald Reagan – 40th President of the United States

Tags: central-banks,Commentary,Debt Ceiling,Economics,Featured,inflation,newsletter