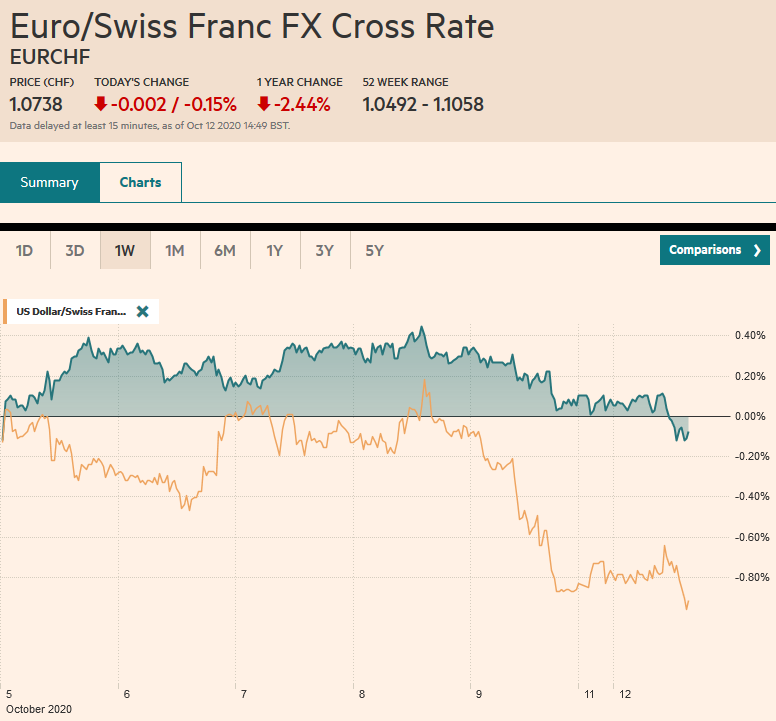

Swiss Franc The Euro has fallen by 0.15% to 1.0738 EUR/CHF and USD/CHF, October 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Led by 2-3% gains in Hong Kong and China, the MSCI Asia Pacific Index rose for the sixth consecutive session is pressing against the high for the year. European stocks are firmer, and the Dow Jones Stoxx 600 is up around 0.5% near midday, and shares are also trading firmer. The strong close before the weekend warns of the risk of a gap higher opening, which would be the third in a row, a cautionary sign of an over-extended market in some technical analysis. While the US stock market is open today, the US and Canadian bond markets are closed for national holidays. European bond

Topics:

Marc Chandler considers the following as important: $CNY, $TRY, 4.) Marc to Market, 4) FX Trends, Brexit, Currency Movement, Featured, newsletter, PBOC, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.15% to 1.0738 |

EUR/CHF and USD/CHF, October 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Led by 2-3% gains in Hong Kong and China, the MSCI Asia Pacific Index rose for the sixth consecutive session is pressing against the high for the year. European stocks are firmer, and the Dow Jones Stoxx 600 is up around 0.5% near midday, and shares are also trading firmer. The strong close before the weekend warns of the risk of a gap higher opening, which would be the third in a row, a cautionary sign of an over-extended market in some technical analysis. While the US stock market is open today, the US and Canadian bond markets are closed for national holidays. European bond yields are softer after an apparent media blitz by some of the dovish ECB members. The long-end of the Italian and Spanish curve are at new record lows. The US dollar is firmer against most of the world’s currencies, with the yen, South Korean won, and Taiwanese dollar notable exceptions. The Chinese currency returned about half of its pre-weekend gains following the PBOC’s move and removed the reserve requirement for forwards. Gold extended its gains to $1933 before succumbing to profit-taking. As US Gulf operations re-start, Norway’s oil strike ended, and Libya is re-opening its biggest field, November WTI is pushing back below $40 a barrel. |

FX Performance, October 12 |

Asia Pacific

The PBOC set the dollar’s reference rate at CNY6.7126, a bit stronger than the models suggested. Its move over the weekend to abolish the (20%) reserve requirement on banks for forward foreign exchange transactions was widely read as an attempt to moderate the yuan’s gains. It follows the biggest quarterly advance in 12 years and the biggest single-day advance since 2005. Beijing has been encouraging portfolio capital inflows, and foreign asset managers hedging their purchases would be the obvious sellers of yuan in the forward market. Cutting the reserve requirement helps facilitate this development and encourage using the onshore yuan (CNY) rather than offshore yuan (CNH).

Japan reported an unexpected increase in August machine tool orders. The 0.2% increase defied expectations for a 1.0% decline following July’s 6.3% gain. This suggests that capex is holding up better than feared. Japan reports the final; August industrial output figures toward the middle of the week. The preliminary estimate was for a 1.7% gain on the month. Separately, producer prices were softer than expected at -0.8% in August after July was revised to -0.6% from -0.5%. The report reinforces the sense that Japan has not escaped the deflationary forces.

The dollar slipped through last week’s lows against the yen (~JPY105.47) and found support above the 20-day moving average (~JPY105.38). There is scope for additional slippage today after the JPY106 area proved to be a formidable cap last week. The Australian dollar is in narrow ranges below the pre-weekend high (~$0.7245). There is an option for A$1 bln at $0.7200 that expires today. A break of the $0.7200 area signals a pullback toward $0.7150-$0.7175. The near-term risk is that the dollar rises further against the Chinese yuan. Initial potential extends to CNY6.78 from around CNY6.75 now.

Europe

We have argued that frequently the unnamed ECB officials that talk to the press do so because they lost or are losing internal fights. They are the hawks. On the other hand, the doves took their case to the press over the weekend and today by name. They include Schnabel, Lane, Visco, and Kazimir. The ECB does not meet until later this month, and there is no reason to expect fresh moves. New measures that will likely include extending and expanding the Pandemic Emergency Purchase Program, and possibly a rate cut, now that a dual-rate system has been adopted (TLTRO lending at a rater below the minus 50 bp deposit rate).

The Turkish lira squeezed higher (~0.8%) ahead of the weekend, but today is better offered (~-0.3%). It reported a larger than expected August current account deficit. The central bank’s increase in the fx swaps rate to 11.75% from 10.25% it conducts with member banks is another move to raise funding costs. FX swaps account for around half of the banks’ funding. The average funding costs have been ratcheted higher, which is thought to take some pressure off interest rates that affect the broader economy. The funding costs have risen more than 400 bp from the July low a little below 7.35%. Still, the impact on the currency is difficult to measure with the exception in some counter-factual scenario, as the lira was setting new record lows, and the central bank has depleted its reserves. The CBRT meets on October 22, and another hike in the one-week repo rate looks likely, and funding costs may rise to 12%. Some recent pressure is thought to emanate from the implicit threat of US sanctions if Turkey, a NATO member, proceeds with testing the controversial air defense system recently procured from Russia. Turkey and Russia are on opposite sides of the Azerbaijan-Armenia war, but there share other common interests. Realpolitik considerations suggest that Prime Minister Erdogan may move in the coming weeks to demonstrate good faith to Russia, and wager that the US election and more weighty issues will keep America’s response likely limited to rhetoric and, no more than a slap on the wrist.

The UK-EU trade talks continue today. UK Prime Minister Johnson continues to threaten to abandon the talks if there is no outline of a deal before the EU summit at the end of the week. The uncertainty will continue in the coming days. There has been a shift in expectations, and many participants seem to be expecting a break-through shortly. It may take the form of the French backing down on the hardline position on access to British fishing waters.

The euro is trading in a narrow range at the upper end of the pre-weekend range, which saw it as high as $1.1830. It dipped below $1.18 in the European morning. Chart support is seen near $1.1780. North America led the rally before the weekend, and its appetite does not appear satiated. Sterling is also consolidating. It is holding above $1.3000. There two sets of expiring options to note. The first is for about GBP290 at $1.3010, and the other is for around GBP220 at $1.3050. The $1.3080 area corresponds to a (50%) retracement of the decline that began at the start of last month a little below $1.35.

America

The US presidential election offers the obvious framing of the lack of an agreement on fiscal policy. Yet, this does it a disservice. It is not clear that if President Trump, who seemed to suggest, he wants an even bigger package than the $2.2 trillion bill passed by the House Democrats, would find support from many Republican Senators. Some object to size, others to substance. The Republican Senate had supported a $650 bln package. Even if there was an agreement at this late date, fiscal stimulus is most unlikely to be delivered before the election, as if that is the key game changer of the trends in the polls. It would take the better part of two weeks to draft the legislation. In March, it took almost three weeks to begin distributing the stimulus. Leaving aside the drama, Trump arguably delivered the Republican agenda of tax cuts, deregulation, and strict constructionist and conservative judges’ appointment. For this agenda, confirming the Supreme Court nominee is of greater priority. Barrett’s confirmation hearings begin today, and a vote is planned within two weeks.

It is a busy week for US economic data, with September CPI, PPI, industrial production, and retail sales, among the hard data and October Empire and Philadelphia Fed surveys. Nearly half of the FOMC speak this week as well. In contrast, Canada has a light agenda, and the highlight of Mexico’s data is today’s August industrial production report. Mexico is expected to report a 2.4% increase on the month after a 6.9% increase in July.

The US dollar is consolidating last week’s losses against the Canadian dollar. The three-day slide that saw it fall around 1.5% (CAD1.3110). The CAD1.3150-CAD1.3180 offers resistance. A move above CAD1.3200 would suggest a corrective phase rather than consolidation. The greenback fell by about 1.2% against the peso before the weekend. The momentum has stalled near MXN21.12, and consolidation is featured today. The US dollar met offers near MXN21.30. Last month, ‘s low was near MXN20.85, and a retest seems likely, even if not today.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,$TRY,Brexit,Currency Movement,Featured,newsletter,PBOC