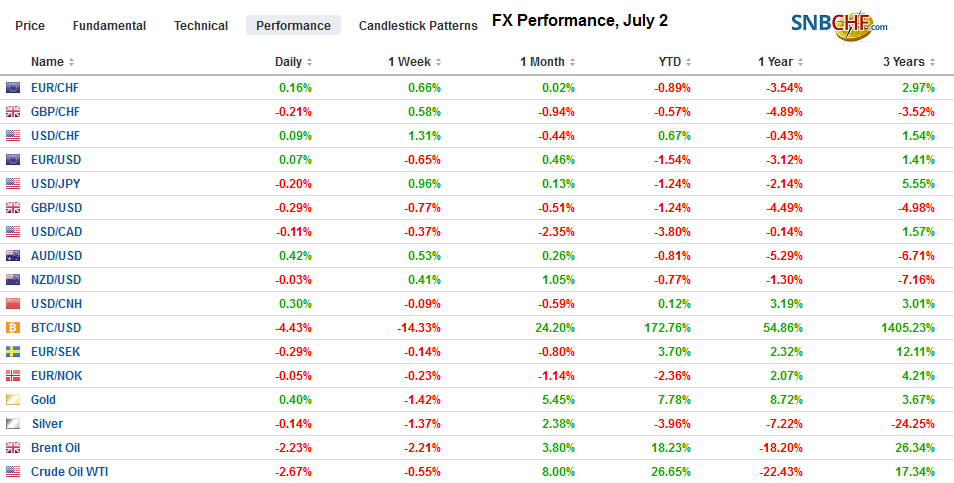

Swiss Franc The Euro has risen by 0.17% at 1.1162 EUR/CHF and USD/CHF, July 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The euphoria that greeted the resumption of US-China and US-North Korea talks has subsided. Global equities have turned mixed after yesterday’s surge. Hong Kong played catch-up, and despite ongoing demonstrations, the Hang Seng rallied over one percent, and the Hong Kong Dollar strengthened beyond its band midpoint for the first time in nine months. Europe’s Dow Jones Stoxx 600 is consolidating near three-month highs, and US shares are trading with a heavier bias. The S&P 500 gapped higher yesterday, and that gap (~2944-2951.2) is

Topics:

Marc Chandler considers the following as important: 4) FX Trends, EUR/CHF, Eurozone Producer Price Index, Featured, FX Daily, Germany Retail Sales, Italy, newsletter, U.K. Construction PMI, USD, USD/CHF, WTO

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.17% at 1.1162 |

EUR/CHF and USD/CHF, July 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The euphoria that greeted the resumption of US-China and US-North Korea talks has subsided. Global equities have turned mixed after yesterday’s surge. Hong Kong played catch-up, and despite ongoing demonstrations, the Hang Seng rallied over one percent, and the Hong Kong Dollar strengthened beyond its band midpoint for the first time in nine months. Europe’s Dow Jones Stoxx 600 is consolidating near three-month highs, and US shares are trading with a heavier bias. The S&P 500 gapped higher yesterday, and that gap (~2944-2951.2) is important from a technical perspective. Meanwhile, the debt market rally continues, led by ideas that Italy will avoid excessive debt proceeding. Italy’s 10-year yields are off almost 10 bp after falling below 2% yesterday. New record low yields are being posted throughout the core and periphery. The Italian two-year yield briefly dipped below zero for the first time. The dollar is mostly softer, though sterling continues to underperform. The Reserve Bank of Australia delivered the widely expected rate cut, and the Aussie is leading today’s move against the dollar (~0.2%) after yesterday’s slide. |

FX Performance, July 2 |

Asia Pacific

China has brought forward another measure that opens its financial sectors. It will lift the ownership limit for companies in financial services. This is one of the areas that foreign investors, especially in the US, had been strongly advocating.

South Korea reported a 0.2% decline n headline CPI in June, which was the first decline since January. The year-over-year remained unchanged at 0.7%. The central bank meets July 17. Pressure is building to reverse last November’s rate hike, but this month’s meeting is seen a bit early.

The Reserve Bank of Australia cut the cash rate by 25 bp to 1.25%. The accompanying statement kept the door open to additional easing. Another cut as early as August has largely (~80%) been discounted, and there is a strong leaning to yet another cut before the end of the year. Of course, the timing will depend on the growth, employment, and price developments, but the idea that more accommodation will be delivered going forward is deeply ingrained.

The Aussie posted a key reversal yesterday by trading at new highs for the move and then reversing lower to close below the pre-weekend low. After the cut announcement, which initially knocked it back, it returned to test the $0.6990 area. The intraday technical readings suggest it may struggle to resurface above $0.7000. The dollar gapped higher yesterday against the yen, and that gap appears to be attracting prices today. The gap is found between last Friday’s high (~JPY107.95) and Monday’s low (~JPY108.05). There is an option for $400 mln at JPY108.10 that expires today and a $1.9 bln option at JPY108.00 that expires tomorrow. On the upside is a roughly $420 mln option at JPY108.50 that will be cut today. There is another one billion option struck there that expires tomorrow. The dollar rose against the Chinese yuan for the first time in four sessions. The 0.4% gain is the most since mid-May. Yesterday, the dollar reached almost CNY6.8350, and today it briefly traded above CNY6.88 before closing just below.

EuropeItaly has taken Europe by storm. Some last-minute projections for less spending and higher revenue is allowing the government to forecast a smaller deficit (2.04% rather than 2.40%) and improvement in the structural deficit of 0.3% rather than a 0.2% deterioration. Nearly half the projected savings comes from clawing back funds from social programs that have a low take-up, according to reports. The new projections will make it easier for the EC to do what it wanted, and that is to avoid a confrontation now. |

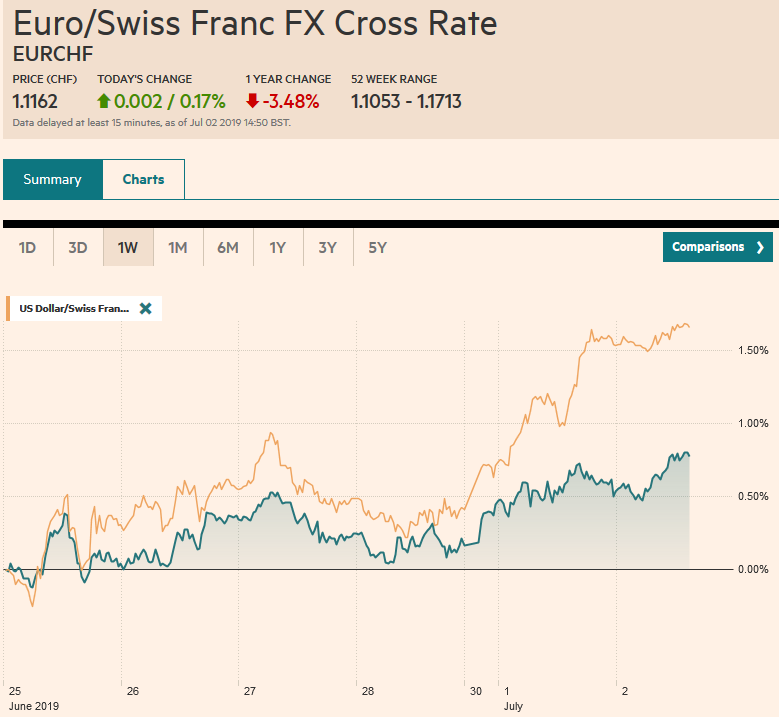

Eurozone Producer Price Index (PPI) YoY, May 20191(see more posts on Eurozone Producer Price Index, ) Source: investing.com - Click to enlarge |

| This seems to simply delay the conflict to after the summer when the 2020 budget comes into focus. The EU projects a structural deficit more than twice as high as Italy. The impressive rally in Italian bonds, which has knocked 20 bp off the 10-year yield since the weekend, has done little for Italian bank shares. An index of Italian bank shares fell nearly 1% yesterday and are duplicating that today. |

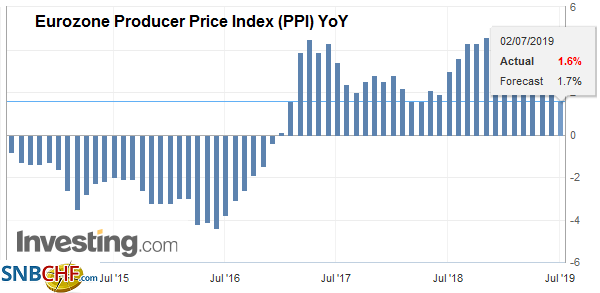

U.K. Construction Purchasing Managers Index (PMI), Jun 2019(see more posts on U.K. Construction PMI, ) Source: investing.com - Click to enlarge |

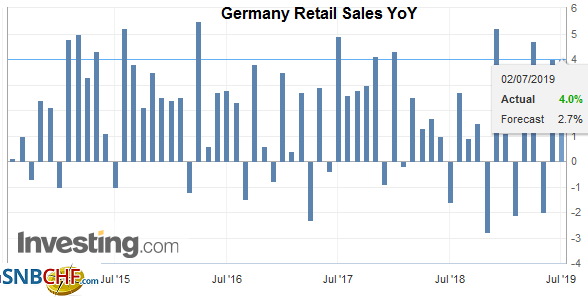

| Germany reported a disappointing 0.6% decline in May retail sales. The Bloomberg survey found a median forecast of a 0.5% increase. The disappointment may have been mitigated by the fact that April’s 2% decline was revised to only a 1% loss. |

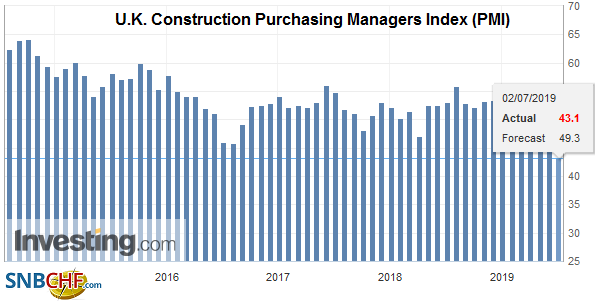

Germany Retail Sales YoY, May 2019(see more posts on Germany Retail Sales, ) Source: investing.com - Click to enlarge |

Iran announced yesterday that it breached the limit for low-enriched uranium. It is understood to be a small breach and is seen as a demand that others, especially Europe and Russia, provide more economic help. In effect, and at the risk of over-simplifying, the treaty ostensibly traded economic aid for a curb on Iranian nuclear development. The US unilateral withdrawal and embargo is choking the country, while Europe insists it adheres to the agreement. The payments workaround it currently limited to trade for food and medicine which is allowable under the US embargo, though dollar transactions are prohibited.

The euro initially extended yesterday’s sharp loss, falling to $1.1275 but holding just above the 61.8% retracement of the rally that began on June 18. Initial resistance is seen near $1.1320. The $1.13 area may prove sticky with around a 650 mln euro option struck there that expires today. Tomorrow 3.4 bln euros in options between $1.1290 and $1.1300 expire, and then on July 4, another option for 1.2 bln euros at $1.1290 expires. Sterling appeared to have built a shelf last week near $1.2660 but pushed through it yesterday and follow-through selling today saw it approach $1.26. The intraday technical indicators are stretched, and the old support (~$1.2660) should now act as resistance.

America

With US-China trade talks resuming, we anticipated that the Trump Administration would turn its attention to Europe and Japan. It wasted no time. The US added $4 bln of goods that it will add to the $21 bln of products published in April that will be used to retaliate against Europe for illegal subsidies for Airbus. Another round of public hearings will be held in early August with an eye toward adding another $4 bln of goods to the list. What differentiates this action from the steel and aluminum tariffs or the threatened auto tariffs is that the US went through WTO processes. The US action waits for the WTO decision on the appropriate level of response. That decision is expected in the coming weeks. Meanwhile, the EU has a case against US subsidies for Boeing that is making its way through the WTO processes.

The US reports June auto sales. A 17.0 mln unit pace is expected. Retail sales of vehicles in H1 appear to be on track from their weakest showing in six years. Fleet sales helped cushion the blow. Auto sales are cyclical, and the 12-month moving average peaked in the first half of 2016 near 17.4 mln units. Output appears to be slowing, and high inventories will need to be worked off.

The US dollar tested and held the pre-weekend low against the Canadian dollar yesterday (~CAD1.3060) and recovered to close above CAD1.31. Today it has remained above CAD1.31 but has not been able to move above yesterday’s high (~CAD1.3145). Consolidation is likely today. The dollar is also consolidating against the Mexican peso. It practically transversed the MXN19.00-MXN19.20 range yesterday and is straddling the middle of it today. Trump has praised Mexico for getting control of its borders and has rescinded the tariff threat. The Dollar Index narrowly extended yesterday’s advance but is reversing lower in the European morning. Support is seen in the 96.45-96.55 band. It may take a break of the 96.20 area to boost confidence a high is in place.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,EUR/CHF,Eurozone Producer Price Index,Featured,FX Daily,Germany Retail Sales,Italy,newsletter,U.K. Construction PMI,USD/CHF,WTO