Summary The National Stock Exchange of India will end all licensing agreements and stop offering live prices overseas. Philippine central bank cut reserve requirements for commercial banks. Egypt cut rates for the first time since 2015. Israeli police recommended that Prime Minister Netanyahu be charged. South Africa President Zuma resigned before a no confidence vote was held. Brazil President Temer will issue a decree for the military to take control of security in the state of Rio de Janeiro. Colombia hopes to start an oil hedging program. Stock Markets In the EM equity space as measured by MSCI, South Africa (+7.8%), China (+7.2%), and Russia (+6.8%) have outperformed this week, while Egypt (-1.9%), UAE

Topics:

Win Thin considers the following as important: Brazil, Colombia, Egypt, emerging markets, Featured, India, Israel, newsletter, Philippine, South Africa, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

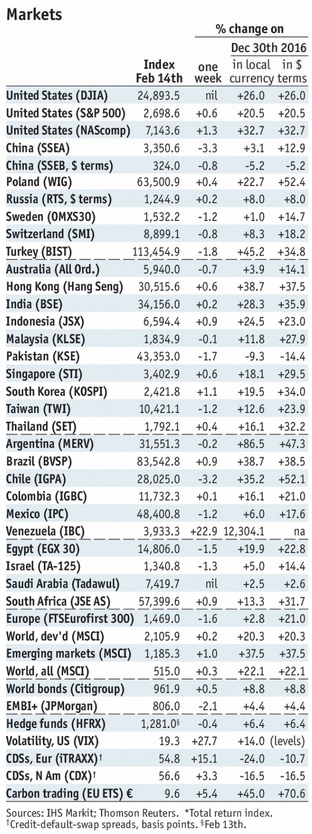

Stock MarketsIn the EM equity space as measured by MSCI, South Africa (+7.8%), China (+7.2%), and Russia (+6.8%) have outperformed this week, while Egypt (-1.9%), UAE (-1.2%), and India (flat) have underperformed. To put this in better context, MSCI EM rose 5.3% this week while MSCI DM rose 4.4%.

In the EM local currency bond space, South Africa (10-year yield -33 bp), Turkey (-11 bp), and Poland (-11 bp) have outperformed this week, while the Philippines (10-year yield +18 bp), Israel (+9 bp), and India (+9 bp) have underperformed. To put this in better context, the 10-year UST yield rose 1 bp to 2.86%. In the EM FX space, RUB (+3.8% vs. USD), ZAR (+3.3% vs. USD), and COP (+3.0% vs. USD) have outperformed this week, while PHP (-1.4% vs. USD), ILS (-1.0% vs. USD), and CNY (-0.6% vs. USD) have underperformed. |

Stock Markets Emerging Markets, February 14 |

IndiaThe National Stock Exchange of India along with other Indian exchanges will end all licensing agreements and stop offering live prices overseas. MSCI noted that “If the changes are put into effect, the result will be disruptive and harmful to international institutional investors in Indian equities,” adding that India’s market classification could change unless the “restrictive measures” are removed.

PhilippinePhilippine central bank cut reserve requirements for commercial banks one percentage point to 19% effective March 2. Monetary Board Member Felipe Medalla said the bank will consider another reduction after assessing the impact of the first cut. The goal is to bring this requirement below 10% by the end of Governor Espenilla’s term in 2023, Medalla added. The bank said the move will free up PHP90 bln in liquidity, but stressed that it will mop up excess liquidity via its term deposit facility.

EgyptEgypt cut rates for the first time since 2015. The monetary policy committee cut the overnight deposit rate by 100 basis points to 17.75 percent. This starts the process of unwinding the 700 bp of tightening seen after the pound was floated. Inflation eased to 17.1% y/y in January, the lowest since October 2016 and right before the November 2016 devaluation. More rate cuts are likely this year, especially with the pound remaining so firm. IsraelIsraeli police recommended that Prime Minister Netanyahu be charged with bribery, fraud, and breach of trust. Prosecutors along with Attorney General Mandelblit will now examine the evidence collected by the police and then decide whether to indict the Prime Minister. Mandelblit was once Netanyahu’s cabinet secretary and was appointed Attorney General by him two years ago. Netanyahu has denied all wrongdoing and vowed to continue leading the country.

South AfricaSouth Africa President Zuma resigned before a no confidence vote was held. Clearly, the writing was on the wall as the ANC had finally united in trying to push Zuma out. Parliament quickly appointed Deputy President Ramaphosa to serve as President until next year’s general elections. Ramaphosa should quickly announce a cabinet shuffle that jettisons all remnants of the Zuma years.

BrazilBrazil President Temer will issue a decree for the military to take control of security in the state of Rio de Janeiro. An army general would be put in charge of Rio’s civilian police. The decree requires congressional approval and would last until the end of this year. According to Brazilian law, a military intervention prevents any changes in the constitution. This could impact pension reforms, which require an amendment to the constitution.

ColombiaColombia hopes to start an oil hedging program. Finance Minister Cardenas hopes to be able to hedge against declines in crude oil prices. He added that Colombia would need to change the legal framework to allow the government to enter into potentially risky financial transactions. Cardenas noted that this would be a good time to hedge because oil prices seem higher than what they probably will be in the long term.

|

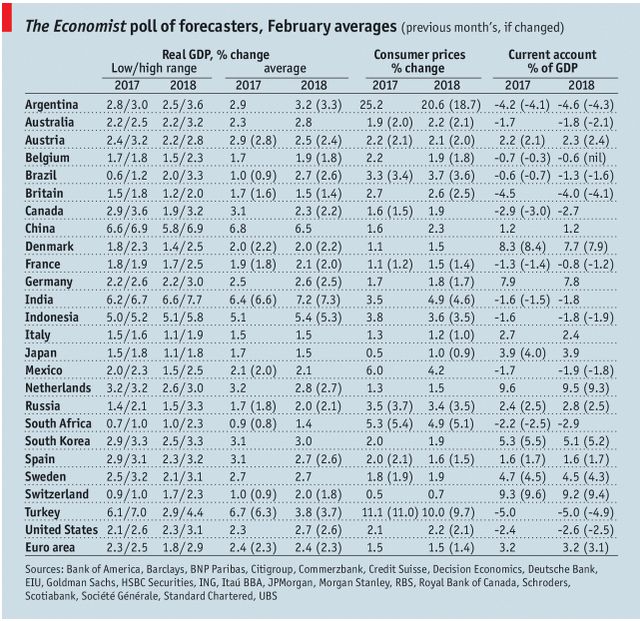

GDP, Consumer Inflation and Current Accounts Source: economist.com - Click to enlarge |

Tags: Brazil,Colombia,Egypt,Emerging Markets,Featured,India,Israel,newsletter,Philippine,South Africa,win-thin