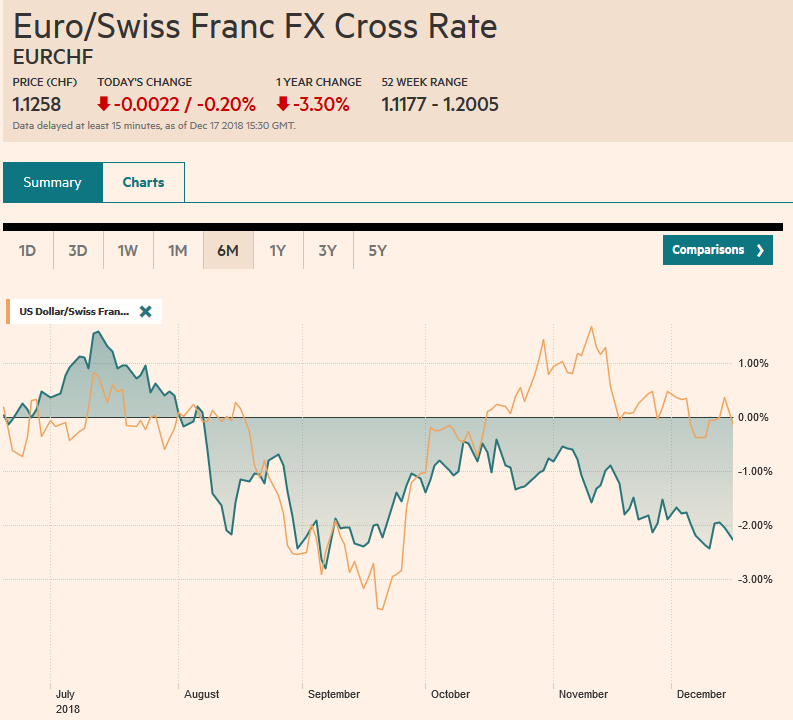

Swiss Franc The Euro has fallen by 0.20% at 1.1258 EUR/CHF and USD/CHF, December 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Activity in the global capital markets is subdued as investors move to the sidelines as the year-end approaches. The Federal Reserve headlines the holiday week that also features a Bank of England a Bank of Japan meeting. Only the Fed is expected to change rates. The dollar, which rose against most currencies last week, is a little softer today. Global equities are mostly lower, though the Nikkei. Benchmark 10-year yields slipped in Australia and Japan, but are edging higher in Europe. US shares are little changed in Europe.

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, CAD, EUR, EUR/CHF and USD/CHF, Featured, GBP, JPY, MXN, newsletter, SPY

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.20% at 1.1258 |

EUR/CHF and USD/CHF, December 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

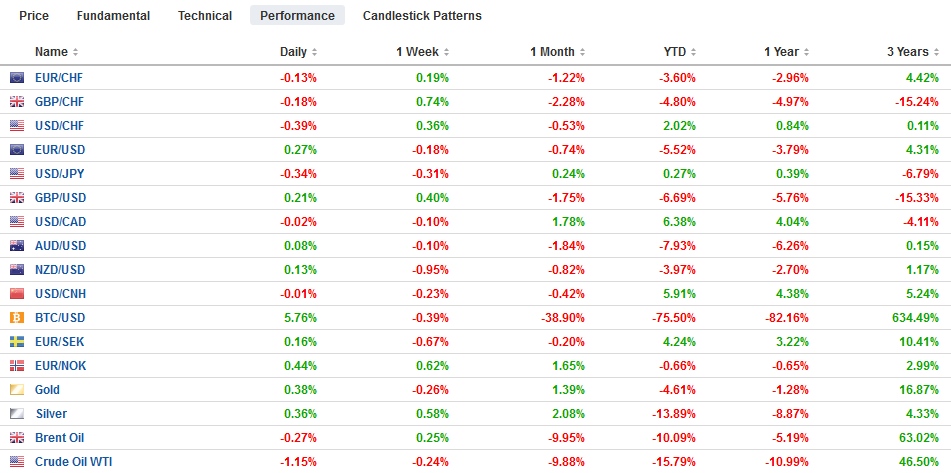

FX RatesOverview: Activity in the global capital markets is subdued as investors move to the sidelines as the year-end approaches. The Federal Reserve headlines the holiday week that also features a Bank of England a Bank of Japan meeting. Only the Fed is expected to change rates. The dollar, which rose against most currencies last week, is a little softer today. Global equities are mostly lower, though the Nikkei. Benchmark 10-year yields slipped in Australia and Japan, but are edging higher in Europe. US shares are little changed in Europe. The North American economic calendar begins off light with the US reporting the Empire State manufacturing survey, offering among the first insights into activity in December, while Canada reports November existing home sales, which fell in both September and October. Both the US and Canada report on portfolio capital flows. |

FX Performance, December 17 |

Asia Pacific

Approval for Japan’s cabinet softened nearly five percentage points over the past month to stand at 42.4%. The monthly survey found a majority do not approve of the recent law to allow more foreign guest workers. The BOJ meeting concludes a day after the FOMC meeting. It has slowly reduced its bond purchases but has not called it tapering and the 10-year benchmark JGB has drifted back to near zero (less than two basis points today). No one expects the BOJ to hike rates before the sales tax increases next October.

China holds its annual policy summit to set next year’s priorities this week. There are two main schools of thought. The first holds that Chinese officials did not realize how isolated they were on the international stage and will seek to mend fences and strengthen domestic institutions, including modernizing the economy, to be better positioned in the future to withstand tensions with the US. It will seek to accommodate the US now and help its industry move up the value-added chain and find alternative markets and inputs. The second is more pessimistic near-term. President Xi is depicted as more nationalist and less reform-minded. Small concessions may be made to the US but not enough to avoid an escalation of trade tensions.

The Australian government is projecting a larger budget surplus for FY2020 due to better than expected corporate tax revenue, higher commodity prices, and a firm labor market. Australia has been running a budget deficit since 2009. It ran a surplus before the Great Financial Crisis and anticipates a return to surplus. Separately, the Reserve Bank of New Zealand is expected to boost the Tier 1 capital requirement, and this is would likely force Australian banks to pump more money into is New Zealand entities, with potential currency implications.

The dollar is subdued against the yen. It is confined to about a quarter of a yen range JPY113.25-JPY113.50. There is a $895 mln option at JPY113.50 that will be cut today and another roughly $450 mln at a JPY113.10 option that also expires. We see intraday technical indicators favoring the dollar’s upside in early North American activity. The Australian dollar is in less than a 1/5 of a cent range. It has been unable to resurface above $0.7200 (where an A$1.2 bln option rolls off today. Here too, we see the greenback poised to strengthen in North America. The yuan is virtually unchanged and the onshore and offshore yuan have converged.

Europe

The news stream is light. Three issues dominate. First, the UK government is pushing back against calls for a second referendum, which appeared to be gaining support. Separately, there is some effort to allow the House of Commons to vote on the various alternatives, including a second referendum and a no-deal exit. Under such conditions, it is possible that no path has a majority. It is because of that that some argue, returning the issue back to the voters, who in the non-binding referendum in June 2016 instructed leaving the EU. Second, as indicated last week, Italy is formally proposing a 2.04% budget deficit rather than the initial 2.40% shortfall. Depending on the details, it is possible the EC accepts this. However, some still argue that the assumptions, especially on growth, may be too optimistic. Third, the Yellow Vest protests that have paralyzed France appear to be losing momentum, though, like the Occupy Movement, it seems to have a contagion. Large demonstrations were reported in Hungary over the weekend.

Eurozone economic data included a slightly smaller than expected October trade balance. The 12.5 bln euro seasonally adjusted surplus narrowed from the revised 13.0 bln surplus in September, which had initially been reported at 13.4 bln. EMU’s trade surplus has been slowly declining. The 12-month moving average peaked in late 2016 near 22 bln euros a month. Last year’s average was near 19.5 bln euros, and the 12-month average now stands below 17 bln euros. Separately, the November inflation estimate was shaved a little, with the core rate easing to 0.97% from 0.98% and the headline rate to 1.95% from 1.96%.

After recording an outside down week last week, the euro has not experienced follow-through selling to start the new week. On the contrary, it has recovered toward the middle of the pre-weekend range. The intraday technicals indicators warn that the upside in the European morning may have exhausted the bulls. There is a 614 mln euro option at $1.1360 that may be sufficient to stall the advance. There is also a roughly 532 mln euros at a $1.1320 strike that also expires today. Sterling is straddling $1.26. There is a large (GBP1.6 bln) option at $1.2700 that seems too far to be in play today. We suspect the $1.2640 area may be a sufficient cap.

North America

Outside of the US Empire Manufacturing Survey and Canada’s existing home sales data, market participants are looking at a quiet day. Canada’ portfolio flow report tends not to move the market, while the US TIC data is reported after the markets close today. The focus is this week’s FOMC meeting, where a rate hike is expected. Many observers anticipate a dovish hold by which it is meant that the Fed will signal a pause and moderate the rate hikes it anticipates next year. In September, the median forecast was for three increases in 2019. The market did not price in more than two and now is skeptical of even one.

The other issue that is important for investors is the possibility that there is a partial government shutdown at the end of the week due to a dispute over funding the wall between the US and Mexico. The Trump Administration demands something on the magnitude of $5 bln, while the Democrats are willing to allow $1.37 bln. A government shutdown could impact six of the 15 cabinet departments that have not been funded yet.

The US dollar is trading quietly just below CAD1.34. The pair is coiling like a spring. Today the triangle pattern is marking a CAD1.3320-CAD1.3410 range. The Dollar Index is finding support near 97.20 but has been unable to push above 97.50. Mexico President AMLO is talking about a budget surplus, which eases investors’ concerns, and has sent the peso higher. After briefly poking through MXN20.50, the upper end of its range ahead of the weekend, the US dollar was sold below MXN20.08 before stabilizing near MXN20.15. Mexico’s central bank also meets this week. A 25 bp rate hike is the most likely scenario.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$AUD,$CAD,$CNY,$EUR,$JPY,EUR/CHF and USD/CHF,Featured,MXN,newsletter,SPY