In a bizarre series of events that have had limited coverage but which are sure to have far-reaching consequences for benchmark pricing in the precious metals markets, the LBMA Gold Price and LBMA Silver Price auctions both experienced embarrassing trading glitches over consecutive trading days on Monday 10 April and Tuesday 11 April. At the outset, its worth remembering that both of these London-based benchmarks are Regulated Benchmarks, regulated by the UK’s Financial Conduct Authority (FCA). In both cases, the trading glitches had real impact on the benchmark prices being derived in the respective auctions, with the auction prices deviating noticeably from the respective spot prices during the auctions. It’s also worth remembering that the LBMA Gold Price and LBMA Silver Price reference prices that are ‘discovered’ each day in the daily auctions are used to value everything from gold-backed and silver-backed Exchange Traded Funds (ETFs) to precious metals interest rate swaps, and are also used widely as reference prices by thousands of precious metals market participants, such as wholesalers, refineries, and bullion retailers, to value their own bi-lateral transactions.

Topics:

Ronan Manly considers the following as important: benchmark price, Bloomberg, CME Group, Featured, Financial Conduct Authority, gold futures, gold price, gold price manipulation, IBA, ICE Benchmark Administration, LBMA, LBMA Gold Price, LBMA Silver Price, London Bullion Market Association, London gold market, London Gold Market Fixing Limited, London Silver Market, London Silver Market Fixing Limited, newslettersent, price manipulation, reference price, Reuters, Ronan Manly (Bullionstar), silver price, Thomson Reuters, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

In a bizarre series of events that have had limited coverage but which are sure to have far-reaching consequences for benchmark pricing in the precious metals markets, the LBMA Gold Price and LBMA Silver Price auctions both experienced embarrassing trading glitches over consecutive trading days on Monday 10 April and Tuesday 11 April. At the outset, its worth remembering that both of these London-based benchmarks are Regulated Benchmarks, regulated by the UK’s Financial Conduct Authority (FCA).

In both cases, the trading glitches had real impact on the benchmark prices being derived in the respective auctions, with the auction prices deviating noticeably from the respective spot prices during the auctions. It’s also worth remembering that the LBMA Gold Price and LBMA Silver Price reference prices that are ‘discovered’ each day in the daily auctions are used to value everything from gold-backed and silver-backed Exchange Traded Funds (ETFs) to precious metals interest rate swaps, and are also used widely as reference prices by thousands of precious metals market participants, such as wholesalers, refineries, and bullion retailers, to value their own bi-lateral transactions.

Although the gold and silver auctions are separately administered, they both suffer from limited direct participation due to the LBMA only authorising a handful of banks to directly take part. Only 7 banks are allowed to participate directly in the Silver auction while the gold auction is only currently open to 14 entities, all of which are banks. Limited participation can in theory cause a lack of trading liquidity. Added to the mix, a central clearing option was introduced to the LBMA Gold Price auction on Monday 10 April, a day before Tuesday’s gold auction screw-up. The introduction of this central clearing process change saw four of the direct participants suspended from the auction since they had not made the necessary system changes in time to process central clearing. This in itself could have caused a drop in liquidity within Tuesday’s gold auction as it reduced the number of possible participants.

Other theories have been put forward to explain the price divergences, such as the banks being unwilling to hedge or arbitrage auction trades due to the advent of more stringent regulatory changes to prevent price manipulation. While this may sound logical in theory, no one, as far as I know, has presented empirical trade evidence to back up this theory. There is also the possibility of deliberate price manipulation of the auction prices by a participant(s) or their clients, a scenario that needs to be addressed and either ruled out or confirmed.

ICE Benchmark Administration (IBA), the administrator of the LBMA Gold Price, also introduced a price calculation Algorithm into the gold auction in mid-March 2017, a change which should also be considered by those seeking to find a valid explanation for the gold auction price divergence where the opening price kept falling through multiple auctions rounds whilst the spot price remained far higher. Could the algorithm have screwed up on 11 April?

Whatever the explanations for the price divergences, these incidents again raise the question as to whether these particular precious metals auctions are fit for purpose, and why they were designed (and allowed to be designed) at the outset to explicitly block direct participation by nearly every precious metals trading entity on the planet except for a limited number of London-based bullion bank members of the LBMA.

LBMA Silver Price fiasco

First up, on Monday 10 April, buried at the end of a Reuters News precious metals market daily news wrap was a very brief snippet of news referring to an incident which dogged the LBMA Silver Price during Monday’s daily auction (an auction which starts at midday London time). According to Reuters:

“silver prices slipped after the LBMA silver price benchmark auction was paused for 17 minutes after a circuit breaker was triggered when the auction price moved outside of the spot range, the CME said in a statement.”

What exactly the CME meant is unclear because whatever statement Reuters was referring to has not been released on the CME Group website or elsewhere, and Reuters did not write a separate news article about the incident.

To recap, the LBMA Silver Price is administered by Thomson Reuters on a calculation platform run by the CME Group, and operated on a contract basis on behalf of the London Bullion Market Association (LBMA). However, there is nothing anywhere on the CME’s LBMA Silver Price web page, or on the Thomson Reuters LBMA Silver Price web page, or on the LBMA website, in the form of a statement, comment or otherwise, referring to this ‘circuit breaker’ that persisted for ’17 minutes’ in the LBMA Silver Price auction during which time the ‘auction price moved outside of the spot range‘

On its calculation platform, CME makes use of a pricing algorithm to automatically calculate a price for each round of the LBMA Silver Price auction (excluding the first auction round). From page 8 of its LBMA Silver Price Methodology Guide:

“3.7 Starting Price

The initial auction price value is determined by the auction platform operator by comparing multiple Market Data sources prior to the auction opening to form a consensus price based on the individual sources of Market Data. The auction platform operator enters the initial auction price before the first round of the auction begins….”

“3.4 End of Round Comparison

If the difference between the total buy and sell quantity is greater than the tolerance value, the auction platform determines that the auction is not balanced, automatically cancels orders entered in the auction round by all participants, calculates a new price, and starts a new round with the new price.”

There is also a manual price override facility which can be invoked if needed:

3.8 Manual Price Override

In exceptional circumstances, CME Benchmark Europe Ltd can overrule the automated new price of the next auction round in cases when more significant or finer changes are required. When doing so, the auction platform operator will refer to a composition of live Market Data sources while the auction is in progress.”

As to why the “auction platform operator” did not invoke these manual override powers and seek market data sources during the time in which the silver auction was ‘stuck’ for 17 minutes is unclear. A 17 minute pause would presumably be, in the CME’s words, ‘exceptional circumstances’.

Unfortunately, neither the CME website, the Thomson Reuters website, or the LBMA website provides intra-round pricing data for the LBMA Silver Price, so anyone who doesn’t have a subscription to the live data of the auction is well and truly left in the dark as to what actually happened on Monday 10 April. Unlike the LBMA Gold Price auction which at least provides an ‘Auction Transparency Report’ for each auction (see below), the LBMA Silver Price auction is sorely lacking in any public transparency whatsoever.

But what is clear from the Reuters information snippet is that the LBMA Silver Price auction on Monday 10 April suffered a serious trading glitch, that saw the prices that were being formed in the auction deviate from where the silver spot price was trading during that time. This price deviation suggests a lack of trading liquidity in the auction and/or an inability of the participants to hedge their trades in other trading venues. As to whether the final LBMA Silver Price that was derived and published as the daily benchmark price on 10 March was outside the spot range (and above or below spot) is not mentioned in the Reuters report.

The complete opacity about this incident is concerning but not really surprising since nearly everything in the London precious metals markets is shrouded in secrecy, and corporate communication in this area is truly abysmal.

Recalling that Thomson Reuters and CME announced in early March that they are abruptly pulling out of the contract for administrating and calculating the LBMA Silver Price, this latest fiasco is unwelcome news for the LBMA – CME – Thomson Reuters triumvirate, and raises further questions for the FCA as to whether this Silver auction and benchmark should even be allowed to continue in its present or similar form.

Turning to the London gold auction, on the afternoon of Tuesday 11 April, the LBMA Gold Price auction (which starts at 3:00pm London time) experienced what can only be described as a shocking and serious trading fiasco which has real world consequences for all trading entities that use the LBMA Gold Price Benchmark reference price (and there are many that do so). As a reminder, ICE benchmark Administration (IBA) administers the daily LBMA Gold Price auctions on behalf of the LBMA.

Again it was Reuters that broke the gold auction news. In a short article titled ‘London gold benchmark fixes $12/oz off spot price‘, Reuters said the following:

“London’s gold price benchmark fixed some $12 below the spot price on Tuesday afternoon as the auction appeared to become locked in a downward spiral. From an initial $1,265.75, close to the spot price at the time, the auction price ratcheted steadily lower before fixing at $1,252.90 in the ninth round. From the fifth round to the eighth the bid and offer volumes remained frozen, unable to match.“

“This came a day after ICE introduced clearing for the LBMA Gold Price auction”

Reuters concludes its article by noting that the ICE clearing was introduced:“before several participating banks had the necessary systems in place.”

“As a result, China Construction Bank, Societe Generale, Standard Chartered and UBS are yet to confirm a date for their participation in the cleared auction.. ICE declined to comment. The LBMA, which owns the intellectual property rights to the auction, was not immediately available to comment.”

This forced reduction in the number of participants in the auction seems to be relevant to the issue and therefore requires further scrutiny.

ICE Central Clearing – Foisted on the LBMA Gold Price auction?

In mid-October 2016 during the LBMA precious metals conference in Singapore, ICE Benchmark Administration announced that it would introduce central clearing into the London Gold Price by utilizing a series of daily futures contracts which it planned to launch in February 2017. The introduction of central clearing into the auction was initially planned for March 2017.

The LBMA Gold Price Oversight Committee meeting minutes for 4 November 2016 specify the March 2017 launch date and make clear that all banks ‘wanted to move‘ to use the clearing route, and that ICE Benchmark Administration ‘wish to keep running a healthy auction‘ (whatever that means). The minutes stated:

“IBA gave a central clearing update to the Committee, notifying them that the cleared instrument would be launched in January 2017 and the auction trades could be routed there from March 2017. The Committee were informed that IBA had spoken to every bank and every bank wanted to move. Discussion moved to the technical implications for this new model and IBA’s primary wish to keep running a healthy auction.”

Up until at least the end of February, ICE’s LBMA Gold Price page stated the following:

“From March 2017, subject to regulatory review, centrally cleared settlement will be available for transactions which originate from IBA’s gold auction underlying the LBMA Gold Price.

This will give firms the choice of settling their trades bilaterally against each counterparty (as they currently do), or submitting their trades to clearing and settling versus the clearing house. This mechanism removes the requirement for firms to have bilateral credit lines in place with all of the other Direct Participants in the auction.

Central clearing opens the auction to a broader cross-section of the market. It also facilitates greater volume in the auction.“

By the end of March 2017, the above statement had been altered from March 2017 to “Q2 2017″ with ICE pushing back the launch date for the introduction of central clearing:

“From Q2 2017, subject to regulatory review, centrally cleared settlement will be available for transactions which originate from IBAs gold auction underlying the LBMA Gold Price….”

Reuters again covered these ICE clearing delays in a series of articles during March, highlighting the fact that 4 of the 13 banks that are direct participants in the LBMA Gold Price auction were not ready for the introduction of central clearing due to delays in making unspecified changes to their internal IT systems that would allow such central clearing processing. So anybody who had been reading these Reuters articles would have been aware that there were risks on the horizon in terms of some of the LBMA Gold Price auction participants being slow in being ready for the changes.

In a 15 March article titled ‘London gold rush – ICE to launch clearing before banks are ready‘, Reuters said that ICE would introduce central clearing to the auction on 3 April and that:

“U.S.-based exchange operator ICE has already pushed back the launch of its service by several weeks to allow the banks and brokers who participate in the auction to adapt their IT systems, four sources with direct knowledge of the matter told Reuters.”

“Sources at many participant banks said that they were unhappy with the speed at which ICE was seeking to introduce clearing, which require investment in IT processes and back office systems and raise complex compliance issues.”

“However, at least four of the 14 banks and brokers who participate in the LBMA Gold Price auction will still not be ready to use the new system.

Banks that are not ready would be suspended from the auction until they have the necessary IT infrastructure in place or would have to participate through other players who could clear deals, according to the sources.

ICE’s readiness to provoke such disruption illustrates how much it wants to avoid further delays that could torpedo its ambitions to become the dominant exchange in London’s vast bullion market, market sources said”

Reuters picked up this theme again on 21 March with an article titled “ICE delays launch of clearing for London gold benchmark: sources“, in which it said that the 3 April start date had again been pushed back and that:

“two sources told Reuters that ICE had again delayed and there was now no set start date.”

“Sources earlier told Reuters that Societe Generale, Standard Chartered, ICBC Standard Bank and China Construction Bank would not be ready to clear the LBMA auction in time for April 3.”

Again interestingly, ICE’s desire to promote its own gold futures contracts was seen as a primary driver for trying to rush through the introduction of central clearing for the gold auction, as doing so would add volume to ICE’s daily gold futures contracts:

“market sources say ICE plans to use clearing of the LBMA Gold Price auction, which it administers, to funnel business to its contracts and give it a head start over rivals.”

As a reminder, ICE and CME have both recently launched gold futures contracts connected to the London market, and the London Metal Exchange (LME) plans to launch its own suite of London gold futures contracts in early June.

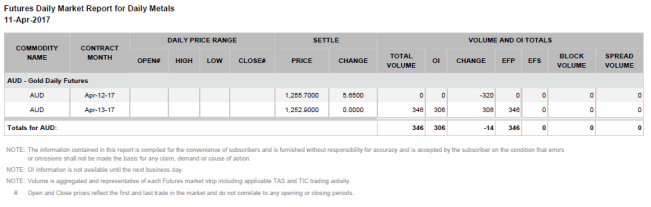

How these ICE daily gold futures work in conjunction with the afternoon LBMA Gold Price auction is unclear but the futures have daily settlement each day between 3:00 pm and 3:05 pm London time. An email to the IBA CEO asking for details of how the futures are linked to the auction went unanswered.

Both the ICE and CME contracts had a damp squib start, experiencing weeks of zero trading volumes. See BullionStar article from 8 February 2017 titled “Lukewarm start for new London Gold Futures Contracts”.

On 30 March, Bloomberg announced on Twitter that central clearing in the LBMA Gold Price auction would start on Monday 10 April.

ICE to start clearing #gold auction from April 10. More exclusively on @TheTerminal #METL #metals

— BN Commodities (@BNCommodities) March 30, 2017

Downward Spiral

Downward Spiral

So what was this downward spiral that the LBMA Gold Price auction experienced on the afternoon of Tuesday 11 April when it became, in the words of Reuters, locked in a downward spiral?

Let’s look at the ICE Auction Transparency Reports for the few days before and during the 11 April afternoon fiasco. These reports show the number of auction rounds, the number of participants,and the bid and offer volumes for each round as well as the price at the end of each round.

Fourteen entities are now authorized to be direct participants in the LBMA Gold Price auction, 13 of which are banks, the other being new participant INTL FCStone since early April. INTL FCStone is a financial services company that has a slant towards commodities. The 13 banks are:

- Bank of China

- Bank of Communications

- China Construction Bank

- Industrial and Commercial Bank of China (ICBC)

- Goldman Sachs

- HSBC Bank USA

- JPMorgan Chase Bank (London Branch)

- Morgan Stanley

- Société Générale

- Standard Chartered

- The Bank of Nova Scotia – ScotiaMocatta

- Toronto-Dominion Bank

- UBS

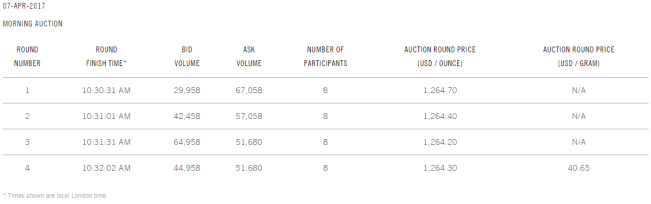

Unlike the old London Gold Fixing which had 5 member banks that were obliged to always turn up (and since 2004 dial in) for every auction, this LBMA Gold Price auction does not require all the authorized participants to dial-in. Most of the time, far fewer than the full contingent turn up. For example on Friday 7 April, 8 banks turned up at the morning auction while only 7 banks turned up at the afternoon auction (i.e only a 50% turnout). However, Friday 7 April is also relevant since that was the last day before ICE introduced central clearing to the gold auction.

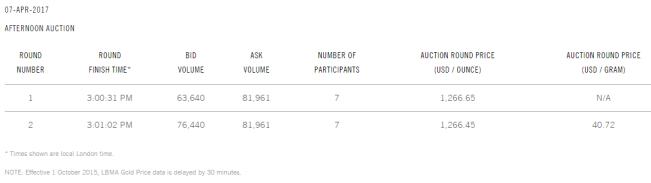

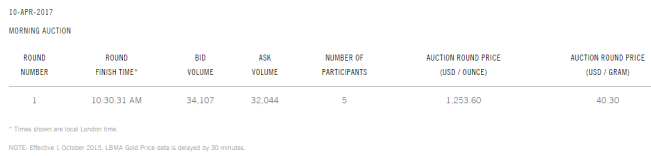

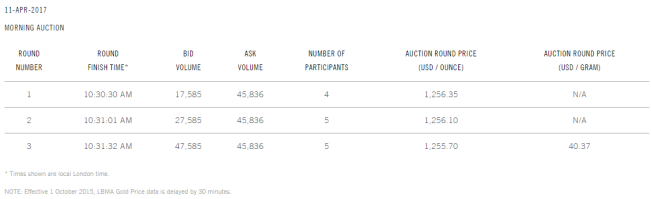

Fast forwarding to the morning gold auction on Monday 10 April when ICE first introduced central clearing, you can see from the below auction report that only 5 banks participated. This is the same small number that took part in the former London Gold Fixing which was run by the infamous and scandal ridden London Gold Market Fixing Limited and which consisted of Deutsche Bank, Barclays, HSBC, Scotiabank and Société Générale.

The reason the turnouts after the introduction of central clearing are so low is that 4 of the direct participant banks have been excluded from the auction due to not being ready to implement central clearing – a fact predicted by Reuters News in March. This means that the usual number of between 7-10 banks participating in the auction has now been reduced by 4, as four banks cannot take part. As Reuters said on 21 March “Banks that are not ready would be suspended from the auction until they have the necessary IT infrastructure in place”.

The irony of this debacle is that the participating banks all already have bilateral credit limits with each other and so don’t need to do central clearing in the auction. Central clearing is supposed to make it easier for a far wider range and number of participants to take part. But if this entails enhancements to IT systems that some of the most sophisticated investment banks on the planet are struggling with, what hope is there for other precious metals trading entities to participate.

The ICE LBMA Gold Price web page now includes a double asterisk next to the names of the culprit banks that are not ready for central clearing. These banks are China Construction Bank, Société Générale, Standard Chartered, and UBS. the double asterisk states that “** Date of participating in the cleared auction to be determined.”

So now, more than 2 years after the LBMA Gold Price has been introduced, we are back to a situation where only 5 large bullion banks are participating in a daily gold price auction, an auction which has huge ramifications for the reference pricing of gold across myriad gold markets around the world.

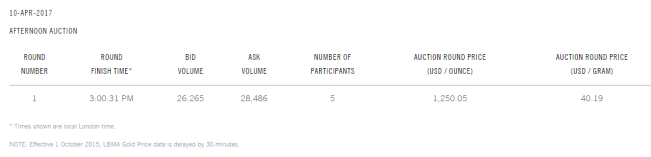

Both of the auctions on 10 April finished within the first round, with buy volume and sell volume in balance, so there was no need for subsequent auction rounds.

Turning to the morning auction of Tuesday 11 April, only a measly 4 banks took part in the first round of the auction, and 5 participants took part in rounds 2 and 3. The bid and ask volumes were not that much out of balance, and the auction finished after 3 rounds.

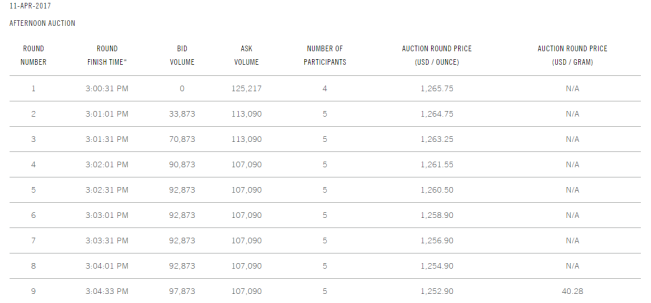

Turning to the afternoon auction of 11 April, the price action commentary provided by Reuters was as follows:

“from an initial $1,265.75, close to the spot price at the time, the auction price ratcheted steadily lower before fixing at $1,252.90 in the ninth round. From the fifth round to the eighth the bid and offer volumes remained frozen, unable to match.“

Below you can see visually see what happened round by round from the first round price of $1,265.75 where there was zero bid volume and 125,217 ozs (nearly 4 tonnes) of ask volume, through the fifth to (actually) the ninth rounds where bid volume was an unchanging 92,873 ozs and ask volume was an unchanging 107,090 ozs, but still the price fell from $1,260.50 to fix in round 9 at $1,252.90, i,e, the price fell $7.60 in 2 minutes while the volumes didn’t budge. And most critically, the fixing price was $1252.90 while the spot price was trading at $1267 at that time.

As Kitco News said in its coverage of the LBMA Gold Price fiasco:

“the benchmark ended up being set almost $15 dollars below where spot prices were trading at the time. The PM Gold Price showed a benchmark at $1,252.90 an ounce; however at the time, spot gold prices were trading around $1,267 an ounce, with prices heading towards a new five-month high.”

How could this happen? How could the auction price diverge so much from the spot price at that time and how could the auction go through round after round lowering the price while the bid and ask volumes did not change and while the spot price was actually far higher than any of the prices in the auction?

Kitco’s explanation, which is mostly based on the view of one person, Jeff Christian of the CPM Group, put the problem down to “poorly conceived regulations and a faulty price discovery mechanism“, i.e. a lack of liquidity due to banks being scared off by tightening regulations, and that this “sharp reduction in liquidity during the auction process” is causing “a large discrepancy in prices“. Christian also said that “because of regulations, banks and other financial institutions are backing away from becoming market makers.”

But this reasoning of backing away due to regulations is not backed up by the facts for the simple reason that banks have continued to join the LBMA Gold Price auction at a rapid rate over the last 2 years, i.e. there is a trend of ever more banks applying to be authorized to participate in the auction. For example, since the auction was launched on 20 March 2015 with 6 banks, 9 more banks have signed up JP Morgan, Morgan Stanley, Standard Chartered, Bank of China, ICBC, China Construction Bank, Bank of Communications, Toronto Dominion Bank, and INTL FCStone. Note that Barclays was one of the original six banks in the auction but dropped out after it downscaled its the precious metals business in London. There are also the same number of LBMA Market Makers now as there were two years ago, in both cases 13 LBMA Market Makers.

Kitco’s article also fails to mention the central clearing implementation fiasco brought about by ICE’s rush to channel activity into its gold futures contracts and Kitco even fails to realize that 4 banks were suspended from the auction due to this central clearing issue.

Another factor relevant to the screwed up afternoon auction on 11 April that should be considered is the fact that in mid-March 2017, ICE Benchmark Administration introduced a price algorithm into the LBMA Gold Price auction. This fact has been totally ignored by the financial media.

From a human Chairperson to an automated Algorithm

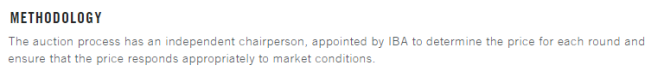

Up until mid March 2017, the LBMA Gold Price auction used a human ‘independent chairperson’ to choose the opening price in the auction and also the auction price in each subsequent round. The identities of these independent chairpersons have never been divulged by ICE nor the LBMA.

Critically, sometime during the 3rd week of March 2017, ICE Benchmark Administration (IBA) introduced a pricing algorithm into the LBMA Gold Price auction. This change in procedure (moving from an auction chairperson to an auction pricing algorithm) was not publicised by either ICE or the LBMA but is clear from looking at Internet Archive imprints of the ICE LBMA Gold Price webpage.

In an imprint of the LBMA Gold Price webpage from 9 March 2017, the methodology section states that:

“The auction process has an independent chairperson, appointed by IBA to determine the price for each round and ensure that the price responds appropriately to market conditions.”

See screenshot below for the same statement – taken from the same webpage:

Bullet point 1 of the Auction Process for the 9 March version of the webpage also refers to the chairperson as being responsible for setting the starting price and the price of each subsequent round “in line with current market conditions and the activity in the auction.”

But by 16 March, when the next imprint of the LBMA Gold Price page was made by the Internet Archive, the reference in the methodology section to an independent chairperson had been fully deleted, and bullet point 1 had been changed from mentioning a chairperson to discussing an algorithm, specifically changed to “IBA sets the starting price and the price for each round using an algorithm that takes into account current market conditions and the activity in the auction.”

See screenshot below for the same statement – taken from the same webpage:

So if there is an algorithm that is taking into account current market conditions in addition to activity in the auction, why did this algorithm not take the current spot prices into account over rounds 4 – 9 of the LBMA Gold Price auction on the afternoon of Tuesday 11 April?

Furthermore, for such a major change to the methodology and auction process in an auction whose benchmark price is widely used in the gold world, it’s very surprising that neither ICE, nor the LBMA, nor the London financial media mentioned this substantial algorithmic change. On its website, ICE states that the LBMA Gold Price methodology is “reviewed by the LBMA Gold Price Oversight Committee as documented in its Terms of Reference.”

It therefore looks like this Oversight Committee is the responsible party for having implemented the pricing algorithm. However, even the minutes of the meetings of this LBMA Gold Price Oversight Committee are published months and months after the actual meetings have taken place and then only in a ‘redacted’ form, so even if this committee had discussed the introduction of an algorithm during a meeting in March or just prior to that, the majority of the gold world would be completely in the dark about such a change.

I can find no mention of this pricing auction on ICE’s LBMA Gold Price webpage, and nothing in any of the auction’s methodology documents.

Conclusion

The trading glitch with the LBMA Silver Price on Monday 10 April seems to have been completely missed by London’s financial media except for the brief reference by Reuters. The fact that there is no information on the CME, Thomson Reuters and LBMA websites about the issue should raise concern for users of this benchmark and for the UK’s regulator, the FCA. In an ideal world, there should be a full ‘outage’ report published on each of the 3 websites explaining what happened, but this will not happen in the shadowy and secretive London Silver Market.

Perhaps the auction price divergence in the LBMA Silver Price stems from a lack of liquidity brought on by the limited presence of auction participants, or due to the inability or unwillingness of participants to hedge or arbitrage their auction trades against the London OTC spot or other trading venues? The simple thing to do would be for CME, Thomson Reuters and the LBMA to explain themselves since this would minimize guesswork and to provide global silver market entities with clarity. Anything short of a full explanation by the parties concerned is irresponsible.

For the LBMA Gold Price auction, ICE Benchmark Administration needs to release a full ‘outage’ report and explanation on what exactly happened in the afternoon auction on 11 April and explain to the global gold market whether the introduction of central clearing was in any way responsible for the price divergence, and whether there are any conflicts of interest in trying to get banks to use its daily gold futures contracts. While they are at it, ICE should fully explain how the recent introduction of a pricing algorithm impacts the gold auction and whether this too had an impact on the auction price entering a downward spiral.

As the LBMA Silver Price and LBMA Gold Price are both Regulated Benchmarks, the FCA regulator needs to step up to the plate and for once show that it is on the side of the users of these benchmarks and not the powerful London banks.

Both of these auctions require full transparency and ease of direct participation by the full spectrum of the world’s gold and silver trading entities. Currently, they fall far short of these goals.

Ronan Manly

E-mail Ronan Manly on:

Tags: benchmark price,bloomberg,CME Group,Featured,Financial Conduct Authority,gold futures,gold price,gold price manipulation,IBA,ICE Benchmark Administration,LBMA,LBMA Gold Price,LBMA Silver Price,London Bullion Market Association,London gold market,London Gold Market Fixing Limited,London Silver Market,London Silver Market Fixing Limited,newslettersent,price manipulation,reference price,Reuters,silver price,Thomson Reuters,Uncategorized