The absolutely unprecedented wave of shutdowns, new restrictions and regulations that the coronavirus epidemic has triggered on a global scale is truly hard to quantify. We’ve simply never seen anything like it before. Never in the history of mankind have countries all over the globe intentionally hit the kill switch on their own economies and simultaneously pulled the brakes on anything even remotely resembling productive activity. Some of the consequences of these radical...

Read More »100 Years Ago, Russian Stocks Had A Very Bad Day

In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world’s largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump. Yesterday. in the latest expression of his building anti-Trumpian sentiment, Bridgewater released a...

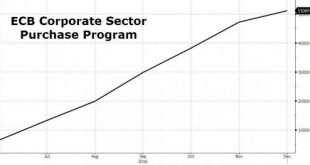

Read More »ECB Assets Rise Above 36 percent Of Eurozone GDP; Draghi Now Owns 10.2 percent Of European Corporate Bonds

The ECB’s nationalization of the European corporate bond sector continues. In the ECB’s latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding. For the week ending 27th January, the bond purchases stood at €1.9bn across sectors. This increases the number of...

Read More »Lagarde Urges Wealth Redistribution To Fight Populism

IMF Managing Director Christine Lagarde, Italian Finance Minister Pier Carlo Padoan and Founder, Chairman and Co-CIO of Bridgewater Associates, Ray Dalio - Click to enlarge As we scoffed oveernight, who better than a handful of semi, and not so semi, billionaires – perplexed by the populist backlash of the past year – to sit down and discuss among each other how a “squeezed and Angry” middle-class should be fixed. And...

Read More »Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered “fake news” within the “serious” financial community, disseminated by fringe blogs? Good times. In an interview with Swiss Sonntags Blick titled appropriately enough “A Recession Is Sometimes Necessary“, the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by...

Read More »Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? Good times. In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks and their ‘supremacy over the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org