The prices of the metals moved up a bunch this week, with gold + and silver +%excerpt%.55. We have seen some discussion of gold backwardation in the context of scarcity, and hence setting expectations of higher prices. That’s good, as the swings from contango to backwardation and back are the only way to understand changing supply and demand in the market. You should be cautious about trading news. With Fed’s meeting, gold and silver prices moved to backwardation: Future delivery prices are lower than gold and silver delivered today. However, the cobasis is a sensitive indicator. It predicts the likely path of the price, but you should get an updated picture before buying based on an old reading after a sizeable price move. In this Report, we’ll look at both metals bases, as well as their cobasis term structures. So read on… First, here is the graph of the metals’ prices. The Prices of Gold and Silver We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

Topics:

Keith Weiner considers the following as important: backwardation, cobasis, contango, dollar price, Gold and its price, gold basis, gold price, silver basis, silver price

This could be interesting, too:

Dave Russell writes Gold Hits New All Time Highs

Joseph Y. Calhoun writes Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

Stephen Flood writes Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Keith Weiner writes Silver Fever, or Silver Fading?

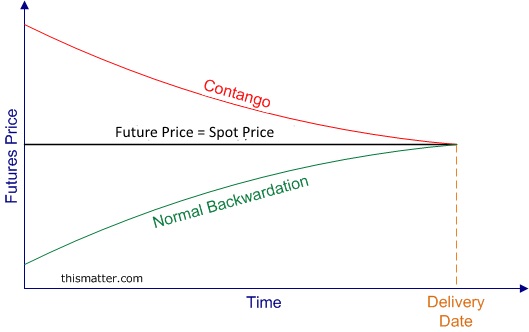

The prices of the metals moved up a bunch this week, with gold + $32 and silver +$0.55. We have seen some discussion of gold backwardation in the context of scarcity, and hence setting expectations of higher prices. That’s good, as the swings from contango to backwardation and back are the only way to understand changing supply and demand in the market.

You should be cautious about trading news. With Fed’s meeting, gold and silver prices moved to backwardation: Future delivery prices are lower than gold and silver delivered today.

However, the cobasis is a sensitive indicator. It predicts the likely path of the price, but you should get an updated picture before buying based on an old reading after a sizeable price move.

In this Report, we’ll look at both metals bases, as well as their cobasis term structures. So read on…

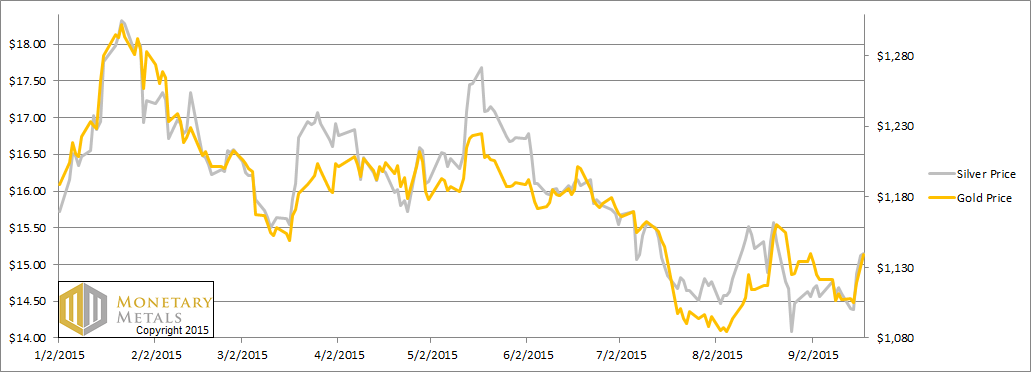

First, here is the graph of the metals’ prices.

The Prices of Gold and Silver

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

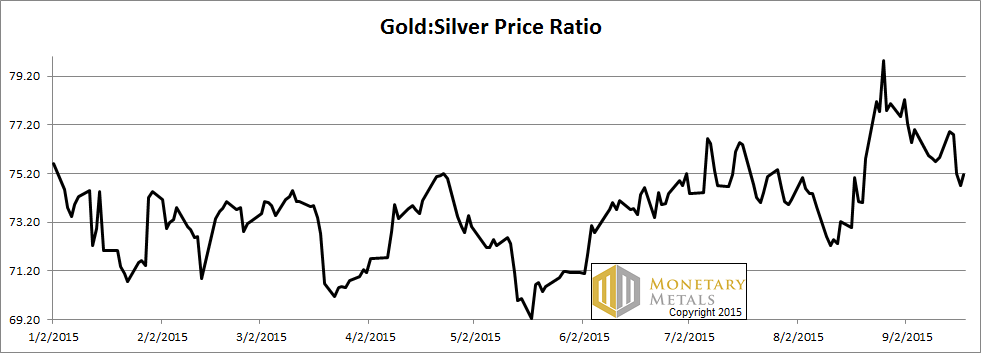

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved down again this week.

The Ratio of the Gold Price to the Silver Price

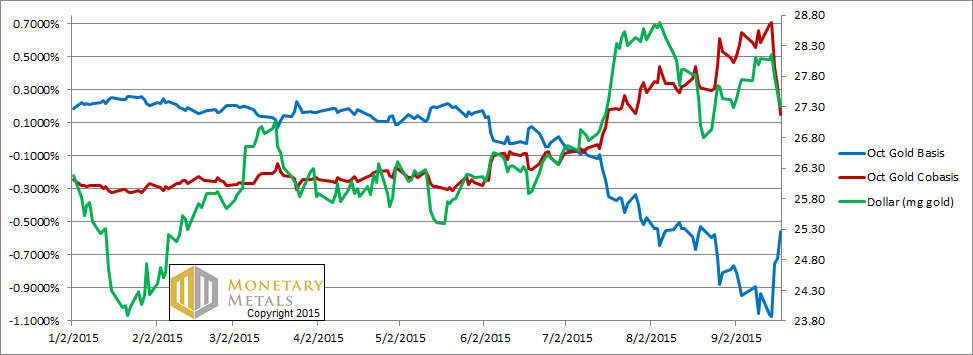

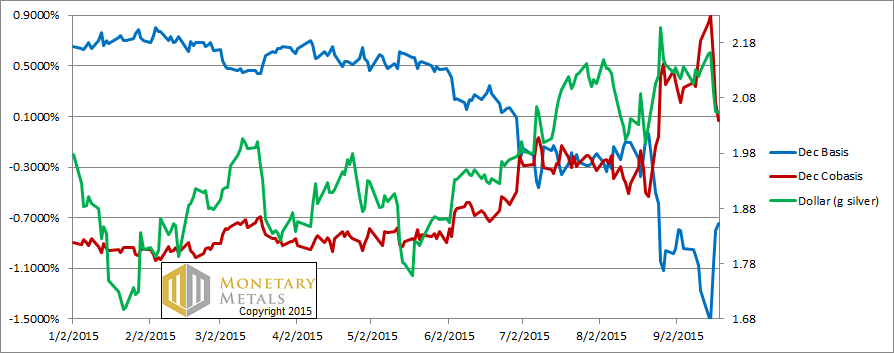

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

The Gold Basis and Cobasis and the Dollar Price

The price of the dollar fell dramatically (i.e. the price of gold rose), but the scarcity (i.e. cobasis) of gold dropped proportionally. As the price rises, there’s less buying of metal and more selling. That’s to be expected.

The fundamental price is up another ten or twelve bucks, still well over hundred bucks above the market price.

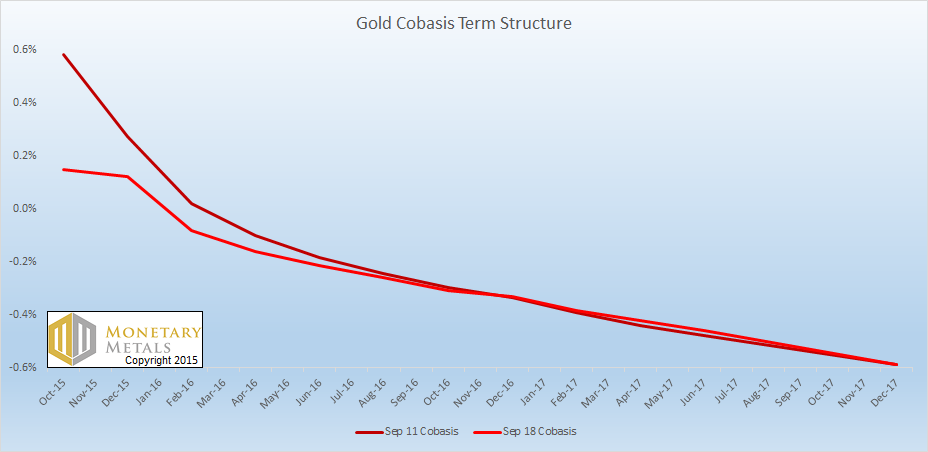

Let’s look at the gold cobasis out two years. We show both a week ago Friday Sep 11, and this Friday Sep 18.

The Gold Cobasis Term Structure

Three things are noteworthy. One, these are small values. 60 basis points annualized on a contract that will deliver in just over a month is under a dollar per ounce. You need high quality realtime data to see this with any accuracy.

Two, with the higher price, backwardation mostly subsided. We had 60 basis points for the October contract and just under 30 for December. A week and $32 later, these numbers are reduced to 15 and 12 basis points respectively.

Three, the impact was felt in nearer contracts only. More than a year out, there’s no meaningful difference in the cobases.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

It’s the same picture in silver. Price of the metal up, and scarcity down. The silver fundamental price didn’t budge. Silver is now just about fairly priced for current fundamentals.

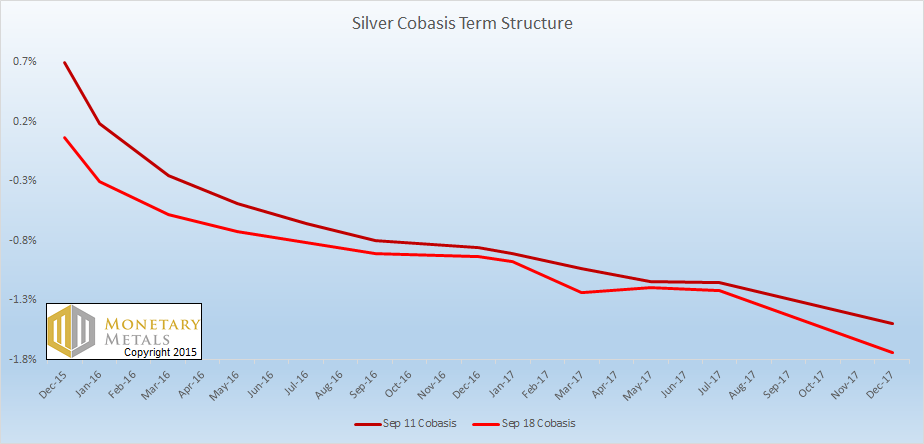

Let’s look at the silver cobasis term structure.

The Silver Cobasis Term Structure

There is an even bigger collapse than in gold. The December contract had a 70 bps backwardation on Sep 11. Now it’s 7 bps. January had a sizeable backwardation, now the cobasis is -31bps.

Unlike in gold, the drop occurs across the entire term structure. This 55-cent increase in the silver price did more to alleviate silver scarcity than the 32-buck increase in the gold price. Maybe this shows silver’s dual nature as an industrial metal also (where rising price disincentives consumption, a factor not applicable to gold). Or maybe it’s just a reflection of the greater proportional move in silver of 3.8% vs. 2.9% in gold.

Monetary Metals is sponsoring a seminar in central London on October 2, to discuss economics and markets, with a focus on how to approach saving, investing, and speculating. Please registerhere.

See more for