Warren Buffett has frequently advised aspiring investors to take a contrarian view on markets and "be fearful when others are greedy and be greedy when others are fearful." In fact, being dismissive of the wall street 'herd mentality' has resulted in some of Buffett's most successful trades over the years including his decision to load up on bank stocks during the 'great recession'. But the market wizards at Credit Suisse and UBS are apparently advising their wealthy retail clients to ignore Buffett's sage advice and instead follow a strategy that can loosely be summarized as "Buy The Fucking Dip." It's a genius plan, if we understand it correctly. Per Bloomberg: Credit Suisse Group AG and UBS Group AG have a message for their wealthy clients: it’s not too late to buy equities. Political risk is keeping many rich individuals on the sidelines of a rally that’s sent global stocks surging to records amid a recovering world economy. Now’s the time for them to jump back in and take advantage of the gains still to be made, say the people looking after their cash. “Whenever it feels really difficult and challenging to put money at work, ultimately those are often the better investments,” Burkhard Varnholt, deputy chief investment officer of Credit Suisse, said at a roundtable discussion at Bloomberg’s Zurich office on Feb. 27.

Topics:

Tyler Durden considers the following as important: Bankers, Business, Credit Suisse, economy, Finance, financial markets, Financial services, headlines, hedge fund, Investment banks, Money, recovery, UBS, US Federal Reserve, Wall of Worry, Warburg family, Warren Buffett, Zurich

This could be interesting, too:

investrends.ch writes Der Franken als letzter sicherer Hafen: Wenn die Welt am Dollar zweifelt

investrends.ch writes ODDO BHF holt UBS-Managerin Simone Westerfeld als stellvertretende CEO

investrends.ch writes Hedgefonds-Branche erlebt Gründungsboom – Kapital erreicht Rekordhöhe

investrends.ch writes UBS: Schweizer Pensionskassen bleiben risikobewusst – doch sie können die Rendite halten

Warren Buffett has frequently advised aspiring investors to take a contrarian view on markets and "be fearful when others are greedy and be greedy when others are fearful." In fact, being dismissive of the wall street 'herd mentality' has resulted in some of Buffett's most successful trades over the years including his decision to load up on bank stocks during the 'great recession'.

But the market wizards at Credit Suisse and UBS are apparently advising their wealthy retail clients to ignore Buffett's sage advice and instead follow a strategy that can loosely be summarized as "Buy The Fucking Dip." It's a genius plan, if we understand it correctly. Per Bloomberg:

Credit Suisse Group AG and UBS Group AG have a message for their wealthy clients: it’s not too late to buy equities.

Political risk is keeping many rich individuals on the sidelines of a rally that’s sent global stocks surging to records amid a recovering world economy. Now’s the time for them to jump back in and take advantage of the gains still to be made, say the people looking after their cash.

“Whenever it feels really difficult and challenging to put money at work, ultimately those are often the better investments,” Burkhard Varnholt, deputy chief investment officer of Credit Suisse, said at a roundtable discussion at Bloomberg’s Zurich office on Feb. 27. “That sense of skepticism, that wall of worry, which is still there, to me is not a discouragement.”

Of course, we're pretty sure that when Buffett said to be "greedy when others are fearful," he wasn't talking about the type of fear that people feel about investing in a massive equity bubble that is trading well beyond any reasonable valuation metric that anyone has ever considered reasonable in the history of markets.

Meanwhile, UBS's CIO found a whole new reason to be positive on equities, namely the Fed's decision to raise interest rates. Yes, you read that correctly, for 8 years low interest rates were credited as the primary reason to own equities (after all, fair values inevitably trend toward infinity as discount rates approach 0%, just ask a finance professor) but now the inverse, high rates, is also apparently a great signal for equities.

Even so, Mark Haefele, CIO of UBS’s wealth-management unit, spent time traveling the world this year, trying to persuade clients to shift out of cash and bonds and into stocks to boost their returns.

While many clients are engaged in a “hunt for yield,” UBS’s customer base overall “would benefit from moving out of bonds and cash” into stocks and higher-yielding alternatives such as hedge funds, said Haefele, who oversees $2.3 trillion.

“Political uncertainty is always difficult to price,” said Guido Fuerer, CIO of Swiss Re, who oversees assets of about $160 billion. “Going beyond politics and thinking about policy uncertainty more broadly, I see the Fed’s normalization path as very positive, not only for market stability but also for us as long-term investors.”

And Zurich Insurance Group also chimed in saying that equity investors should take some comfort in the "pretty

benign macro environment"...which makes a whole lot of sense if you can

just ignore the fact that equities have more than tripled over the past 8

years.

“We can get very fuzzed about political risks

these days because it occupies the headlines,” Urban Angehrn, CIO at

Zurich Insurance Group AG, Switzerland’s biggest insurer, said at the

Bloomberg event. “Underneath that, we have a pretty benign macro

environment that shows a recovery, good consumer and business

confidence. There are a lot of other positive economic trends.”

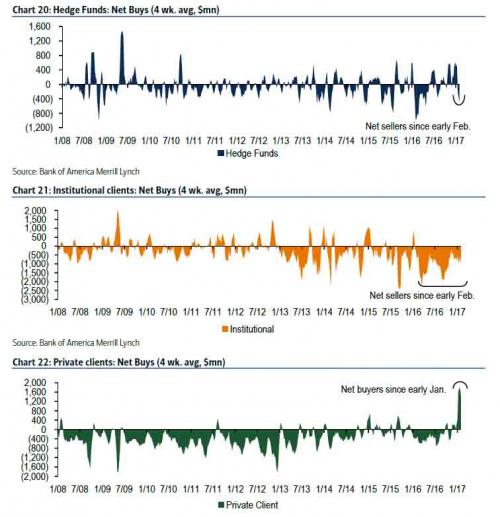

As we pointed out last week, the advice of UBS and Credit Suisse seems to be working. As the following chart shows, Private Clients, aka high net worth retail investors, have been on a furious buying spree unlike anything seen in the past decade (green area chart below). That said, to our complete 'shock', prominent institutional clients have skipped the Trump rally altogether and have been net sellers for the past 12 months, with hedge funds joining in over the last few weeks.

In summary: