Is inflation on the horizon? Should bank reserve balances stored with the Federal Reserve count as "money"? According to Jeffrey Snider, head of global research at Alhambra Investment Partners, and Steven Van Metre, macro fund manager and founder of Portfolio Shield, the answer to these questions is a resounding "no." Drawing upon a data ranging from Treasury auction sales to Eurodollar futures curves, van Metre and Snider explain why low yields are, in fact, deflationary...

Read More »Covid: 62 new deaths as hospitalisations rise in Switzerland

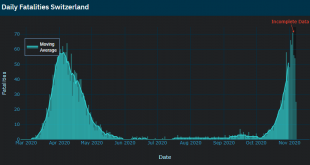

© 8213profoto | Dreamstime.com On 5 November 2020, Switzerland’s Federal Office of Public Health (FOPH) reported 62 deaths among laboratory-confirmed cases of Covid over 24 hours, bringing the total death toll since summer to 606. Current daily deaths are not far from the peak level reached during the first wave over spring, according to FOPH data. In addition, FOPH reported a further 399 hospitalisations over 24 hours. There are currently 3,428 Covid-19 patients in...

Read More »Covid, Nov6: 62 new deaths as hospitalisations rise in Switzerland

Deaths because of and with Covid19 On 5 November 2020, Switzerland’s Federal Office of Public Health (FOPH) reported 62 deaths among laboratory-confirmed cases of Covid over 24 hours, bringing the total death toll since summer to 606. Current daily deaths are not far from the peak level reached during the first wave over spring, according to FOPH data. Total deaths in Switzerland since the beginning of the pandemic have reached 2,622, of which 2,337 were laboratory...

Read More »Markets Gyrate Ahead of Protracted Period of Uncertainty

Markets likely facing an extended period of uncertainty; the dollar is seeing some safe haven bid but is well off its highs Despite President Trump’s claim of victory and his call to halt vote counting and go to the Supreme Court, it’s important to emphasize that the election is simply not over yet; asset prices are sending a cacophony of signals as investors struggle to price multiple possibilities The two day FOMC meeting starts today and concludes with a likely...

Read More »Why High Net Worth Investors are Opting for Physical Gold Vs ETFs, Digital Gold & Crypto-Currencies

As we continue to await the official result of the US Election, in the short-term financial markets remain volatile. However, today Mark O’Byrne is talking with David Bell of PCD Club about why the current uncertainty in global financial markets has High Net Worth Investors seeking out physical gold coins and bars in preference to ETF’s, Digital Gold and Crypto-Currencies. [embedded content] You Might Also Like...

Read More »Counting The Corroborated Stall, Not The Coming Lawfare Election Mess

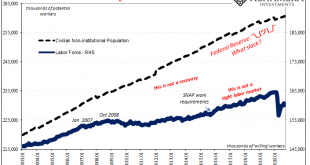

While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too. The rebound is still rebounding, of course, and this upturn...

Read More »Why Socialism Won’t End Worker “Exploitation”

A belief still commonly held today by not just Marxists and socialists, but progressives of many stripes, is the insistence that employers are “stealing” part of their workers’ labor because the wage workers receive from their employer are less than the contribution of their labor to the final value (i.e., selling price) of the finished good. Profit to the employer, the argument goes, is akin to theft from the workers. Profit is “surplus value” created by the...

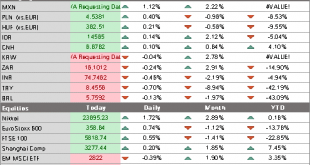

Read More »FX Daily, November 5: The Dollar Slides and the Yuan Jumps

Swiss Franc The Euro has risen by 0.22% to 1.0719 EUR/CHF and USD/CHF, November 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets did not wait for the final vote count and took stocks and bonds higher while pushing the greenback lower. While it appears Biden will be the next US President, investors seemed to like the fact that his agenda will be checked by a Senate that may remain in Republican...

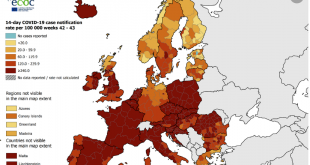

Read More »COVID-19 situation update for the EU/EEA and the UK, as of 4 November 2020

The data presented on this page has been collected between 6:00 and 10:00 CET Disclaimer: National updates are published at different times and in different time zones. This, and the time ECDC needs to process these data, may lead to discrepancies between the national numbers and the numbers published by ECDC. Users are advised to use all data with caution and awareness of their limitations. Data are subject to retrospective corrections; corrected datasets are...

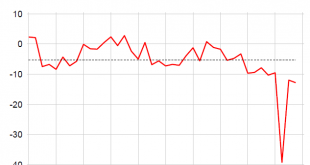

Read More »Swiss Consumer sentiment: No further recovery of consumer sentiment

Consumer sentiment in Switzerland has largely been stagnating since the summer. All sub-indices used for the calculation are still below their long-term average and none have improved significantly compared to this summer’s survey. Economic development and the situation on the labour market are seen as unfavourable. As of October, the consumer sentiment index stands at –13 points, almost at the same level as in July (–12 points). The sentiment remains gloomy,...

Read More » SNB & CHF

SNB & CHF