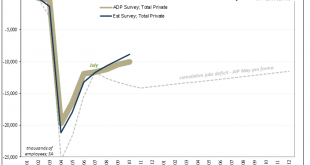

The payroll report for the month of October 2020 was a very good one. This shouldn’t be surprising, perfect BLS publications appear with regularity even during the most challenging of circumstances. Headlines and underneath, everything looked fine last month. It wasn’t perfect, however, and it’s the same things that leave it short of perfection which are entirely too familiar for this last decade of the occasional perfect payroll publication. Meaning, yes,...

Read More »Dollar Soft as Risk On Sentiment Dominates Ahead of FOMC Decision

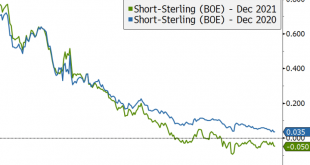

Dollar weakness has resumed as risk on sentiment dominates; the US election outcome is starting to take shape Senate Majority Leader McConnell said passing a stimulus bill is a top priority during the lame duck session; the two day FOMC meeting concludes today with a likely dovish hold; weekly jobless claims will be reported BOE increased its asset purchases by GBP150 bln vs. GBP100 bln expected; UK government is due to announce more details of the growing fiscal...

Read More »CHARLES HUGH SMITH: Could ELECTION SHENANIGANS Investigation UNCOVER Something DEEPER??

CHARLES HUGH SMITH Joins Michelle To Discuss The Presidential Elections, Which Are About The American People's TRUST In Their Right To Chose Their Own President. Or Will America's President Be Selected For Us? #CharlesHughSmith #MichelleHoliday #Election

Read More »Lockdowners and “the Desire to Dominate”

. In many years of lecturing at Mises University, Judge Napolitano has given the same—terrifying—ending to his introductory speech. Not until the horrors of this year did it dawn on me that perhaps his point has its basis in reality. The dear judge often mentions, almost like a joke, the libido dominandi—the desire to dominate, or the will to power, harking back to Augustine of Hippo’s centuries-old writing. We find similar notions in Friedrich Hayek’s “Why the Worst...

Read More »Shareholders call for new priorities for manager salaries

Checking the stock markets in Zurich’s Bahnhofstrasse Keystone Shareholders in Switzerland want a rethink on how managers are paid and demand that priorities regarding corporate governance, sustainability and corporate social responsibility (CSR) be redefined, a survey has found. “Investors consider compensation systems not to be sufficiently aligned with social and environmental priorities and judge adjustments to bonus payments due to Covid-19 highly...

Read More »Here’s Our Historical Analogy Menu: Rome, the USSR or Revolutionary France

The core dynamic is ultimately the loss of social cohesion within the ruling elites and in the social order at large. There’s a definite end of days feeling to the euphoria that the world didn’t end on November 3. And what better way to celebrate the victory of what passes for normalcy with a manic stock market rally? It’s as if everyone knows there is no returning to the good old days of a well-oiled Imperial machine chewing through any and all obstacles, and this...

Read More »Gold and Silver to Explode Higher Regardless of the US Election Result?

Today we are taking our weekly look at the charts for gold and silver. After what has been the most unusual campaign season for both candidates, election day has finally arrived. Regardless of your political persuasions, both gold and silver look to be setting up for an explosive move higher. First let’s take a look at the gold price chart… After pulling back from its all-time high of approx. $2,065, gold has consolidated and seems to have formed a nice base. It has...

Read More »The Idea that Democracy Is the Same as Liberty Is a Weapon in the Hands of Despots

As Americans approach a date with their polling places and “get out the vote” campaigns crescendo, there is plenty of rhetoric that all but deifies democracy. Unfortunately, while democratically determining who will be entrusted with the reins of government may generally represent the best hope to enable governments to change without bloodshed (exemplified by John Adams just going home when he lost the presidency to Thomas Jefferson), democracy is not the defining...

Read More »CHARLES HUGH SMITH: Could ELECTION SHENANIGANS Investigation UNCOVER Something DEEPER?

Portfolio Wealth Global WATCH LISTS: http://portfoliowealthglobal.com/list http://portfoliowealthglobal.com/list2 http://portfoliowealthglobal.com/list3 http://portfoliowealthglobal.com/list4 http://portfoliowealthglobal.com/tech Disclosure/Disclaimer: We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and...

Read More »FX Daily, November 6: A Pause that Refreshens?

Swiss Franc The Euro has fallen by 0.03% to 1.0685 EUR/CHF and USD/CHF, November 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors have piled into risk assets this week, seemingly undeterred by the US elections’ lack of a clear outcome. The coronavirus is still surging, and a new complication has emerged. A mutation of the virus, originating in minks (Denmark), could pose a challenge in developing a...

Read More » SNB & CHF

SNB & CHF