The operators of Germany’s main stock exchange appear committed to merging cryptocurrencies into mainstream finance. Keystone / Boris Roessler The operators of Germany’s main stock exchange have paid more than CHF100 million ($108 million) for a majority stake in Swiss cryptocurrency service provider Crypto Finance. The move reflects a growing trend of traditional financial institutions gearing themselves up for an anticipated growth in the trade of digital financial...

Read More »A Clear Balance of Global Inflation Factors

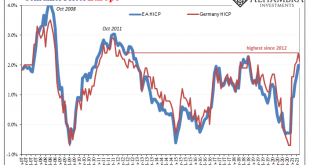

Back at the end of May, Germany’s statistical accounting agency (deStatis) added another one to the inflationary inferno raging across the mainstream media. According to its flash calculations, German consumer prices last month had increased by the fastest rate in 13 years. Even using the European “harmonized” methodology (Harmonized Index of Consumer Prices, or HICP), inflation had reached 2.4% year-over-year which was the highest since 2012. Europe HICP and...

Read More »87: Reading Jeff Snider on the Fed’s Not-Hot Dot-Plot

Non-economist, monetary iconoclast Jeff Snider's commentary on the the 'big news' about the 'hawkish' new Fed forecast implying economic recovery championed by the business press while at the same time an underlying liquidity reading (RRP) glows orange. A warning. ----------WHO---------- Jeff Snider of Alhambra Investments. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "Strolling with You" by John Runefelt at Epidemic Sound. ----------WHAT---------- The Dots Are...

Read More »FX Daily, June 29: Fear that the Mutating Virus Could Slow Recoveries Takes a Toll on Risk Appetites Ahead of Quarter-End

Swiss Franc The Euro has fallen by 0.03% to 1.0959 EUR/CHF and USD/CHF, June 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Fear that the new mutation of the covid virus will slow the global recovery has sent ripples across the global capital markets. The foreign exchange market has the clearest reaction, and the dollar is bid. The dollar-bloc and Norwegian krone lead the currencies lower, while the yen is...

Read More »CEOs Profit as Workers Suffer from Pandemic, says Union

Some companies gave their CEOs pay rises even though the firms were losing money Keystone / Edgar R. Schoepal While the Covid-19 pandemic has caused existential hardship for many employees, CEOs and shareholders have “shamelessly helped themselves”, according to a union study. “The pay gap remains wide open at a very high level,” trade union Unia wrote in its annual pay gap studyExternal link published on Tuesday. The average ratio between the highest and lowest...

Read More »Inflation Isn’t Just The Outlier, The Inflation In It Is, Too

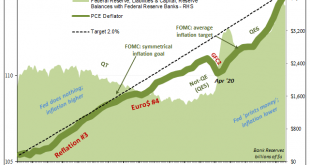

Following the same recent pattern as the BLS and its CPI, the Bureau of Economic Analysis’s (BEA) PCE Deflator ran up hotter in May 2021 than its already high increase during April. The latter’s headline consumer basket rose 3.91% year-over-year, its fastest pace since August 2008. The core rate, which excludes food and energy prices, accelerated to 3.39% from 3.11%, the highest since the early nineties. Having gone through this for two consecutive months, the...

Read More »Inflation or Lockdown Whiplash?

Mainstream analysis sees rising consumer prices, and looks for a monetary cause. Also, when it sees an increase in the quantity of dollars, it looks for rising consumer prices. It is a fact that the quantity of what the mainstream calls money (i.e. the dollar) has risen at an extraordinary rate. The M0 measure has nearly doubled since the start of Covid. It is also a fact that many prices have jumped up significantly. So only one question is open for debate. Is...

Read More »86: Reading Jeff Snider on Central Bankers Having No New Ideas

Non-economist, monetary iconoclast Jeff Snider's commentary on yet another central bank study concluding that there are TANGIBLE problems with quantitative easing and what benefits can be observed are INTANGIBLE. Sweden's Riksbank observes collateral shortages. ----------WHO---------- Jeff Snider of Alhambra Investments. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "Steak Frites" by Dylan Sitts at Epidemic Sound. ----------WHAT---------- Because Central...

Read More »FX Daily, June 28: European Political Drama Kicks off Big Economic Week

Swiss Franc The Euro has risen by 0.18% to 1.096 EUR/CHF and USD/CHF, June 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are off to a quiet start of what promises to be a busy week. Quarter and month-end adjustments, Japan’s Tankan survey, the eurozone’s preliminary June CPI, the US employment report, and an OPEC+ meeting are featured. The MSCI Asia Pacific Index was little...

Read More »UBS Boss says Switzerland is Falling Behind on Structural Change

Cleaning up: Ralph Hamers reckons people trust bankers again © Keystone / Christian Beutler Swiss banks have some catching up to do when it comes to structural change and digitalisation, says Ralph Hamers, CEO of Swiss bank UBS. In his opinion structural change has taken place much faster in other countries and industries than in Switzerland. For example, the dynamics in Asia and Scandinavia are significantly greater, Hamers told newspaper BlickExternal link in an...

Read More » SNB & CHF

SNB & CHF