Monetary inflation is just a type of embezzlement. Historically, inflation originated when a country’s ruler such as king would force his citizens to give him all their gold coins under the pretext that a new gold coin was going to replace the old one. In the process of minting new coins, the king would lower the amount of gold contained in each coin and return lighter gold coins to citizens. Because of the reduced weight of gold coins that were returned to citizens, the ruler was able to generate extra coins that were employed to pay for his expenses. What was passing as a gold coin of a fixed weight was in fact a lighter gold coin. On this Rothbard wrote, More characteristically, the mint melted and re-coined all the coins of the realm, giving the subjects back

Topics:

Frank Shostak considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Monetary inflation is just a type of embezzlement. Historically, inflation originated when a country’s ruler such as king would force his citizens to give him all their gold coins under the pretext that a new gold coin was going to replace the old one. In the process of minting new coins, the king would lower the amount of gold contained in each coin and return lighter gold coins to citizens.

Because of the reduced weight of gold coins that were returned to citizens, the ruler was able to generate extra coins that were employed to pay for his expenses. What was passing as a gold coin of a fixed weight was in fact a lighter gold coin. On this Rothbard wrote,

More characteristically, the mint melted and re-coined all the coins of the realm, giving the subjects back the same number of “pounds” or “marks”, but of a lighter weight. The leftover ounces of gold or silver were pocketed by the King and used to pay his expenses.1

What we have here is an inflation of coins, i.e., an increase in the quantity of coins brought about by the ruler making the gold coins lighter. The extra gold coins that the ruler was able to generate enabled him to channel goods from citizens to himself.

The process of embezzlement was further enhanced when for safety reasons instead of holding their gold themselves, individuals began to store their gold with banks. To acknowledge this storage the banks issued gold receipts. Over time, these receipts became accepted as the medium of exchange. Problems, however, occurred once the banks started to issue receipts that were not backed by gold. The unbacked gold receipts were now employed in the economy along with the fully backed gold receipts. This was an inflation of receipts because of the introduction of unbacked gold receipts (unbacked gold receipt were masquerading as the true representatives of money proper, gold).

The issuer of unbacked receipts could now engage in an exchange of nothing for something. This produced a situation where the issuers of the unbacked receipts diverted goods to themselves without making any contribution to the production of those goods.

In the modern world, money proper is no longer gold but rather coins and notes in circulation; inflation in this case is an increase in the supply of this type of money. The increase in the supply of money creates an exchange of nothing for something. This amounts to the diversion of real wealth from wealth generators to the holders of newly increased money. Also, note that in the modern world banks are issuing demand deposits that are partially backed by money. This is labelled as fractional reserve banking.

It follows, then, that the essence of inflation is not a general rise in prices as such but an increase in the supply of money. Note that we do not say, as the monetarists do, that inflation is caused by increases in money supply. What we are saying is that inflation is increases in money supply. These increases as a rule manifest through increases in the prices of goods and services. On this Mises wrote,

To avoid being blamed for the nefarious consequences of inflation, the government and its henchmen resort to a semantic trick. They try to change the meaning of the terms. They call “inflation” the inevitable consequence of inflation, namely, the rise in prices. They are anxious to relegate into oblivion the fact that this rise is produced by an increase in the amount of money and money substitutes. They never mention this increase. They put the responsibility for the rising cost of living on business. This is a classical case of the thief crying “catch the thief”. The government, which produced the inflation by multiplying the supply of money, incriminates the manufacturers and merchants and glories in the role of being a champion of low prices.2

Money and Prices

It is extraordinary that in attempting to explain movements in prices, various commentators have nothing to say about the role of money in forming the price of a good. After all a price of something is the amount of money, i.e., dollars paid, per unit of something. (The number of dollars per one loaf of bread, or the number of dollars per one shirt etc.).

Once money enters a particular market, more money is paid for a product in that market. Alternatively, we can say that the price of a good in this market has gone up. (Note, again, that a price is the number of dollars per unit of something.)

Observe that when money is injected it enters a particular market. Once the price of a good has risen to the level where it is perceived as fully valued, the money goes to another market which is considered undervalued.

The shift of money from one market to another market is not instantaneous; there is a time lag from increases in money and its effect on the average price increases.

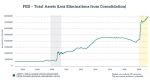

Because of recent massive increases in the money supply, it is likely that the growth momentum of prices is going to follow a rising trend in the months ahead. The yearly growth rate of our measure of money supply (the AMS) climbed to 79 percent in February this year from 6.5 percent in February 2020.

What Is the Present Status of Inflation?

So what is the present status of inflation? Again, by popular thinking, as depicted by the yearly growth rate in the Consumer Price Index (CPI), inflation stood at 5 percent in May against 4.2 percent in April and 0.1 percent in May 2020.

However, in terms of money supply the growth rate of inflation was much larger. Given the massive increase in monetary inflation there is a growing likelihood that the yearly growth rate of the CPI is poised for a strong increase. What matters is not increases in the CPI as such but increases in money supply. Increases in money supply begin the process of impoverishment of wealth generators and create the boom-bust cycle menace.

Note that increases in the prices of goods and services are just the symptoms of the increases in money supply. These increases in prices do not cause the diversion of real wealth from wealth generators to the holders of money out of “thin air.” Price increases are indicators that tell us that the embezzlement of wealth producers is taking place. (Note that price increases do not always portray the severity of the damage inflicted upon wealth producers.)

Once money is injected, it starts the process of impoverishment of wealth producers. Because of the time lag between changes in money supply and the act of embezzlement, the impoverishment cannot be arrested as such. To prevent the further impoverishment of wealth generators, what is required is the closure of all the loopholes for increases in money supply.

- 1. Murray N. Rothbard, What Has Government Done to Our Money? (New York: Libertarian Publishers 1964).

- 2. Ludwig von Mises, Economic Freedom and Interventionism (Irvington-on-Hudson, NY: Foundation for Economic Education, 1990), p. 94.

Tags: Featured,newsletter