What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Discrimination and Opportunities for Women

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »The Limits to Public Opinion and the Failure of Democracy

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »How to Build a Diversified Investment Portfolio for Long-Term Growth

Investing for the long term is a journey that requires careful planning, patience, and, most importantly, diversification. Building a diversified investment portfolio is essential for mitigating risk and ensuring steady growth over time. By spreading your investments across different asset classes, you can weather market fluctuations and achieve your financial goals more effectively. In this article, we’ll explore why diversification matters, outline key asset...

Read More »Housing Affordability Brings Market To A Standstill

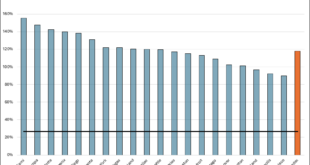

Housing affordability helps explain why residential real estate transactions have reached a standstill. Over the last five years, housing prices have surged. Per the Case-Shiller 20 City Home Price Index, home prices from 20 of the largest cities have risen between 33% and 80%. Over the same five-year period, mortgage rates jumped from 3.68% to 6.81%. Wage growth has helped to offset the higher prices and mortgage rates. However, with the median wage growth of 26%...

Read More »The World at War—An Essential New Book from Ralph Raico

This article is the foreword to The World at War by Ralph Raico, edited and annotated by Edward Fuller. Buy the book at the Mises store. The twentieth century was a century of war, which means it was also a century of tragedy. The full extent of this tragedy, however, is often hidden by the popular narratives of the world wars that continue to be pushed in the West, especially among Americans. But many aspects of the tragedy are also taught far and wide. When it...

Read More »Minimum Wage Laws Can’t Repeal the Laws of Economics

On April 1, 2024 California bill AB 1228 went into effect, raising the minimum wage to $20 an hour for fast food restaurant workers. The media pundits largely celebrated the bill’s boldness. Economists and industry insiders largely complained it would raise prices, lower employment, and maybe even radically diminish a convenient and beloved fixture in American society.A new study from the Institute for Research on Labor and Employment at UC Berkeley has attempted to...

Read More »So entwickeln sich Bitcoin, Litecoin & Co am Nachmittag am Kryptomarkt

Der <a href="/devisen/bitcoin-dollar-kurs">Bitcoin</a>-Kurs wertet am Sonntagnachmittag um 0,22 Prozent auf 100.021,05 US-Dollar auf. Am Vortag stand <a href="/devisen/bitcoin-dollar-kurs">Bitcoin</a> bei 99.805,31 US-Dollar.<!-- sh_cad_1 -->Währenddessen wird <a href="/devisen/bitcoin-cash-dollar-kurs">Bitcoin Cash</a> bei 619,99 US-Dollar... [embedded content]...

Read More »MicroStrategy-CEO: Microsoft sollte in Bitcoin investieren statt eigene Aktien zurückzukaufen

• Diskussion über einen möglichen Einstieg Microsofts in Bitcoin-Investments<br> • MicroStrategy-CEO Michael Saylor empfiehlt Bitcoin statt Aktienrückkäufe <br> • Saylor veröffentlicht Präsentation mit Pro-Argumenten<br> <!-- sh_cad_1 --> Der Technologieriese <a href="/aktien/microsoft-aktie" target="_blank" rel="noopener">Microsoft</a>... [embedded content]...

Read More »Bitcoin, Ether & Co.: Die Performance der Kryptowährungen in KW 49

So bewegten sich die einzelnen Kryptowährungen in der Kalenderwoche 49: [embedded content] Tags: Featured,newsletter

Read More » SNB & CHF

SNB & CHF