One can appreciate the frustration in Tokyo. The Bank of Japan surprised the world by adopting negative rates in January and the yen rallied. Today it disappointed many by not easing, and the yen rallied. The BOJ next meetings in mid-June and like this week, the outcome of its meeting will be announced the day after the FOMC meeting. There is some idea that BOJ may be waiting for Abe’s new fiscal package and the G7 meeting Japan hosts next month. The FOMC’s statement yesterday did not...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

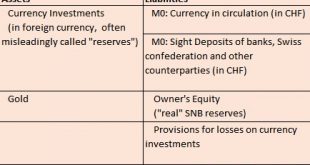

The Q1/2016 update on the SNB investment strategy and its assets. The Swiss National Bank is a passive conservative investor. As opposed to other investors, the exposure in currencies is as important as the strategic asset allocation according asset classes (bonds, equities, cash, real estate). The importance of currencies is one reason why the SNB is often called a hedge fund, the second the volatility of gains and losses.The SNB balance sheet looks as follows: In this post we will...

Read More »Central Banks Roil Markets

The Bank of Japan defied expectations and its economic assessment to leave policy unchanged. The inaction spurred a 3% rally in the yen and an even larger slump in stocks. The financial sector took its the hardest and dropped almost 6%. The yen's surge helped underpin other Asian currencies, especially the South Korean won, which gained nearly 1%. At the end of January, the BOJ surprised by adopting negative interest rates for a small part of Japanese banks' excess reserves. The yen...

Read More »Hillary Will be the Least of Your Worries – America has Economic Diarrhea

Economic Expansions and Recessions in the US since 1900 According to the National Bureau of Economic Research (NBER), the official recession arbiter, the US economy is currently at its fourth longest expansion in history. By the sheer nature of a capitalistic society with its inherent cyclicality it is a safe bet that a new economic recession will hit in the not too distant future. We have argued since June last year that the next recession is imminent and we now feel increasingly...

Read More »FOMC Statement Demonstrates Firm Grasp of the Obvious

The FOMC delivered a statement largely as expected. It upgraded its assessment of the global economy by dropping the reference to risks. It downgraded its assessment of the domestic economy by acknowledging that growth has slowed. Otherwise is general economic assessment remains little changed. The labor market continues to improve, though growth in household spending has slowed. Housing is stronger though fixed business investment and net exports have been soft (though not as soft as...

Read More »What is the BOJ Going to Do?

Under Kuroda’s leadership the BOJ has surprised the market a number of times, most recently with the move to negative rates at the end of January. It is not that such a move, which has been tried by several European central banks, was without merit. After all, growth and inflation prospects are not very encouraging. The Bank of Japan’s one mandate, to raise inflation pressures, has remains as elusive as ever. The BOJ has already pushed out the time that the inflation target will be...

Read More »With Tech Tanking, Can Anything Save The System?

Nice sentence: Tears won’t be confined to Wall Street however: let’s not forget that none other than the Swiss National Bank is also long some 10.4 million shares of AAPL. First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing to explain. The FAANGs (Facebook, Apple, Amazon, Netflix and Google) own their niches and not so long ago were expected to...

Read More »FX Daily April 27: Two Issues Loom Large Today: Soft Australia CPI and FOMC

The foreign exchange market is largely quiet as the market awaits fresh trading incentives and the FOMC statement later in the North American session. The main exception to the consolidative tone is the Australian dollar, which is posting its largest loss (~1.7%) in a couple of months. The short-term market was caught the wrong-footed when Australia reported an unexpected decline in Q1 CPI. The 0.2% decline contrasts to expectations for an increase of the same magnitude. The...

Read More »Political Pundits, or Getting Paid for Wishful Thinking

Bill Kristol – the Gartman of Politics? It has become a popular sport at Zerohedge to make fun of financial pundits who appear regularly on TV and tend to be consistently wrong with their market calls. While this Schadenfreude type reportage may strike some as a bit dubious, it should be noted that it is quite harmless compared to continually leading people astray with dodgy advice. To answer the question posed in the picture with the benefit of hindsight: not really…. (look at the...

Read More »Getting it Wrong on Silver

Erroneous Analysis of Precious Metals Fundamentals We came across an article at Bloomberg today, talking about silver supply troubles. We get it. The price of silver has rallied quite a lot, so the press needs to cover the story. They need to explain why. Must be a shortage developing, right? At first, we thought to just put out a short Soggy Dollars post highlighting the error. Then we thought we would go deeper. Here’s a graph showing the price action in silver since the beginning of...

Read More » SNB & CHF

SNB & CHF