Kosovo’s wood sector shows great growth potential in a country currently suffering from high unemployment and poverty. (Julie Hunt, swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »Swiss upset the Germans with high speed races

Swiss speedsters are crossing over into Germany for high octane car races in souped up sports cars. Their favourite haunt is the town of Singen between Schaffhausen and Lake Constance. Even speeding fines are not putting them off. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit...

Read More »Business booms for Swiss companies

River cruises in Europe are becoming very popular, and Swiss tour operators are getting their piece of the action, and have expanded to Russia. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »Arizona Considers Issuing a Gold Bond

The Arizona House of Representatives has convened an Ad Hoc Committee on Gold Bonds. The purpose is to explore if and how the state could sell a gold bond. This is an exciting development, as the issuance of a gold bond would be a major step towards a working gold standard. Yours truly is a member of the committee. At the first meeting, I gave a proposal for how a gold bond could work to the benefit of the state and...

Read More »The Need for Higher Wages: Lots of Thunder, No Rain

Summary: Major central banks and many economists are calling for higher wages. However, they are reluctant to offer proposals to strengthen those institutions who’s goal is to boost labor’s share of national income. The advocates are more interested in boosting prices than in lifting aggregate demand or addressing the disparity of income and wealth. Charlie Chaplin All that is solid is melting. After...

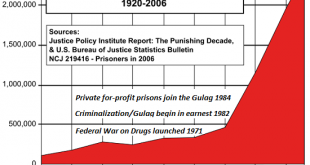

Read More »It’s Time to Abolish the DEA and America’s “War on Drugs” Gulag

Addiction and drug use are medical/mental health issues, not criminalization/ imprisonment issues. It’s difficult to pick the most destructive of America’s many senseless, futile and tragically needless wars, but the “War on Drugs” is near the top of the list.Prohibition of mind-altering substances has not just failed–it has failed spectacularly, and generated extremely destructive and counterproductive consequences....

Read More »Why Switzerland’s franc is still strong in four charts

A very insightful post from Bloomberg. We added some more explanations. We explained that the dollar is currently more overvalued than the Swiss Franc. Swiss National Bank President Thomas Jordan keeps saying the franc is “significantly overvalued.” And that’s despite the central bank’s record-low deposit rate and occasional currency market interventions. While the franc is typically a top choice for foreign...

Read More »FX Daily, August 17: Dollar Snaps Back

Swiss Franc Click to enlarge. FX Rates The US dollar is enjoying a mid-week bounce against all the major currencies. It appears that participants in Asia and Europe are giving more credence to NY Fed Dudley’s comments yesterday. Although many in the market have given up on a rate hike this year, Dudley reaffirmed his belief that the economy was accelerating in H2 and that the market was being too complacent. Many...

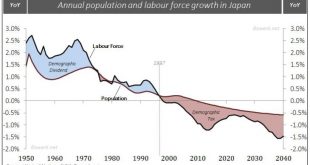

Read More »Stupid is What Stupid Does – Secular Stagnation Redux

Annual population and labour force growth in Japan Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking...

Read More »Great Graphic: Aussie Tests Three-Year Downtrend

Summary: The Australian dollar’s technical condition has soured. Market sentiment may be changing as the MSCI World Index of developed equities posted a key reversal yesterday. It is not clear yet whether the Aussie is correcting lower or whether there has been a trend change. Since late July, I have been looking for the Australian dollar to turn lower. Instead, the Aussie has continued to climb. It has risen...

Read More » SNB & CHF

SNB & CHF