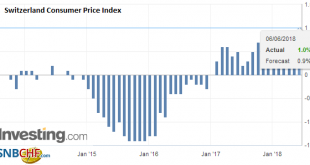

Neuchâtel, 6 June 2018 (FSO) – The consumer price index CPI) increased by 0.4% in May 2018 compared with the previous month, reaching 102.1 points (December 2015=100). Inflation was 1.0% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.4% increase compared with the previous month can be explained by several factors including rising prices for...

Read More »No relief for Swiss renters

Every three months the rate of interest used to set Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time it remained at 1.50%. The last time it dropped was 1 June 2017 when it fell to its lowest level since 2008. The rate is based on the average Swiss mortgage rate over three months. This rate is then rounded to the nearest 0.25%. This time that rate was 1.51%,...

Read More »Weekly Technical Analysis: 04/06/2018 – USD/CHF, EUR/JPY, GBP/USD, AUD/USD, WTI

USD/CHF The USDCHF pair managed to break 0.9850 level and closed the daily candlestick below it, which supports the continuation of our bearish overview efficiently in the upcoming period, paving the way to head towards 0.9723 level as a next station, noting that the EMA50 supports the expected decline, which will remain valid for today conditioned by the price stability below 0.9870. Expected trading range for today...

Read More »Bi-Weekly Economic Review: As Good As It Gets?

In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not. 10 year yields fell nearly 40 basis points in a matter of days as did TIPS yields. The...

Read More »Industrial Commodities vs. Gold – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Oil is Different Last week, we showed a graph of rising open interest in crude oil futures. From this, we inferred — incorrectly as it turns out — that the basis must be rising. Why else, we asked, would market makers carry more and more oil? We are grateful to Peter Tenebrarum at Acting Man and Steve Saville at The...

Read More »Espagne, victime des crises, de grands travaux inutiles, et de la… corruption. Nicolas Klein

Espagne, victime des crises, de grands travaux inutiles, et de la… corruption. Nicolas Klein Les grands travaux inutiles financés avec l’argent public, et qui engendrent dettes, déficits, et menaces de faillite, ont besoin de politiciens corrompus… Dans le contexte morose initié en 2008, l’Espagne était considérée (et l’est encore par beaucoup) comme un « pays à risque » au regard de la rapide dégringolade qu’elle a...

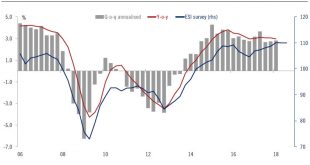

Read More »Europe chart of the week – Spanish growth

Amid domestic political uncertainty, Spanish growth remains strong. This week saw the final release of Spanish GDP growth for Q1. The economy again managed to post robust growth, the highest among the four largest euro area economies (+0.7% q-o-q versus 0.4% q-o-q for the euro area). The breakdown of figures showed that domestic demand was once again the main growth driver. The carryover effect for 2018 reached 2.8%,...

Read More »Slowdown in Middle Eastern tourists to Switzerland

The growth in tourism from the Middle East has been driven by Saudi Arabia and the Emirates After almost tripling in the last decade, the number of tourists to Switzerland from the Middle East is slowing down, with the slowdown expected to be particularly marked this summer. The growth rate of tourists from the Gulf will be zero this summer, according to forecasts by Oxford Economics and the Swiss tourist board....

Read More »More Color on Japanese Capital Flows and the Euro

The euro put in a low on May 29 a little above $1.15. That is nearly a 10.5 cent decline since the three-year high was set in mid-February. The thing that is difficult for investors and analysts to get their head around is that the speculators in the futures market, who as seen as proxies for trend-followers and momentum traders, continue to carry large euro exposure. Too many observers mistakenly focus on the net...

Read More »FX Daily, June 5: Sterling Jumps Ahead, While US Equities Have Small Coattails

Swiss Franc The Euro has fallen by 0.23% to 1.1526 CHF. EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are several euro options that expire today and are stacked every quarter of a cent from $1.1675 to $1.1750. The size of the options increase with the price beginning with 688 mln euros at $1.1675, then 775 euros at $1.17, 1.1 bln euros...

Read More » SNB & CHF

SNB & CHF