After more than two years of work and CHF52 million ($53 million), the world’s highest “3S” cable car system was inaugurated Saturday in southern Switzerland’s Zermatt resort. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »FX Daily, October 01: NAFTA Deal Struck, Softer EMU Mfg PMI, and Firm Greenback Starts Week

Swiss Franc The Euro has risen by 0.16% at 1.1415 EUR/CHF and USD/CHF, October 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Canadian dollar and Mexican peso are extending its pre-weekend gains on news that a new NAFTA deal (US-Mexico-Canada Agreement USMCA) has been struck. Against most of the other major and emerging market currencies, the US dollar...

Read More »Swiss Retail Sales, August 2018: +1.1 percent Nominal and +0.4 percent Real

Neuchâtel, 1 October 2018 (FSO) – Turnover in the retail sector rose by 1.1% in nominal terms in August 2018 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.3% compared with the previous month. These are the provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays rose by 0.4% in August 2018 compared with...

Read More »Switzerland increases employment permits for non-EU workers

Companies argue that the Swiss workforce alone cannot fill every highly skilled job vacancy. The Swiss authorities have responded to demands from companies and cantons for access to highly-skilled employees by granting 1,000 extra permits for workers that come from outside the European Union from next year. From 2019, firms will be able to recruit 8,500 foreign workers from countries such as the United States, China and...

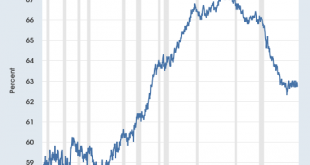

Read More »The Labor Shortage Is Real

Few conventional-media commentators are willing or able to discuss these factors in the labor shortage / declining participation trends. Is there a labor shortage in the U.S.? Employers are shouting “yes.” Economists keep looking for wage increases as evidence of a labor shortage, and since wage increases are still relatively modest, the argument that there are severe labor shortages in parts of the U.S. is...

Read More »Swiss no longer in top ten in world university ranking

ETH Zurich came in at 7th and 19th place in the QS and Shanghai rankings respectively this year. The Federal Institute of Technology in Zurich (ETH Zurich) remains the best university in continental Europe, despite slipping one place to 11th in the Times Higher Education World University Rankings 2019. The listexternal link, which was released on Wednesday, scores 1,250 universities on five main criteria: teaching,...

Read More »Video with Michael Strobaek: Discussing economic growth and investment strategies

What shape are the markets in right now? This month, Credit Suisse Global CIO Michael Strobaek discusses growth in the global and Swiss economies and explains the right investment strategies during the growth phase. Global economic growth. Switzerland is doing well too. It is encouraging that the global economy is in good shape despite the disparate growth rates in the various regions this year. The Swiss economy is...

Read More »[Wikipedia] Bill Bonner (author)

Bill Bonner is an American author of books and articles on economic and financial subjects. He is the founder and president of Agora, Inc., as well as a co-founder of Bonner & Partners publishing. Bonner has written articles for the news and opinion blog LewRockwell.com, MoneyWeek magazine, and his daily financial column Bill Bonner's Diary.

Read More »[Wikipedia] Bill Bonner (author)

Bill Bonner is an American author of books and articles on economic and financial subjects. He is the founder and president of Agora, Inc., as well as a co-founder of Bonner & Partners publishing. Bonner has written articles for the news and opinion blog LewRockwell.com, MoneyWeek magazine, and his daily financial column Bill Bonner's Diary.

Read More »UBS lays out cities most at risk of overheated property markets

“Most households can no longer afford to buy property in the top financial centres without a substantial inheritance”. Sound familiar to Zurich and Geneva dwellers? An index by Swiss bank UBS shows significant risks of real estate bubbles in booming cities such as Hong Kong, Munich and Toronto. The Swiss cities of Zurich and Geneva remain relatively stable. The 2018 Global Real Estate Bubble Indexexternal link,...

Read More » SNB & CHF

SNB & CHF