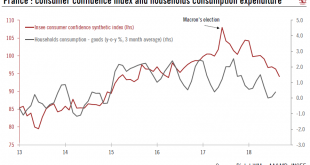

Despite the recent fall in French consumer confidence, spending should pick up in the second half of the year. The French economy disappointed in the first half of this year. While there was a widespread ‘soft patch’ in the euro area, the source and size of the slowdown in France stands out. The real GDP growth rate fell by 0.5 points, much more than the rest of the euro area. Moreover, while the slowdown in the other...

Read More »Four trouble spots. Four pleasant surprises.

August looks back on positive economic and market developments. In retrospect, the first half of the year was soothed by many pleasant surprises, including much-discussed trouble spots that never flared. Read about four perceived market crises. Perceived market crisis 1: Explosion of credit spreads A regular hot-button issue for investors is the perceptibly explosive credit risks that our economy poses. It’s nice to...

Read More »Fed Delivers, Market Yawns

The Federal Reserve did what it was widely to do. The fed funds target range was lifted 25 bp to 2.00-2.25%. Three-quarters of Fed officials anticipate a hike in December. The market had discounted around an 80% chance. The Fed sticks with the three rate hikes in 2019 and one in 2020. The year-end rate in 2021 is the same as in 2020. The Fed is signaling that it does not expect the fed funds target to move above...

Read More »FX Daily, September 28: Dollar Remains Firm While Italy is Punished

Swiss Franc The Euro has fallen by 0.49% at 1.1317 EUR/CHF and USD/CHF, September 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s post-Fed gains have been extended, though the upside momentum appears to be stalling. Japan’s Nikkei advanced 1.35% on the back of the yen’s declines and reached its highest level since 1991. Chinese shares (A and H)...

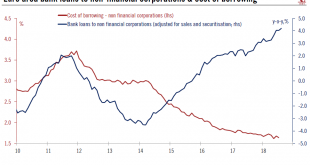

Read More »Credit Growth Remains Buoyant in the Euro Area

Financial conditions remain supportive and are not expected to tighten much in the coming months. Lending to non-financial corporations in the euro grew by an annual 4.2% in August, its fastest rate since April 2009. Forward-looking indicators suggest that euro area credit growth should remain strong over the coming months. Overall, domestic demand is likely to continue to be the main driver of growth in the euro area,...

Read More »UBS Global Real Estate Bubble Index 2018

The UBS Global Real Estate Bubble Index 2018 report is produced by UBS Global Wealth Management’s Chief Investment Office and analyzes residential property prices in 20 developed market financial centers around the world. Hong Kong faces the greatest risk of a housing bubble, followed in descending order by Munich, Toronto, Vancouver, Amsterdam, and London. Stockholm and Sydney moved out of bubble risk territory this...

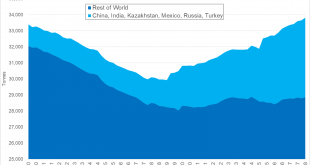

Read More »Central Banks Positivity Towards Gold Will Provide Long Term “Support To Gold Prices”

– There has been a recent change for the better in central bank attitudes to gold – There has been “net gold demand by central banks – approx. 500 tonnes per year – as a source of return, liquidity and diversification” – Policy shift to maintaining stable gold holdings reflects central bank concerns about financial markets and geopolitics – Little in the current global economic and political environment to support any...

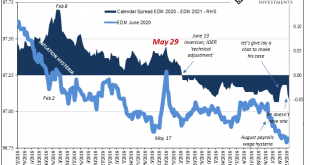

Read More »Make Your Case, Jay

June 13 sticks out for both eurodollar futures as well as IOER. On the surface, there should be no bearing on the former from the latter. They are technically unrelated; IOER being a current rate applied as an intended money alternative. Eurodollar futures are, as the term implies, about where all those money rates might fall in the future. Still, the eurodollar curve inverted conspicuously starting June 13. That was...

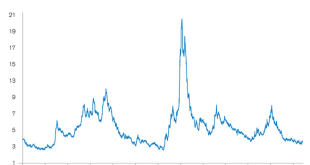

Read More »Seasonality in Cryptocurrencies – An Interesting Pattern in Bitcoin

Looking for Opportunities The last time we discussed Bitcoin was in May 2017 when we pointed out that Bitcoin too suffers from seasonal weakness in the summer. We have shown that a seasonal pattern in Bitcoin can be easily identified. More than a year has passed since then and readers may wonder why we have not addressed the topic again. There is a simple reason for this: the lack of extensive historical data for...

Read More »Novartis to cut 2,200 Swiss jobs by 2020

Novartis currently employs 13,000 people across Switzerland The pharmaceutical giant Novartis will cut about 2,200 jobs in Switzerland over the next four years. Nearly 1,500 jobs are affected in production and about 700 in services. This restructuring is part of the manufacturing strategy launched in 2015 to adapt the industrial base to a reduced product portfolio, announced Novartis on Tuesdayexternal link. It...

Read More » SNB & CHF

SNB & CHF