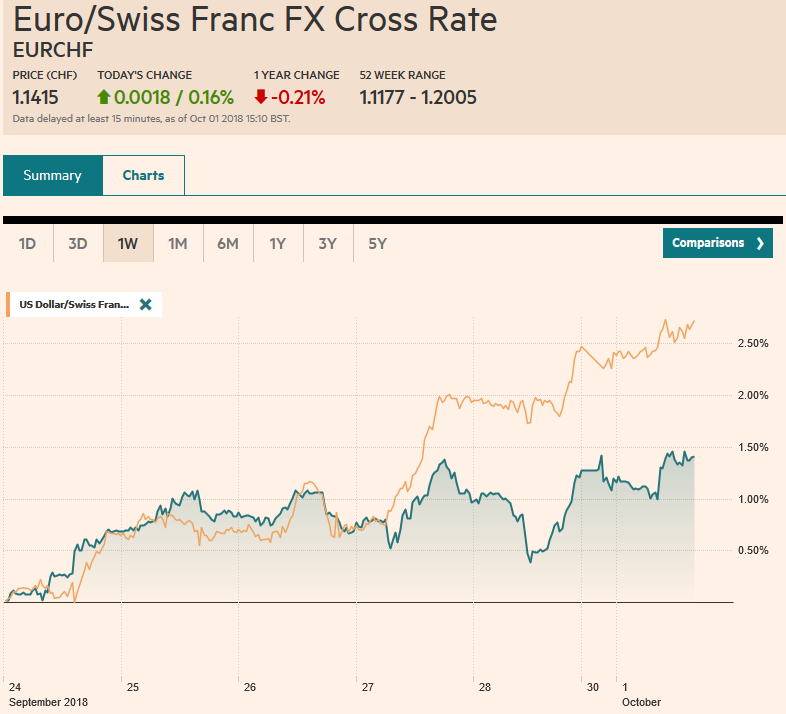

Swiss Franc The Euro has risen by 0.16% at 1.1415 EUR/CHF and USD/CHF, October 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Canadian dollar and Mexican peso are extending its pre-weekend gains on news that a new NAFTA deal (US-Mexico-Canada Agreement USMCA) has been struck. Against most of the other major and emerging market currencies, the US dollar is firm. China’s mainland and Hong Kong markets are closed for a national holiday. Japanese shares edged higher, but most other markets in the region, including South Korea, Taiwan, and Australia slipped. European markets are firmer. The Dow Jones Stoxx 600 is 0.25% higher, led by information

Topics:

Marc Chandler considers the following as important: $INR, $TRY, 4) FX Trends, CAD, EUR, EUR/CHF and USD/CHF, Featured, GBP, Italy, NAFTA, newsletter, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.16% at 1.1415 |

EUR/CHF and USD/CHF, October 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

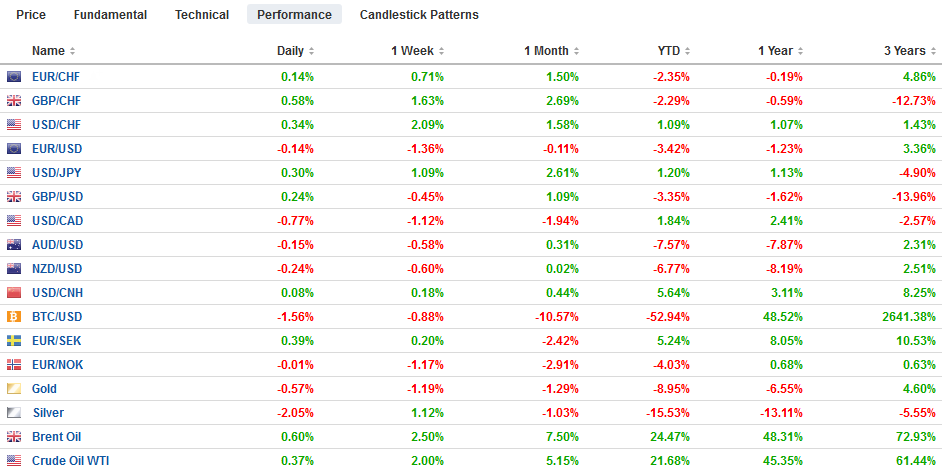

FX RatesOverview: The Canadian dollar and Mexican peso are extending its pre-weekend gains on news that a new NAFTA deal (US-Mexico-Canada Agreement USMCA) has been struck. Against most of the other major and emerging market currencies, the US dollar is firm. China’s mainland and Hong Kong markets are closed for a national holiday. Japanese shares edged higher, but most other markets in the region, including South Korea, Taiwan, and Australia slipped. European markets are firmer. The Dow Jones Stoxx 600 is 0.25% higher, led by information technology, materials, and energy in late morning turnover. Italian shares are leading the way, recouping a little more than a third of the sell-off at the end of last week. After dropping 7.25% before the weekend, Italian bank shares index is up about 1.3% today. Italian bonds are a bit calmer as well, with the 10-year up one-two basis points while yields are two-four basis points higher. The Italian two-year yield is up five bp, while most other EMU yields are slightly firmer. The US 10-year yield is up a couple of basis points to almost 3.09%. |

FX Performance, October 01 |

US-Mexico-Canada Agreement: For all the handwringing, the new agreement does not appear to be a radical change, but a small incremental improvement. And like the agreement struck with South Korea, minor changes appeared enough to satisfy the US Administration. Talk loudly and accept small compromises appears to be the emerging Trump trade doctrine. Canada accepted improved access to its dairy market, dropping the variety of milk program introduced last year. It agreed on stronger intellectual property rights and tighter rules of origin for autos. Canada succeeded in getting the US to agree to keep the Chapter 19 dispute mechanism but accepted a phasing out of the investor-state dispute settlement with Canada, though it will remain for some sectors in Mexico. Canada also agreed to raise the threshold to apply duties and retail sales tax on cross-border purchases. While Canada and Mexico will be exempt from US auto tariffs, the steel and aluminum tariffs will remain in place, with promises that they will be dealt with separately. The US dollar fell 1% against the Canadian dollar before the weekend as optimism that a last-minute deal would be struck surfaced. The US dollar gapped lower in Asia against the Canadian dollar and approached CAD1.28. The gap is found roughly between CAD1.2885 and CAD1.2910. The US dollar is below its 200-day moving average (CAD1.2870) for the first time in six months. The next important technical area is found near CAD1.2700, but the intra-day technicals are stretched. Meanwhile, the US dollar is testing the MXN18.50 area. Last month’s low was set near MXN18.40. It is the fourth consecutive session that the US dollar losing ground to the peso. It has fallen for the weeks

Japan’s Tankan: The BOJ’s quarterly Tankan survey showed some minor deterioration in sentiment among the large companies (both manufacturers and non-manufacturers). Sentiment ticked up among the smaller companies. However, the underlying details were constructive. Capex plans slipped to 13.4% this fiscal year from 13.6% in Q2, but it is still the strongest reading for this late in the fiscal year since the early 1990s. The expectation is that the dollar will average JPY107.40 in the current fiscal year up from about JPY107.25 in the June survey. So far since the fiscal year began, the dollar has averaged JPY110.35. Japanese companies have not adjusted their views for the latest bout of yen weakness. One of the implications of this is that there is upside risk on Japanese profits. The dollar, which broke above JPY113.00 last week is knocking on JPY114.00 today. Initial support is now seen near JPY113.80. Separately, note that Prime Minister Abe’s candidate lost in the weekend election in Okinawa. The winning candidate campaigned in opposition to the construction of a new US military facility, and this may spark US criticism as new trade talks are expected to begin shortly.

EMU PMI: The eurozone flash manufacturing PMI was shaved to 53.2 from 53.3, as a result of disappointing Italian and Spanish readings. The overall report, though, down from 54.6 in August, is the lowest since September 2016. The German and French flash readings were confirmed at 53.7 and 52.5 respectively. Spain’s dropped to 51.4 from 53.0, and Italy’s slipped to 50.0 from 50.1. The manufacturing sector has been underperforming compared with the service sector, and trade tensions are blamed.

Other EMU data: Germany reported disappointing August retail sales. They fell 0.1% while economists had expected a 0.5% increase. Spain’s sales were in line with expectations. Italy reported an unexpected fall in unemployment to 9.7% from a revised 10.2% (was 10.4% initially). For the euro area as a whole, the unemployment rate in August eased to 8.1% from 8.2%. ECB President Draghi’s economic optimism begins with the improvement in the labor market.

Italy: Italy formally presents its draft budget to the EU on October 15, but Finance Minister Tria, who denies threatening to resign, will put the best face on it as he meets the other European finance minister. The 2.4% projected budget deficit is considerably larger than the previous Italian government had agreed, and some pushback from the EU can be expected. However, a repeat of Greece (or Argentina, as some are claiming) seems wide of the mark. Moreover, after the League-Five-Star government was formed, some put a price tax on the campaign promises of 6.5%-7.5% of GDP. Nor is the projected deficit much higher than what some of the rating agencies (e.g., Fitch) anticipated.

Euro: The euro held above the pre-weekend low (~$1.1570) and has moved higher in the European morning to return to the $1.1620 area, as Italian markets stage a modest recovery. There is a large (1.1 bln euro) option at $1.1665 that expires tomorrow. Initial resistance is seen near $1.1630. The 50-day moving average is near $1.1610, and the 100-day moving average is found near $1.1650.

UK: The focus is on the internal fighting within the Tory Party annual conference. May’s speech is on Wednesday. Johnson has stepped up his criticism of the Prime Minister’s plan, and this may be a prelude to a leadership challenge. The economic backdrop is a bit more favorable after the manufacturing PMI unexpectedly improved to 53.8 from a revised 53.0 (initially was 52.8). It is the first improvement since May. Sterling, like the euro, is trading within the pre-weekend range and needs to get above $1.3100 to be important. On the downside, the $1.3000-$1.3020 area offers support.

EM highlights: The Turkish lira is up 1.5% today even though the manufacturing PMI warns of the coming economic shock. The PMI fell to 42.7 from 46.4. It has not been above 50 since March. On Wednesday, the September CPI will be reported. It is expected to jump above 21% from a little below 18%. Today the dollar is slipping below its 50-day moving average (~TRY5.96) for the first time in nearly three months. If the Turkish lira is the strongest of the EM currencies, the Indian rupee is the weakest, off 0.5% today, snapping a three-day advance. Indian bonds, however, are rallying, after the government announced another buy-back program after reducing its borrowing needs last week.

North America: The new NAFTA agreement will dominate the talk. Given the threats to leave NAFTA, the bar for success was low. Still, it will be seen as a success of President Trump’s negotiating tactics and may embolden it elsewhere. Today’s US data includes ISM/PMI manufacturing and construction spending. Separately, September auto sales will be reported. A small gain (to 16.8 mln vehicles seasonally adjusted annualized rate) is expected, which would be the first gain (16.6 mln in August) in three months. Three Fed Presidents, Bostic, Kashkari, and Rosengren will share their economic assessments today. Bostic and Kashkari are among the more dovish Fed officials. Markit reports Canada’s October manufacturing PMI today, but investors may put more weight on the longer-running IVEY survey later in the week.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$EUR,$INR,$TLT,$TRY,EUR/CHF and USD/CHF,Featured,Italy,NAFTA,newsletter