The Federal Reserve’s confidence in the economy and its need to continue to gradually increase interest rates stands in sharp contrast to most of the other major central banks. The European Central Bank will finish its asset purchases at the end of the year, but it is in no position to begin to normalize interest rates. Indeed, the risk is that it may feel compelled to off another Targeted Long-Term Repo, which would,...

Read More »Understanding the Global Recession of 2019

Isn’t it obvious that repeating the policies of 2009 won’t be enough to save the system from a long-delayed reset? 2019 is shaping up to be the year in which all the policies that worked in the past will no longer work. As we all know, the Global Financial Meltdown / recession of 2008-09 was halted by the coordinated policies of the major central banks, which lowered interest rates to near-zero, bought trillions of...

Read More »PKB private bank officials under investigation for fiscal fraud

The headquarters of the PKB Private Bank in Lugano, Switzerland Eighteen managers at the Swiss private bank PKB Privatbank are being investigated in Italy for fiscal fraud and money laundering, according to an Italian prosecutor. The Milan Public Prosecutor’s Office, led by Francesco Greco, is carrying out the investigation against the officials, who are residents in Italy where PKB owns the Italian private bank Cassa...

Read More »The Future is Already Here–It is Just Not Evenly Distributed

When William Gibson would say that “the future is already here-it is just not evenly distributed,” he was referring to how wealth and location determine one’s access to technological advances (the future). Yet it equally can apply to the US-Chinese relationship. In a recent article in the Wall Street Journal, former Treasury Secretary Paulson seemed to express the views of many. If neither the US nor China changes its...

Read More »UBS prepares to fight US mortgage-backed securities lawsuit

UBS says the DOJ is likely to seek “unspecified monetary civil penalties” dating back to 2006 and 2007. UBS Group AG, Switzerland’s largest bank, says it will “vigorously” contest a United States Department of Justice lawsuit concerning mortgage-backed securities it sold in the run-up to the 2008 global financial crisis. In a statement issued on Wednesdayexternal link, UBS said it had been advised that the DOJ intends...

Read More »Fed Sticks To Script, Enjoys the Sweet Spot

The Federal Reserve kept policy on hold, and its sparse statement gave little clue as to what it makes of the pressures in the money markets or the weakness in the housing market. The effective Fed funds rate is bumping against the cap provided by the interest rate on reserves. Some repo rates, like SOFR (the intended replacement for LIBOR), have on occasion poked above what should be the ceiling. The housing market is...

Read More »FX Daily, November 09: Greenback Stabilizes at Higher Levels

Swiss Franc The Euro has fallen by 0.13% at 1.1415 EUR/CHF and USD/CHF, November 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar’s gains scored in the wake of the Fed’s signal that will continue on course to gradually hike rates have been extended. Most emerging market currencies are lower as well. Equity markets are heavy. Bond yields in Europe...

Read More »Cryptoasset start-up backed by Swiss banking heavyweights

Sygnum’s Swiss HQ is situated in the heart of Zurich’s banking district. Some of the doyens of the Swiss financial industry, including former Swiss National Bank president Philipp Hildebrand and ex-UBS CEO Peter Wuffli, have joined the cryptoasset revolution with new financial services operator Sygnum. The Swiss-Singapore enterprise announced itself suddenly on Thursday after operating in stealth mode for months. It is...

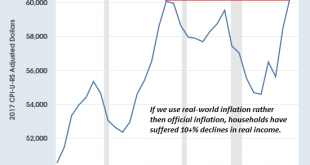

Read More »Why Are so Few Americans Able to Get Ahead?

Our entire economy is characterized by cartel rentier skims, central-bank goosed asset bubbles and stagnating earned income for the bottom 90%. Despite the rah-rah about the “ownership society” and the best economy ever, the sobering reality is very few Americans are able to get ahead, i.e. build real financial security via meaningful, secure assets which can be passed on to their children. As I’ve often discussed here,...

Read More »In Switzerland trains must be on time, and clean

The Swiss Federal Railways has opened a state-of-the-art washing tunnel in Brig, canton Valais, just for trains. The facility, the most modern in ... The Swiss Federal Railways has opened a state-of-the-art washing tunnel in Brig, canton Valais, just for trains. The facility, the most modern in the country, is 90 metres long, fully automatic and will allow the washing of about 3,600 trains per year. A third of the water used - 12.5 million litres per year - can be recycled. "Customers are...

Read More » SNB & CHF

SNB & CHF