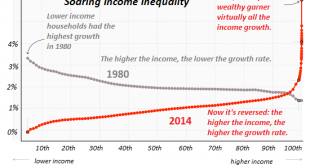

America’s aristocracy is not formalized, and that’s the secret of its success. If there is one central irony in American history, it is this: the citizenry that broke free of the chains of British Monarchy, the citizenry that reckoned everyone was equal before the law, the citizenry that vowed never to be ruled by an aristocracy that controlled the government and finance as a means of self-enrichment, is now so...

Read More »FX Daily, March 20: Brexit Drama Continues but Fed Moves to Center Stage

Swiss Franc The Euro has fallen by 0.14% at 1.1322 EUR/CHF and USD/CHF, March 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: US stocks were not able to hold onto early gains yesterday, and this has helped set the stage for today’s heavier bias. Asia Pacific markets were narrowly mixed, with Japan and Korea eking out small gains while China and Taiwan slipped a...

Read More »Swiss Trade Balance February 2019: New Peak of Exports

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Report urges more sustainability from Swiss financial centre

View of Paradeplatz in Zurich, Switzerland’s largest financial centre (© Keystone / Gaetan Bally) Switzerland must make its financial centre more sustainable and transparent to ensure it doesn’t lose access to the European market, according to a report by PricewaterhouseCoopers seen by Swiss public radio, RTS. This conclusion was part of an assessment carried out by the consulting firm and the World Wildlife Fund (WWF),...

Read More »Cryptocurrencies accepted by Switzerland’s biggest online retailer

An assortment of 2.7 million products, from computers to beer, can now by bought online with cryptocurrencies. (© Keystone / Gaetan Bally) Switzerland’s largest online shop, Digitec Galaxus, has announced it will start accepting payments in bitcoin and other cryptocurrencies. The company, which saw turnover of close to a billion francs last year, is by far the largest Swiss retailer to date to take this step. The move...

Read More »The World Economy’s Industrial Downswing

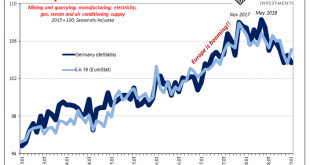

As economic data for 2019 comes in, the numbers continue to suggest more slowing especially in the goods economy. Perhaps what happened during that October-December window was a soft patch. Even if that was the case, we should still expect second and third order effects to follow along from it. Starting with Europe first, Germany’s deStatis had earlier reported factory orders and production levels in January 2019 while...

Read More »FX Daily, March 19: Third Vote on Withdrawal Bill Scuppered Until after EU Summit

Swiss Franc The Euro has fallen by 0.09% at 1.1341 EUR/CHF and USD/CHF, March 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets remain subdued. Many Asian equity markets eased after a strong two-day advance. European equities are slightly firmer. The S&P 500 closed at new five-month highs yesterday. Benchmark 10-year yields are mostly a...

Read More »Parliament sets conditions on further EU payments

Justice Minister Karin Keller-Sutter and Foreign Affairs Minister Ignazio Cassis listen to the debate in the House of Representatives on Monday (Keystone) Switzerland should only make another billion-franc “cohesion” payment to the European Union if the EU doesn’t discriminate against Switzerland, parliament has agreed. The House of Representatives on Monday approved the CHF1.3 billion ($1.3 billion) that will help...

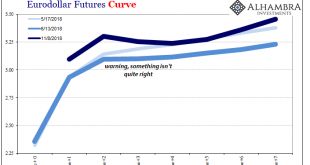

Read More »Chart(s) of the Week: Reviewing Curve Warnings

Quick review: stocks hit a bit of a rough patch right during the height of inflation hysteria. At the end of January 2018, just as the US unemployment rate had finally achieved the very center of attention, global markets were rocked by instability. Unexpectedly, of course. Over the next several weeks, share prices sagged and people blamed it on a number of things: Korean War, the unemployment rate itself (the economy...

Read More »Keynes Was a Vicious Bastard, Report 17 Mar

My goal is to make you mad. Not at me (though I expect to ruffle a few feathers with this one). At the evil being wrought in the name of fighting inflation and maximizing employment. And at the aggressive indifference to this evil, exhibited by the capitalists, the gold bugs, and the otherwise-free-marketers. So, today I am going to do something I have never done. I am going to rant! I am even going to use vulgar...

Read More » SNB & CHF

SNB & CHF