Swiss Franc The Euro has risen by 0.06% at 1.1348 EUR/CHF and USD/CHF, March 18(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The eventful week has begun off slowly. After Wall Street’s best week in four months underpinned Asian’ equities, where all the markets but Thailand, advanced, led by the nearly 2.5% rally in Shanghai. Note that New Zealand’s...

Read More »Red Cross develops war video games – with rules

The idea that the International Committee of the Red Cross (ICRC) is developing military shooter video games may be a surprise to many. But the aim is not to kill everything that moves; it’s a training tool to teach people that there are rules, even in wartime. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and...

Read More »Red Cross develops war video games – with rules

The idea that the International Committee of the Red Cross (ICRC) is developing military shooter video games may be a surprise to many. But the aim is not to kill everything that moves; it’s a training tool to teach people that there are rules, even in wartime. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos...

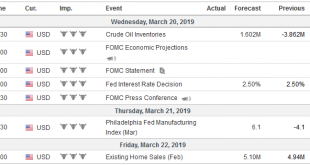

Read More »FX Weekly Preview: Three Highlights in the Week Ahead

Three events next week will shape the investment climate. The Federal Reserve meets and will update its forecasts and guidance. The British House of Commons may vote for a third time on the Withdrawal Bill before Prime Minister May heads of the EU Summit to ask for an extension of the UK leaving the EU. The eurozone sees the flash March PMI, with great hope that the green shoots of spring will be evident. There is...

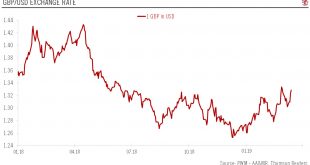

Read More »Brexit update: UK parliament opts for an extension

After an eventful week in parliament, the Brexit ball is set to keep rolling as MPs move to extend the 29 March deadline. The British Parliament concluded a series of votes on Brexit this week with an intention to extend the 29 March Brexit deadline. What remains unclear at this point is whether the UK will seek a short (two months) or a longer extension (two years). It is also not clear what this extension would be...

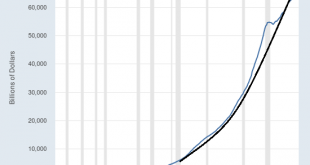

Read More »The Coming Crisis the Fed Can’t Fix: Credit Exhaustion

Thus will end the central banks’ bombastic hubris and the public’s faith in central banks’ godlike powers. Having fixed the liquidity crisis of 2008-09 and kept a perversely unequal “recovery” staggering forward for a decade, central banks now believe there is no crisis they can’t defeat: Liquidity crisis? Flood the global financial system with liquidity. Interest rates above zero? Create trillions out of thin air and...

Read More »US lobbies Switzerland to drop Chinese telecom giant Huawei

Sunrise is working in Switzerland with Chinese tech giant Huawei on the new generation of “5G” mobile Internet connectivity. (Keystone) The US has expressed concern over the use of Chinese technology in Switzerland, suggesting it may be used for espionage, reports the Sonntagszeitung newspaper. Sonntagszeitung cited the Swiss foreign ministryexternal link as saying that the US embassy in Bern had conducted “an exchange...

Read More »US lobbies Switzerland to drop Chinese telecom giant Huawei

Sunrise is working in Switzerland with Chinese tech giant Huawei on the new generation of “5G” mobile Internet connectivity. (Keystone) The US has expressed concern over the use of Chinese technology in Switzerland, suggesting it may be used for espionage, reports the Sonntagszeitung newspaper. Sonntagszeitung cited the Swiss foreign ministryexternal link as saying that the US embassy in Bern had conducted “an exchange...

Read More »Swiss agency suspends payments to migration platform

The Swiss Agency for Development and Cooperation (SDC) has temporarily suspended payments to a civil society platform on migration issues. Financial conflicts of interest and accusations of pro-migration bias are being investigated. On Thursday, the Federal Department of Foreign Affairs (FDFA) confirmed that the Swiss Civil Society Platform on Migration and Developmentexternal link will not be receiving any further...

Read More »Swiss agency suspends payments to migration platform

The Swiss Agency for Development and Cooperation (SDC) has temporarily suspended payments to a civil society platform on migration issues. Financial conflicts of interest and accusations of pro-migration bias are being investigated. On Thursday, the Federal Department of Foreign Affairs (FDFA) confirmed that the Swiss Civil Society Platform on Migration and Developmentexternal link will not be receiving any further...

Read More » SNB & CHF

SNB & CHF