The combination of the dovish hold by the Federal Reserve and the eurozone’s miserable flash Purchasing Managers Index casts a pall over the economic outlook. Japan’s flash PMI remained stuck at February’s 48.9, while core inflation unexpectedly eased. Three months after the European Central Bank stopped buying bonds, the German 10-year Bund yield fell below zero for the first time since 2016. Japan’s 10-year yield is...

Read More »Swiss join protests against EU copyright reform

The EU copyright reform has been surrounded by controversy, particularly over Article 13, which imposes obligations on internet service providers to obtain licences from rightholders to publish content. Tens of thousands of people across Europe, including in the Swiss city of Zurich, staged protests on Saturday against the European Union’s planned copyright reform billexternal link. More than 1,000 demonstrators marched...

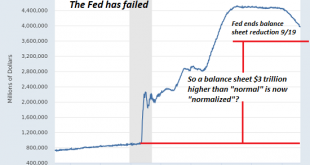

Read More »Politics Has Failed, Now Central Banks Are Failing

With each passing day, we get closer to the shift in the tide that will sweep away this self-serving delusion of the ruling elites like a crumbling sand castle. Those living in revolutionary times are rarely aware of the tumult ahead: in 1766, a mere decade before the Declaration of Independence, virtually no one was calling for American independence. Indeed, in 1771, a mere 5 years before the rebellion was declared,...

Read More »Is Inflation Beginning? Are You Ready?

Extrapolating The Recent Past Can Be Hazardous To Your Wealth “Those who cannot remember the past are condemned to repeat it,” remarked George Santayana over 100 years ago. These words, as strung together in this sequence, certainly sound good. But how to render them to actionable advice is less certain. Aren’t some facets of the past – like the floppy disk – not worth remembering? And aren’t others – like a first...

Read More »Switzerland waives post-Brexit visa requirement for British nationals

(Copyright 2019 The Associated Press. All Rights Reserved.) The Swiss government has dropped the requirement that British nationals obtain a visa to enter Switzerland for a lengthy stay after Britain leaves the European Union. The British government has also extended the same privilege to Swiss nationals wishing to enter Britain after Brexit. The decision was made by the seven-member Federal Council on Friday and will...

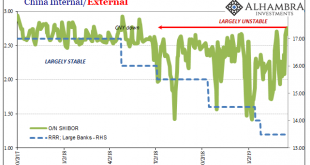

Read More »February 2019 PBOC/RMB Update

This will serve mostly as an update to what is going on inside the Chinese monetary system. The PBOC’s balance sheet numbers for February 2019 are exactly what we’ve come to expect, ironically confirmed today on the domestic end by the FOMC’s dreaded dovishness. Therefore, rather than rewrite the same commentary for why this continues to happen I’ll just link to prior discussions (here’s another). China...

Read More »Wunschdenken von Frau BR Amherd

Das VBS hat seit dem neuen Jahr eine Cheffin. Anlässlich der SOG-DV vom 16. März 2019 hat sie sich an die Offiziere gewandt und dabei einige interessante Äusserungen (Hervorhebungen durch den Autor) gemacht, so etwa zu den “Entwicklungen im internationalen Streitkräftebereich”: “Wir stellen steigende Verteidigungsausgaben, eine Ausrichtung auf die Bekämpfung hybrider Bedrohungsformen, ein erneutes Schwergewicht auf die...

Read More »Parliament rejects reform of health insurance scheme

A doctor’s visit – patients have to cover a level of costs before the health insurance pays in Switzerland (© Keystone / Christian Beutler) Patients will not have to pay out extra money for health services before the health insurance covers the costs, after parliament surprisingly threw out the controversial proposal on Friday. In a previous decision earlier this month, parliament had agreed to increase the deductible...

Read More »FOMC: Above Trend Growth Requires Continued Monetary Support

The Federal Reserve sounded more dovish than many expected and this prompted a 5-7 bp drop in US rates, and the dollar fell to new lows for the week against many of the major currencies. The median Fed forecast now anticipates no hike this year but one next year. The Fed will also taper the roll-off of its balance sheet and completing it by the end of September. In December, 11 officials anticipated two or three hikes...

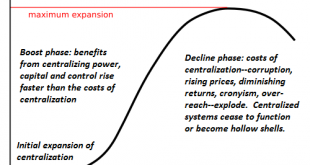

Read More »Which Nations Will Crumble and Which Few Will Prosper in the Next 25 Years?

Adaptability and flexibility will be the core survival traits going forward. What will separate the many nations that will crumble in the next 25 years and those few that will survive and even prosper while the status quo dissolves around them? As I explain in my recent book Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic, the factors that will matter are not necessarily cultural or...

Read More » SNB & CHF

SNB & CHF