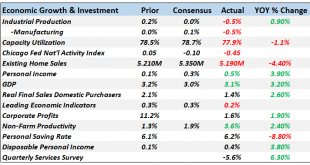

Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction. But moving in the wrong direction, even deeply, as we discovered in 2015/16,...

Read More »Competition watchdog takes closer look at Sunrise-UPC deal

Sunrise, who is to buy UPC for CHF6.3 billion, expects the deal to go through in Autumn. COMCO, the Swiss Competition Commission, is to intensify its investigation of telecoms operator Sunrise’s takeover of UPC Switzerland, amid fears that the move could create positions of market dominance in several areas. Making the announcementexternal link Monday, COMCO wrote that “initial investigations showed that the buyout...

Read More »What Kind Of Risks/Mess Are We Looking At?

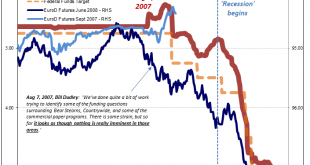

The fact that the mainstream isn’t taking this all very seriously isn’t anything new. But how serious are things really? That’s pretty much the only question anyone should be asking. What are the curves telling us about what’s now just over the horizon? I hesitate to use 2008 comparisons too often because many people immediately jump to extrapolations, especially in these more esoteric market indications. If you say...

Read More »Dollar Supply Creates Dollar Demand, Report 2 June

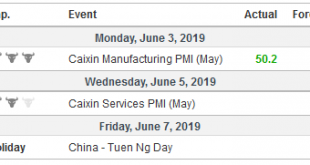

We have been discussing the impossibility of China nuking the Treasury bond market. We covered a list of challenges China would face. Then last week we showed that there cannot be such a thing as a bond vigilante in an irredeemable currency. Now we want to explore a different path to the same conclusion that China cannot nuke the Treasury bond market. To review something we have said many times, the dollar is borrowed....

Read More »FX Daily, June 03: US Penchant for Tariffs Keeps Investors on Edge

Swiss Franc The Euro has risen by 0.04% at 1.1181 . FX Rates Overview: The weekend failed to break the grip of investor worries that is driving stocks and yields lower. The US Administration’s penchant for tariffs is not simply aimed at China, where there is some sympathy, but the move against Mexico, dropping special privileges for India, and apparently, had considered tariffs on Australia. At the same time, the...

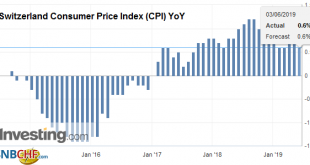

Read More »Swiss Consumer Price Index in May 2019: +0.6 percent YoY, +0.3 percent MoM

03.06.2019 – The consumer price index (CPI) increased by 0.3% in May 2019 compared with the previous month, reaching 102.7 points (December 2015 = 100). Inflation was 0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.3% increase compared with the previous month can be explained by several factors including rising prices for fuel and for...

Read More »Switzerland world’s 4th most competitive nation, according to business school ranking

© Bogdan Lazar | Dreamstime.com Every year, Lausanne-based IMD business school publishes its global competitiveness ranking. Switzerland climbed from 5th last year to 4th behind Singapore, Hong Kong and the US. Venezuela (63rd) was last. The ranking, established in 1989, incorporates 235 indicators and takes into account a wide range of “hard” statistics such as unemployment, GDP and government spending on health and...

Read More »FX Weekly Preview: Curiouser and Curiouser

The first week of June features the Reserve Bank of Australia meeting, an ECB meeting, and the US employment data. The RBA is expected to deliver its first rate cut in three years. The market appears to have discounted not only a second cut in H2 but has priced nearly half of a third cut as well. A soft inflation reading after the seasonal bump in April and disappointing survey data, with Brexit and trade tensions,...

Read More »Fewer Swiss farms and dairy cows, more egg-layers and goats

There was a 3.1% jump in the number of goats in 2018, especially in mountain regions. (Keystone / Arno Balzarini) Last year 768 farmers in Switzerland called it quits, while others increased their livestock numbers and production of organic food. Figures released this week by the Swiss Federal Statistical Officeexternal link revealed a 1.5% drop in the number of farms, bringing the total down to 50,852. However, the...

Read More »Switzerland a top place for skilled foreign workers and students

Switzerland is ranked the most attractive destination for international students. Switzerland is one of the most attractive locations for highly qualified foreign workers, according to a new study by the Organisation for Economic Cooperation and Development (OECD). In a ranking of 35 countries presented on Wednesday, Switzerland comes third behind Australia and Sweden as an attractive destination for skilled workers...

Read More » SNB & CHF

SNB & CHF