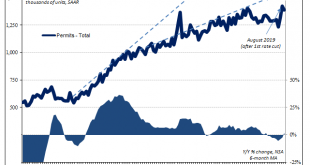

While things go wrong for Jay Powell in repo, they are going right in housing. Sort of. It’s more than cliché that the real estate sector is interest rate sensitive. It surely is, and much of the Fed’s monetary policy figuratively banks on it. When policymakers talk about interest rate stimulus, they largely mean the mortgage space. Homebuilders, at least, responded in August 2019 to the first rate cut in a decade exactly the way the FOMC had imagined when...

Read More »The Unraveling Quickens

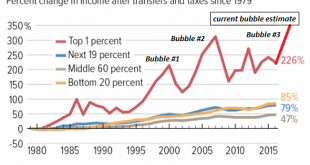

Even if we don’t measure the erosion of intangible capital, the social and political consequences of this impoverishment are manifesting in all sorts of ways. The central thesis of my new book Will You Be Richer or Poorer? is the financial “wealth” we’ve supposedly gained (or at least a few of us have gained) in the past 20 years has masked the unraveling of our intangible capital: the resilience of our economy, our social capital, i.e. our ability to find common...

Read More »JPMorgan Warns U.S. Money Market Stress to ‘Get Much Worse’

◆ Severe funding pressures in U.S. money markets tipped to resurface heading into year-end by JPMorgan who warn that financial stresses are likely to ‘get much worse’ ◆ Goldman Sachs and Bank of America also warn funding issues remain (see below) ◆ Federal Reserve will start buying $60 billion of Treasury bills every month ◆ Funding markets are on notice for a possible year-end liquidity crunch ◆ Growing stresses in U.S. banking and financial system should support...

Read More »Germany Increase Gold Reserves In September For The First Time In 21 Years – IMF

◆ The gold reserves of the German Bundesbank rose in September for the first time in 21 years; German gold reserves rose to 108.34 million ounces in September from 108.25 million ounces last month ◆ It was the Germany’s first gold purchase since 1998 and while the amounts are not huge at 90,000 troy ounces, it highlights the Bundesbank and German concerns about the global monetary system and euro itself as Christine Lagarde takes over the ECB ◆ International...

Read More »FX Daily, October 23: Markets Lack Much Conviction, Await Fresh Developments

Swiss Franc The Euro has fallen by 0.06% to 1.0999 EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: UK Prime Minister Johnson is neither dead in a ditch as he said he would prefer to be than request an extension of Brexit, nor will the UK leave the EU at the end of the month. Yesterday’s vote rejected the attempt to fast-track the legislation needed to support the divorce...

Read More »USD/CHF technical analysis: 0.9912/15, 4H 200MA limit immediate upside

USD/CHF struggles to hold the latest recovery gains. A seven-week-old rising trend line, 50% Fibonacci retracement acts as the closest upside barrier. 61.8% of Fibonacci retracement offers adjacent support. The USD/CHF pair’s recovery from 0.9840 seems to lack momentum as the quote witnesses a pullback to 0.9900 ahead of the European session opening on Wednesday. With this, the 61.8% Fibonacci retracement level of September-October rise, at 0.9885, acts as the close...

Read More »Japan Tobacco staff protest over job cuts

Affected JTI staff are unhappy with the proposed resettlement package, and management’s lack of transparency about job cuts and future plans. Almost 100 Japan Tobacco International (JTI) staff protested outside their Geneva headquarters on Tuesday against job cuts. Around a quarter of the Geneva workforce are affected by major restructuring plans. Last month the multinational firm behind cigarette brands like Winston, Camel and Benson & Hedges...

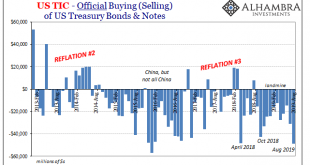

Read More »August TIC: Trying To Get Collateral Out of the Shadows

The second most frustrating aspect of trying to analyze global shadow money is how the term “shadow” really applies in this case. It’s not really because banks are being sneaky, desperately maintaining their cover for any number of illicit activities they are regularly accused of undertaking. The money stays in the shadows for the simple reason central bankers don’t know their jobs; even after a somehow Global Financial Crisis in 2008, they don’t realize the full...

Read More »A New Stage of the US-China Conflict

The US-China diplomatic relationship may be entering a new stage. The balance of power between the key players – Trump, China, the US Congress, and the Democrats – is changing and their roles are being reshuffled. This might be enough to break the endless cycle of agreements and re-escalations. In short, we think both Trump and Chinese officials have a greater incentive to reach a deal (or at least not to escalate) this time around. Meanwhile, the rising antagonist...

Read More »The Growing Opposition Against the ECB

Few investors and market observers were really surprised when Mario Draghi announced the ECB’s next massive easing package in mid-September. Cutting rates further into negative territory and the revival of QE were largely expected sooner or later, as the “whatever it takes” outgoing ECB President is now faced with a wide economic slowdown in the Eurozone. After all, over the last decade, the ECB has proved to be a “one-trick pony”, with negative rates and bond-buying...

Read More » SNB & CHF

SNB & CHF