The Eurogroup has approved short-term debt measures for Greece. The explanations on the ESM website are not very precise. A chronology of the Greek debt crisis and the European institutions.

Read More »Determinants of (Low) Real Interest Rates

On his blog, James Hamilton summarizes a Bank of England working paper by Lukasz Rachel and Thomas Smith on the determinants of low real interest rates.

Read More »Seignorage and Cantillon Effects in India

On Alt-M, Larry White discusses three aspects of the Indian “demonetization” experiment. The transition from old notes blocks “honest” currency transactions, reduces income, and harms the poor who don’t have access to alternative means of payment. Because not all old notes will be redeemed, the transition into new notes will generate seignorage revenue for the government on the order of USD 40 billion, according to White’s estimates. Not all groups or industries get access to the new...

Read More »“Wer hat Angst vor Blockchain? (Who’s Afraid of the Blockchain?),” NZZ, 2016

NZZ, November 29, 2016. HTML, PDF. Central banks are increasingly interested in employing blockchain technologies, and they should be. The blockchain threatens the intermediation business. Central banks encounter the blockchain in the form of new krypto currencies, and as the technology underlying new clearing and settlement systems. Krypto currencies bear the risk of “dollarization,” but in the major currency areas this risk is still small. New clearing and settlement systems benefit...

Read More »Bundesbank Considers Electronic Money

In the Welt, Karsten Seibel reports about the Bundesbank pondering over digital money. The Riksbank does the same.

Read More »“Bitcoin May Have Implications for Monetary Policy,” LSE Business Review, 2016

The LSE Business Review (apparently) has published my VoxEU article.

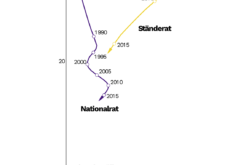

Read More »In Switzerland, the “Elites” Represent Voters

In a post on DeFacto, Michael Hermann argues that in Switzerland the conflict between voters and “political elites” actually has receded. According to Hermann, popular votes helped clarify where voters disagreed with parliamentarians, and this led policy makers to adjust. The figures illustrate how over time, votes in the two chambers of parliament converged towards outcomes in popular votes. Campaigns supported by the right-wing SVP party may have contributed to these developments....

Read More »God and Money

In the NZZ, Thomas Fuster comments on the Catholic church’s critical perspective on capitalism. Der Theologe Martin Rhonheimer hat schon recht: Die Kirche stellt die falsche Frage. Zu ergründen gälte es nicht, wie Armut entsteht, zumal Armut dem ursprünglichen Zustand des Menschen entspricht. Fragen sollte sie sich, wie Wohlstand entsteht. Täte sie dies, hätte der gewinnorientierte Unternehmer, der mit seinen Investitionen zahllosen Menschen ein Auskommen ermöglicht, wohl einen besseren...

Read More »Roger Farmer’s “Prosperity for All”

On his blog, Roger Farmer advertizes his new book, “Prosperity for All,” and argues that governments should stabilize asset prices: Following the Great Stagflation of the 1970s, economists backtracked and revived the classical economic theory that had dominated academic economics for a hundred and fifty years, beginning with Adam Smith in 1776 and culminating in the business cycle theory described by Keynes’s contemporary Arthur Pigou in his 1927 book, Industrial Fluctuations. That...

Read More »Richard Baldwin’s “The Great Convergence”

Link to slides of a presentation at the Peterson Institute. According to Baldwin, the new globalization (since 1990) reflects the fact that ICT enabled G7 firms to precisely control what goes on inside developing-nation factories.

Read More » Dirk Niepelt

Dirk Niepelt