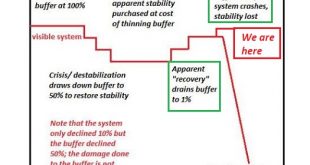

The wild action in the markets and the economic devastation on Main Street may have the spotlight for now, but with the current trajectory we’re on, modern industrial technological civilization will shut down... Killing fields will be the result of millions of people bugging out of the cities, and survivors will have to live off of the land. Only, there are several problems with that. The future is bleak, and it may sound like hyperbole, yet it’s inevitable, but thankfully,...

Read More »Charles Hugh Smith 2021 There Is A Major Collapse on U S, But Nobody Is Talking About It

Please Subscribe to my NEW Channel! http://bit.ly/dailynewsreport Thank You...

Read More »Dollar Remains Firm Despite Dovish Fed Hold

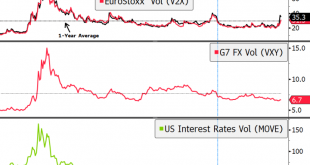

The FOMC delivered a dovish hold, as we expected; we get our first look at Q4 GDP; Fed manufacturing surveys for January will continue to roll out; weekly jobless claims data will be closely watched The vaccination gap between the UK and the US vs. Europe continues to wide, and grievances against suppliers are getting worse; Germany January CPI will be reported; if inflation risks were rising , ECB officials wouldn’t be so concerned about the strong euro and its...

Read More »Gold, the Tried-and-True Inflation Hedge for What’s Coming!

Global confirmed coronavirus cases surpassed 100 million this week. There is no denying that the coronavirus pandemic has caused tremendous hardship and loss. To mitigate new cases climbing further, stricter lockdown and travel restrictions are being announced and implemented, with the curfew in the Netherlands as an example. Lock-down fatigue, as evidenced by the riots against this implemented curfew, is growing. Through it all, hope is on the horizon as vaccine...

Read More »FX Daily, January 28: A Sea of Red Gives the Dollar a Bid

Swiss Franc The Euro has risen by 0.02% to 1.0764 EUR/CHF and USD/CHF, January 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The steepest loss in US equities since last October is rippling through the capital markets in the form of de-risking. The rout is not over, and the S&P 500 is poised to gap lower. Many of the largest markets in the Asia Pacific region were off around 2%. The nearly 1% loss in...

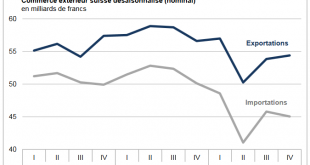

Read More »Swiss Trade Balance Foreign trade 2020: historic decline against the backdrop of a pandemic

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »The Coming Revolt of the Middle Class

That’s how Neofeudal systems collapse: the tax donkeys and debt-serfs finally rebel and start demanding the $50 trillion river of capital take a new course. The Great American Middle Class has stood meekly by while the New Nobility stripmined $50 trillion from the middle and working classes. As this RAND report documents, $50 trillion has been siphoned from labor and the lower 90% of the workforce to the New Nobility and their technocrat lackeys who own the vast...

Read More »Why the Utes Opposed Biden’s Plans to Limit Oil Drilling

Within a day of the inauguration, the Biden administration issues a bevy of new executive orders designed to please a variety of the Democratic Party’s core special-interest groups. Among these was an executive order curtailing oil and gas leasing on federal and tribal lands. But a problem quickly presented itself: many tribes earn a significant amount of income through oil and gas drilling on their lands. These operations also provide jobs for tribal members. The...

Read More »FX Daily, January 27: The Fed and Earnings on Tap

Swiss Franc The Euro has fallen by 0.27% to 1.075 EUR/CHF and USD/CHF, January 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites seem subdued even if GameStop’s surge draws attention. Asia Pacific equities mostly slipped lower, and profit-taking was seen in Hong Kong and Seoul, which are off to an incredibly strong start to the year. Small gains were reported in Tokyo, Beijing, and Taipei....

Read More »Switzerland and UK to push ahead with financial services deal

Britain is keen to maintain the City of London’s attractiveness as a global financial centre Keystone / Facundo Arrizabalaga Britain and Switzerland will press on with plans to strike a trade deal for their vast financial services industries, UK Chancellor of the Exchequer Rishi Sunak said on Wednesday ahead of talks with his Swiss counterpart. The Treasury said the virtual discussions with Swiss Finance Minister Ueli Maurer would focus on the goal of “a...

Read More » SNB & CHF

SNB & CHF