Britain is keen to maintain the City of London’s attractiveness as a global financial centre Keystone / Facundo Arrizabalaga Britain and Switzerland will press on with plans to strike a trade deal for their vast financial services industries, UK Chancellor of the Exchequer Rishi Sunak said on Wednesday ahead of talks with his Swiss counterpart. The Treasury said the virtual discussions with Swiss Finance Minister Ueli Maurer would focus on the goal of “a comprehensive mutual recognition agreement” to cut costs and barriers for UK firms operating in Switzerland and vice versa – a type of arrangement that the European Union had rejected in Brexit talks with London. Britain is keen to maintain the City of London’s attractiveness as a global financial centre after

Topics:

Swissinfo considers the following as important: 3.) Swiss Business and Economy, 3) Swiss Markets and News, Featured, Latest News, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Britain is keen to maintain the City of London’s attractiveness as a global financial centre Keystone / Facundo Arrizabalaga

Britain and Switzerland will press on with plans to strike a trade deal for their vast financial services industries, UK Chancellor of the Exchequer Rishi Sunak said on Wednesday ahead of talks with his Swiss counterpart.

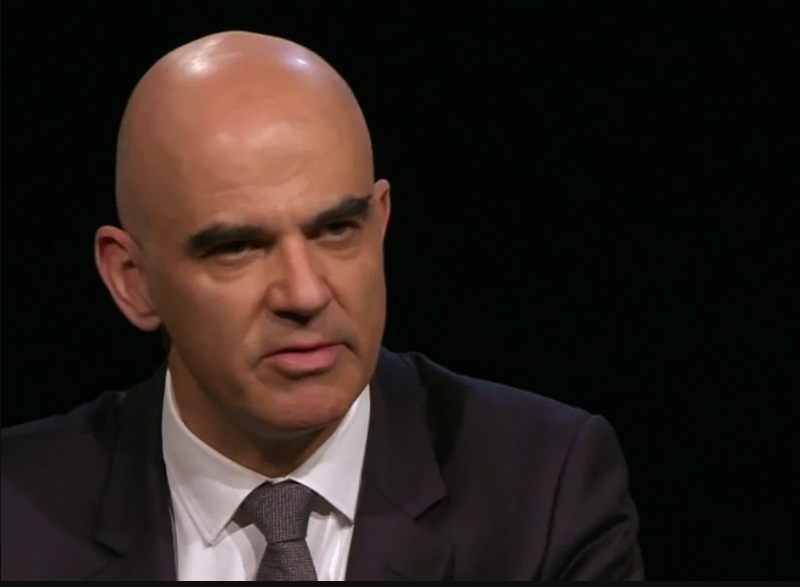

The Treasury said the virtual discussions with Swiss Finance Minister Ueli Maurer would focus on the goal of “a comprehensive mutual recognition agreement” to cut costs and barriers for UK firms operating in Switzerland and vice versa – a type of arrangement that the European Union had rejected in Brexit talks with London.

Britain is keen to maintain the City of London’s attractiveness as a global financial centre after full access to the EU, hitherto its biggest customer, ended last month.

“The UK and Switzerland are both global financial centres, with a shared commitment to high standards of regulation, market integrity and investor protection,” Sunak said in a statement.

“Our ambition is to deliver one of the most comprehensive agreements of its kind in financial services as part of our plan to seize new opportunities in the global economy now we have left the EU.”

Brussels had rejected the City of London’s request for mutual recognition in the trade deal it struck with Britain, instead insisting on equivalence – or a full alignment of rules – as the price for future financial market access.

Because Britain is no longer bound by EU rules since its full departure from the bloc on December 31, British-based exchanges will once again offer trading in Swiss shares from February 3.

Rebuilding volumes

In June 2019, Brussels blocked EU investors from trading on Swiss bourses after a treaty row, with Switzerland then banning EU exchanges from trading Swiss shares.

Britain’s finance ministry and exchanges said earlier this month that it may take time to rebuild volumes.

Wednesday’s talks are expected to cover insurance, banking, asset management and capital markets, the Treasury said.

Tags: Featured,Latest news,newsletter