Der Cryptomarkt zeigte diese Woche wieder sein hässliches Gesicht. Die Preis-Volatilität hat in der Vergangenheit viele Investoren reich gemacht. Wer zum richtigen Zeitpunkt in einen Low Cap Altcoin investierte, konnte über Nacht Millionär werden. Doch das Beispiel Luna zeigt auch, dass man ebenso alles verlieren kann, wenn man nicht zum richtigen Zeitpunkt aus einem Altcoin aussteigt. Crypto News: Luna kollabiert innerhalb von wenigen TagenZu Beginn der Woche...

Read More »Is Gold Starting to Behave Itself?

Gold is doing what it is supposed to do! Equity markets are tumbling, “NASDAQ 100 Rout Erases $1.5 Trillion in Market Value in 3 Days” reads one Bloomberg headline. The big names such as Apple lost over US$225 billion, Microsoft almost US$200 billion, Amazon and Tesla each lost US$175 billion market value over the three trading days from May 4 to May 9. Bonds are also declining in value as yields are rising. The market selloff has been the most extreme in the tech...

Read More »Synchronizing Chinese Prices (and consequences)

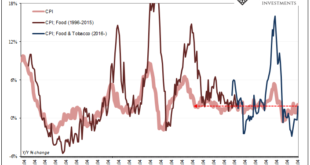

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things. To start with, yesterday China’s NBS reported the index for its consumer prices rose 2.1% year-over-year in April 2022. That’s up from...

Read More »Real Wages Fall Again as Inflation Stays Near 40-Year Highs

Inflation is so high in America that we’re now supposed to believe that inflation is “moderating” if it doesn’t go above 8.5 percent. That, at least, was the message in much of the speculation yesterday around what April’s CPI inflation numbers would show. Much of the “consensus” was that inflation would come in around 8 percent, and that inflation overall had peaked and is therefore moderating. It’s too early to know if inflation has peaked, but one thing if for...

Read More »Swiss remain divided over 5G rollout

The Swiss government is committed to the rapid expansion of a 5G network. © Keystone / Peter Klaunzer Swiss opinion over the expansion of the 5G telecommunications network is still split down the middle, according to the latest survey on the subject. The Swiss government is convinced that the new technology poses minimal health risks and is committed to the rapid erection of 7,500 5G antennae. Some 42.5% of adults support this strategy, but 41.7% are against,...

Read More »The War on Gold Ensures the Dollar’s Downfall

Last month was the 89th anniversary of one of America’s biggest blunders on her descent from honest, sound money into weaponized political money: Executive Order 6102. Signed on April 5, 1933, U.S. President Franklin Delano Roosevelt required all persons holding more than five ounces of gold to deliver their “gold coin, gold bullion, and gold certificates, now owned by them to a Federal Reserve Bank, branch or agency, or to any member bank of the Federal...

Read More »Stagflation Comes from Exorbitant Money Creation and Unhampered Government Spending

Too much government spending and loose monetary policy lead to rising prices combined with falling economic growth rates. All Keynesian roads lead to stagflation. It is the result of economic mismanagement. Again and again, the belief has been proven wrong that central bankers could guarantee the so-called price stability and that fiscal policy could prevent economic downturns. The present crisis is one more piece of evidence that interventionist monetary and fiscal...

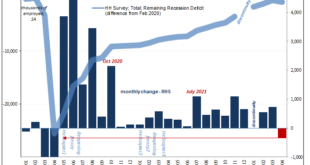

Read More »Neither Confusing Nor Surprising: Q1’s Worst Productivity Ever, April Decline In Employed

Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem. The Establishment Survey was right in the (statistical) zone, so for most of the public the...

Read More »Jeff Snider on how Russia is using the eurodollar system despite sanctions

Paul Buitink talks to Jeff Snider of Alhambra Investments. Jeff explains how Russia, despite the sanctions, is still using the eurodollar system to transact internationally, for example by using off-shore banks across the world and middle-men in China and India. Not being part of Swift is difficult but doesn't stop them from using the eurodollar system. Jeff comments on the ruble exchange rate and how the threat of stopping gas or payments provide for mutually assured destruction between...

Read More »Bitcoin Crash sorgt für Panik im Markt

Der Support bröckelte in den vergangenen Tagen weiter, so dass Bitcoin erst unterhalb von 30K wieder stabil wurde – der Markt reagierte mit Panik. Doch es gibt auch gute Nachrichten, die man erkennt, wenn man sich die langfristigen Daten des BTC-Preises ansieht. Bitcoin News: Bitcoin Crash sorgt für Panik im MarktAktuell ist der Bitcoin nur noch 28.400 US-Dollar wert. Ein neues Jahrestief vom Wochenanfang wurde damit nochmals unterboten. Doch die allgemeine Panik des...

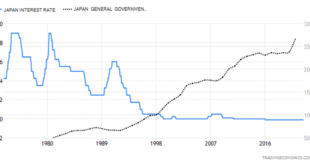

Read More » SNB & CHF

SNB & CHF