Each week we will publish the best articles by Marc Meyer, one of the most critical voices against the SNB.This post explains 3 points: That the SNB does not understand what assets and liabilities are – and due to this misunderstanding – it speculates with massive leverage. The difference between good and bad deflation, and that Switzerland has good deflation. That both the SNB and the Swiss government do what some Swiss exporters want. Therefore, the formerly admired central bank...

Read More »Five Central Banks Meet as Monetary Policy is Downgraded

Fixed exchange rates limit the degrees of freedom for policymakers. The breakdown of Bretton Woods in 1971 removed this constraint on official action, and the results were larger budget deficit and higher inflation. The zero bound on interest rates also posed a constraint on behavior. Until this year, despite the long struggle against deflation, the Bank of Japan never instituted a negative policy rate. Since the early days of the Great Financial Crisis, some had warned of limits of...

Read More »Showcasing the art of papercutting

What does it take to practice the art of papercutting? An exhibition looks at 30 years of work by the “Friends of papercutting” association. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »Speculators Cut Long Sterling Exposure While Adding to Long Aussie

The Commitment of Traders reporting period ending March 8 showed little position adjusting ahead of the ECB meeting two days later. A little more than 3/4 of the gross positions we track saw less than 5k contract change and only two were above 6k. The gross long speculative sterling position was cut by a quarter or 9.6k contracts to 29.4k. Speculators also built a larger gross long Australian dollar position, adding 9.7k contracts to 86.1k. The conventional focus on net positions does...

Read More »Greenback’s Tone Sours, Sterling may Shine

The reversal of the US dollar's gains half way through Draghi's press conference has undermined the near-term technical tone. The risk is on the downside, at least in the first part of the week, ahead of the FOMC meeting. The US Dollar Index posted an outside down session on March 10. It drove the five-day moving average through the 20-day average, and turned the RSI and MACDs. Follow through selling ahead of the weekend was limited, but a break of 96.00 suggests potential toward year...

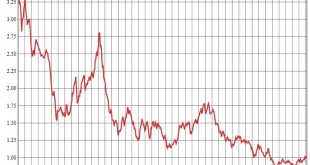

Read More »Great Graphic: Canadian Dollar Trendline Approached

The Canadian dollar's advance continues. Neither the widening of interest rate differentials in the US favor nor a poor employment report has managed to buckle the Loonie. Oil and the general risk-on mood trump the other concerns. In addition, investors are concluding that fiscal stimulus will reduce the possibility of additional monetary stimulus. The implied yield on the June BA futures is now the highest since last June. The Great Graphic, made on Bloomberg shows the greenback's...

Read More »The box office hit that is still relevant four decades on

“The Swissmakers” is one of the most successful Swiss films of all time. A satire on immigration, writer-director Rolf Lyssy talks about why it was so popular and why it stands the test of time. (Carlo Pisani, swissinfo.ch) It is estimated that when “The Swissmakers” came in cinemas in 1978 one in every five Swiss watched it, making it one of the most successful Swiss films ever in terms of number of viewers. Lyssy, who turned 80 at the end of February, spoke to swissinfo.ch from his...

Read More »A Few Thoughts Ahead of the Weekend

The market reaction to Draghi's indication, once again, that interest rate policy has run its course, will be debated for some time. Draghi delivered the goods that many investors said was lacking last December. The ECB policy more than anyone expected. All the boxes were checked. Although the end date was not extended beyond March 2017, the four-year TLTROS will run into the new decade, and Draghi indicated that rates will remain low well beyond the end of the asset purchases....

Read More »Dollar Recovers Against the Euro and Yen

The euro is paring the recovery that began in the middle of the ECB's press conference yesterday. The markets had reacted as one intuitively would expected to broad easing of interest rates and credit conditions. The market reversed, and violently so, only after Draghi seemed to rule out further interest rate cuts. Many investors took this to mean the ECB had gone all in and that monetary policy had reach the end. We do not expect this interpretation to be sustained. Even though...

Read More »Draghi Delivers, but Now What?

Draghi delivered. He managed to get approval for everything. Rate cuts, acceleration of purchases, including corporate bonds to the purchase program and new long-term repos were announced. The knee-jerk reaction was favorable. The euro fell over 1% and peripheral European bonds rallied. The deposit rate was cut 10 bp to minus 40 bp. The asset purchases were increased by 20 bln euros a month to 80 bln. Investment grade, non-financial corporate bonds would be included, easing...

Read More » SNB & CHF

SNB & CHF