Since the UK voted to leave the EU, emerging market equities have outperformed equities from the developed markets. This Great Graphic, composed on Bloomberg, shows the MSCI Emerging Market equities (yellow line) and the MSCI World Index of developed equities (white line). Both time series are indexed as to June 15, but they were at nearly identical levels as the UK voted. The developed market equities fell more...

Read More »Ticino tourism could be big loser from burka ban

Growing numbers of Arab visitors to southern Switzerland were helping save the region’s tourist industry. But now a ‘burka ban’ is in force, which could turn many away. (SRF/swissinfo.ch) Italian-speaking Ticino became the first and only Swiss canton to introduce a ban on any face covering headgear, which came into effect on July 1. The first fine was handed out on the same day to a Swiss niqab-wearing Muslim from Zurich who travelled to Ticino in defiance of the law. Hotels in the region...

Read More »Will the army become compulsory for everyone?

A new study on improvements to the army suggests opening conscription to women. (SRF/swissinfo.ch) Experts evaluating the challenges facing the Swiss conscription system after 2030 have suggested considering universal compulsory service. This could potentially include service in the army for women and for foreigners living in Switzerland. The study, released by the government on Thursday, looked at potential changes which could be made to take advantage of the needs of Swiss society and...

Read More »Basel improvises to deal with street prostitution

Basel police want prostitutes to respect the law when it comes to looking for business in the city. To do this, they’ve come up with an unusual solution. (SRF/swissinfo.ch) After complaints from people living in Basel’s red light district, the authorities marked out areas where prostitutes are allowed to stand with special green pictograms. The authorities estimate the numbers of sex workers in Basel to be around 800. Between 30 and 50 actually work on the streets, and the remainder work in...

Read More »Sending rejected asylum seekers home

When a request for asylum is rejected, the applicant is supposed to leave the country straight away. Not everybody does, and there are vast differences in how the cantons deal with this. (SRF/swissinfo.ch) In Renens in canton Vaud, around 100 rejected asylum seekers have been camping for months. When it comes to deporting rejected asylum seekers, Vaud is the most lax canton, followed by Geneva, Schaffhausen and Zug. Nine cantons are relatively strict. But the cantons of Aargau, Graubünden,...

Read More »Swatch profit plunges as demand falls across europe, asia

Swatch Group AG said first-half profit fell by more than half — the most in at least 15 years — as demand for its watches in Hong Kong, France and Switzerland collapsed. © Radub85 | Dreamstime.com Sales fell about 12 percent, the Biel, Switzerland-based maker of Omega and Tissot timepieces said in an unscheduled statement on preliminary results. Analysts expected a 22 percent drop in net income and a 7 percent...

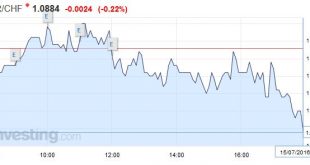

Read More »FX Daily, July 15: Sterling and Yen Remain Key Drivers in FX

Swiss Franc While the yen remained weak, the other major safe-haven, the Swiss Franc had gains. We often emphasized the main differences: The Swiss have a far higher trade surplus per capita The Swiss government does not do fiscal experiments like helicopter money, the SNB does only the monetary part. While the Swiss monetary stimulus is higher than the Japanese one. The effect of FX interventions is stronger than...

Read More »Swiss stocks higher on stimulus bet

SMI last Week The Swiss Market Index (SMI) is set to finish this week higher tracking equity market gains around the world as investors begin to anticipate a new wave of economic stimulus from central banks. Bonds Swiss Bond yields remained under zero, even until the duration of 30 years. Swiss Company News In Switzerland, economic news was light. Data showed that producer and import prices continued to decline...

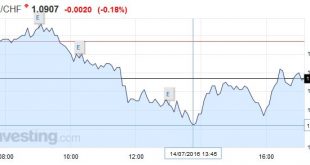

Read More »FX Daily, July 14: Will BOE Ease on May Day?

Swiss Franc The euro-Swiss is moving back to reality, after the risk-on run in the beginning of the week. The continued yen weakening is slightly negative for the franc given that some algorithms correlate the two safe-haven currencies. Click to enlarge. United Kingdom After a nearly three weeks of turmoil following the UK referendum, there is now a sense of order returning to UK politics. Two elements of the new...

Read More »Great Graphic: If You Think Sterling has Bottomed, Where may it Go?

Summary: Many think sterling has bottomed. A number of technical factors point to potential toward $1.42. Fundamental considerations do not appear as supportive as technicals. With the Bank of England apparently surprising the market more than one might have expected, given the split surveys, many are thinking sterling has bottomed. If it has bottomed, where could it go? A number of technical...

Read More » SNB & CHF

SNB & CHF