Comment on GBP and CHF by Dayle Littlejohn My articles My siteAbout meMy booksFollow on: Swiss Franc EUR/CHF - Euro Swiss Franc, October 28(see more posts on EUR/CHF, ). - Click to enlarge Since the UK public decided to vote out of the European Union GBP/CHF exchange rates have dropped 22 cents. To put this into monetary value a 200,000 Swiss Franc purchase now costs an extra £26,000 and I believe...

Read More »Brexit brings specter of common EU tax plan, and bodes poorly for Switzerland’s immigration negotiation

© Dreamshot | Dreamstime.com - Click to enlarge Ireland is facing another tax battle with the European Union and this time it will have to fight its own corner. Less than two months after the European Union ordered Ireland to claw back a record 13 billion euros ($14.2 billion) from Apple Inc., saying the nation illegally allowed the iPhone maker to reduce its tax rate, the European Commission will propose legislation...

Read More »KOF Economic Barometer Is Climbing

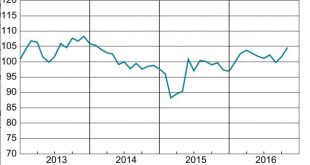

KOF Economic Barometer rose by 3.1 points (from revised 101.6 in September) to 104.7. It thus recovered from its recent summer trough of below the 100 points and stands as high as for the last time in January 2014. Accordingly, the outlook for the Swiss suggests above potential short-term growth rates. In October 2016, the KOF Economic Barometer, with a new reading of 104.7, pointed visibly above its long-term...

Read More »Pharma giants drag SMI stocks down

SMI A weak performance from Swiss pharma giants pulled the Swiss Market Index down again this week after investors dropped stocks in the sector on lackluster earnings reports. The peripheral European stocks and Japan managed to buck the trend this week, global stock markets remain under pressure in the run up to US election. SMI Index, October 29(see more posts on SMI Swiss Market Index, ) - Click to enlarge...

Read More »Yellen and Fischer Still Singing from the Same Song Book

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Many see Yellen and Fischer at odds over benefits of high pressure economy. However, this fails to put the comments in the proper context–same message different styles. They are arguing against the doves who don’t want to hike this year. Many observers are...

Read More »Ending a Taking Economy and Creating a Giving Economy Part 2

Here is Part 2 of the guest essay by Zeus Y. There no longer seems to be a rational alignment between economic cost and value. This means questioning so-called conventional wisdom and critically considering whether or not to own property or even to go to college. Here are some examples: • In my own life, I owned a Florida vacant lot that would normally (and did actually significantly appreciate) in value, but the...

Read More »Jim Grant Puzzled by the actions of the SNB

Retaken from Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold. From multi-billion bond buying programs to negative interest rates and probably soon helicopter money: Around the globe, central bankers are...

Read More »FX Daily, October 27: Rising Yields Continue to be the Main Driver

Swiss Franc EUR/CHF - Euro Swiss Franc, October 27(see more posts on EUR/CHF, ). - Click to enlarge GBP/CHF rates have levelled out over the past couple of weeks following some heavy losses earlier this month. The Pound crashed following UK Prime Minister Theresa May’s comments regarding the triggering of Article 50 early next year. Whilst we knew this was coming the timeline was shrouded in uncertainty and the...

Read More »Great Graphic: CRB Index Revisited

Summary: Interest rates and 10-year break-evens are rising. Some think the CRB Index is tracing out a head and shoulders bottom. We look for inflation in non-tradable goods’ prices (think services). Bond yields are rising. The break-even rates, which compare conventional yields to the inflation-linked securities are also rising. These developments, which we do not think can be attributed to central bank...

Read More »Syngenta slumps on concern of protracted ChemChina EU review

© Perolsson | Dreamstime.com Syngenta AG shares tumbled on concern that China National Chemical Corp.’s $43 billion takeover of the Swiss herbicide and pesticide maker risks regulatory delays in the European Union. ChemChina didn’t submit so-called remedies in the EU’s early-stage review of the deal by the Oct. 21 deadline, the European Commission’s press office said by phone on Monday. Companies often decide to put off...

Read More » SNB & CHF

SNB & CHF