Swiss government accounts closed with a surplus of CHF2.8 billion ($3 billion) for 2017, compared with a forecast deficit of CHF250 million, Finance Minister Ueli Maurer said at a press conference in Bern on Wednesday. This was due mainly to higher-than-estimated tax revenues. The surplus would have been even higher, at CHF4.8 billion, had it not been for an accounting provision of CHF2 billion. The real surplus of...

Read More »Sovereign Wealth Funds Investing In Gold For “Long Term Returns” – PwC

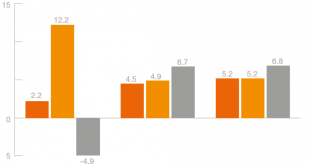

– Sovereign wealth funds investing in gold for long term returns – PwC – Gold has outperformed equities and bonds over the long term – PwC Research – Gold is up 6.7% and 6.8% per annum over 10 and 20 year periods; Stocks and bonds returned less than 5.2% respectively over same period (see PwC table) – From 1971 to 2016 (45 years), “gold real returns were approximately 10% while inflation increased 4%” – Gold also...

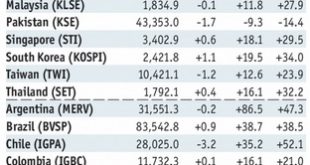

Read More »Emerging Markets: What Changed

Summary The National Stock Exchange of India will end all licensing agreements and stop offering live prices overseas. Philippine central bank cut reserve requirements for commercial banks. Egypt cut rates for the first time since 2015. Israeli police recommended that Prime Minister Netanyahu be charged. South Africa President Zuma resigned before a no confidence vote was held. Brazil President Temer will issue a...

Read More »What Kind of Stock Market Purge Is This?

Actions and Reactions Down markets, like up markets, are both dazzling and delightful. The shock and awe of near back-to-back 1,000 point Dow Jones Industrial Average (DJIA) free-falls is indeed spectacular. There are many reasons to revel in it. Today we shall share a few. To begin, losing money in a multi-day stock market dump is no fun at all. We’d rather get our teeth drilled by a dentist. Still, a rapid...

Read More »Favoritisme de la BNS: l’horlogerie suisse supplantée par Apple

La grande nouvelle du jour est que Apple aurait vendu plus de montrer dans le monde que toute l’horlogerie suisse réunie. Ces chiffres sont tout de même à relativiser fortement, car ils sont le fruit d’analyse de marché, diffusés par le CEO de Apple lui-même…. Source: http://www.fhs.swiss/fre/origins.html - Click to enlarge En rouge, l’industrie horlogère suisse dans sa totalité face à Apple en bleu. Ainsi,...

Read More »FX Daily, February 16: Worst Week for the Dollar since 2015-2016, While Stocks Continue to Recover

Swiss Franc The Euro has fallen by 0.13% to 1.1513 CHF. EUR/CHF and USD/CHF, February 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Nearly all the major currencies have risen at least two percent against the US dollar this week. The Canadian dollar is an exception. It has risen one percent this week ahead of today’s local session. Sterling is becoming another...

Read More »Great Graphic: Bears Very Short US 10-Year Ahead of CPI

Summary: Speculators have a large net short 10-year Treasury position. The gross short position is a record. CPI is likely to be softer, while retail sales may show a still robust consumer. The US reports January CPI figures tomorrow. The market seems especially sensitive to it. The main narrative is that it is an inflation scare spurred by the jump in January average hourly earnings that pushed yields higher...

Read More »Idaho House Votes Overwhelmingly to Remove Income Taxation from Gold & Silver

- Click to enlarge Boise, Idaho (February 12, 2018) – The Idaho State House today overwhelmingly approved a bill which helps restore constitutional, sound money in the Gem State. State representatives voted 60-9 to pass House Bill 449 sending the measure introduced by House Majority Leader Mike Moyle and Senate Assistant Majority Leader Steve Vick to the Senate for a hearing in the Local Government and Taxation...

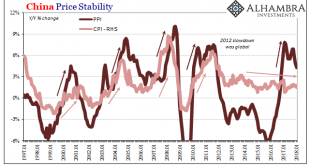

Read More »China: Inflation? Not Even Reflation

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference. There was, to me anyway, a lot of Japan in it, even still if “globally...

Read More »Why I Own Gold and Gold Mining Companies – An Interview With Jayant Bandari

Opportunities in the Junior Mining Sector Maurice Jackson of Proven and Probable has recently interviewed Jayant Bandari, the publisher of Capitalism and Morality and a frequent contributor to this site. The topics discussed include currencies, bitcoin, gold and above all junior gold stocks (i.e., small producers and explorers). Jayant shares some of his best ideas in the segment, including arbitrage opportunities...

Read More » SNB & CHF

SNB & CHF