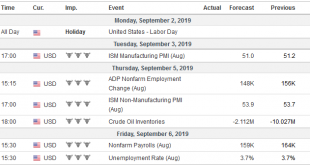

Markets in the US and Canada were closed on Monday for national Labor Day holidays. Here is a succinct summary of key developments that will set the backdrop for Tuesday. 1. On September 1, the new round of tariffs in the US-China fight took effect. The US placed a 15% tariff on around 3000 Chinese goods that thus far had escaped action. China put a 10% level on 1700 US goods. No date has been given for the next round of face-to-face talks that were expected this...

Read More »Big Difference Which Kind of Hedge It Truly Is

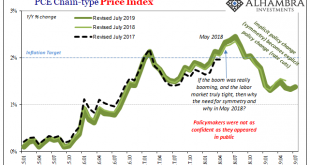

It isn’t inflation which is driving gold higher, at least not the current levels of inflation. According to the latest update from the Bureau of Economic Analysis, the Federal Reserve’s preferred inflation calculation, the PCE Deflator, continues to significantly undershoot. Monetary policy explicitly calls for that rate to be consistent around 2%, an outcome policymakers keep saying they expect but one that never happens. For the month of July 2019, the index...

Read More »September Monthly

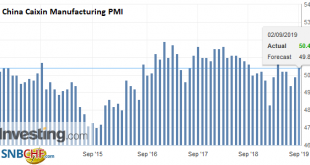

Three forces are shaping the investment climate. The US-China trade conflict escalates at the start of September as both will raise tariffs on each other’s goods and are threatening another round in mid-December (US 25% tariffs on $250 of Chinese imports will increase to 30% on October 1). Some third parties may benefit from the re-casting of supply chains, but the first impact is understood to weaken growth impulses. That is aggravating the slowdown already evident...

Read More »FX Weekly Preview: Talking and Fighting in the Week Ahead

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull. At the same time, US and Chinese officials probe each other to see if sufficient disruption has been felt to force concessions. Talking and...

Read More »USD/CHF technical analysis: Upside capped by 4-week old resistance-line

USD/CHF remains below near-term resistance-line forming part of immediate rising wedge bearish formation. 200-bar SMA, 50% Fibonacci retracement can question pair’s downside below 0.9857/54 confluence. USD/CHF fails to extend the latest upward trajectory as it trades near 0.9900 during Asian session on Monday. While drawing trend-lines with the help of highs and lows marked since August 23, a short-term rising wedge, bearish formation, appears on the four-hour...

Read More »Drivers for the Week Ahead

We remain dollar bulls; this is an important data week for the US Final August eurozone manufacturing PMIs will be reported Monday; UK reports August PMIs this week RBA meets Tuesday and is expected to keep rates steady at 1.0%; BOC meets Wednesday and is expected to keep rates steady at 1.75% Swedish Riksbank meets Thursday and is expected to keep rates steady at -0.25%; in EM, the central banks of Chile and Russia meet Market sentiment rallied last week on a lot of...

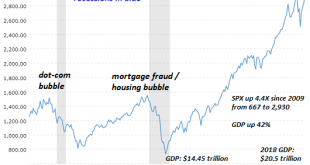

Read More »Labor Day Reflections on Retirement and Working for 49 Years

What happens when these monstrous speculative bubbles pop? Let’s start by stipulating that if I’d taken a gummit job right out of college, I could have retired 19 years ago. Instead, I’ve been self-employed for most of the 49 years I’ve been working, and I’m still grinding it out at 65. By the standards of the FIRE movement (financial independence, retire early), I’ve blown it. The basic idea of FIRE is to live frugally and save up a hefty nestegg to fund an early...

Read More »Most Swiss Election Candidates Favour Raising Retirement age to 67

A majority of the candidates putting themselves forward for election as federal parliamentarians on 20 October 2019 favour raising Switzerland’s retirement age to 67, according to a survey done by Smartvote and reported in the newspaper NZZ am Sonntag. © Epicstock | Dreamstime.com This could produce a parliamentary majority on the issue after the federal election. Switzerland’s official retirement age has moved into political focus as the country’s pay-as-you-go...

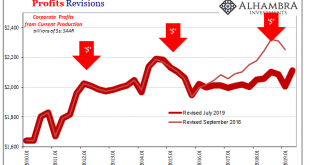

Read More »GDP Profits Hold The Answers To All Questions

Revisions to second quarter GDP were exceedingly small. The BEA reduced the estimate by a little less than $800 million out of nearly $20 trillion (seasonally-adjusted annual rate). The growth rate therefore declined from 2.03502% (continuously compounded annual rate) to 2.01824%. The release also gave us the first look at second quarter corporate profits. Like the headline GDP revisions, there wasn’t really much to them. At least not when viewed in isolation....

Read More »Swiss Research Leads to Cancer Break Through

Researchers at the Paul Scherrer Institute recently deciphered the structure of the CC chemokine receptor 7 (CCR7), a signaling protein. © Bogdan Hoda | Dreamstime.com Cancer cells use CCR7 to guide themselves into the lymphatic system, spreading cancer throughout the body. The resulting secondary tumors, called metastases, are responsible for most cancer deaths. This new understanding of CCR7 is a break through that forms a foundation for developing drugs that could...

Read More » SNB & CHF

SNB & CHF