Our central scenario has long been that we would see some lowering of US-China trade tensions ahead of the US presidential elections. But deep-seated issues may prevent a major breakthrough.President Trump is considering offering a ‘limited’ or ‘interim’ trade agreement to China as his advisors prepare the ground for face-to-face talks scheduled for October. He has notably announced that the additional 5% tariffs on Chinese goods scheduled for early October were being pushed back to the middle of the month.This initiative marks a notable de-escalation of the US-China trade dispute after a tumultuous month of August, which saw the Trump administration imposing new tariffs on Chinese imports. The Treasury department also designated China a “currency manipulator” in August after the Chinese

Read More »Articles by Thomas Costerg and Dong Chen

US-China: Trump’s tariff net expands

August 2, 2019With additional tariffs in the pipeline, should the Fed take notice?US President Trump pre-announced a further expansion of the US tariffs on imports from China: the remaining half of imports not yet taxed will be at a rate of 10%. It was our central scenario that the tariff net would be increased before the 2020 elections, but we are surprised by the timing, so close on the heels of the G20 meeting in Osaka.Such tariffs further reduce the possibility of an encompassing trade deal with China before the US elections. Yet at the same time, they do not seem to signal a breakdown in trade talks (which would then lead to our alternative scenario).From a Federal Reserve rate perspective, we do not exclude that these tariffs are also a way (admittedly convoluted) of putting more pressure on

Read More »2019 US-China trade outlook: major challenges remain

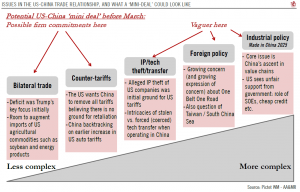

December 19, 2018A tentative deal is possible by March, but tensions will likely flare up again.Following the Trump-Xi dinner on 1 December, there are signs of goodwill on both sides, leaving the impression that a ‘mini deal’ is possible before the 1 March 2019 deadline set by the US. This could push back the threat of additional tariffs in the very near term.But we think the devil will be in the details, and particularly in the implementation details. Some sort of hiccup is likely to take place once we enter this phase, in our view.Long-term thorny issues, such China’s economic (and technological) rise are unlikely to find an easy resolution – and there is perhaps not enough time to squeeze in these before the March deadline. These structural concerns could come back and haunt any ‘truce’. Both countries

Read More »US-China trade update: G20 meeting preview

November 23, 2018Although highly uncertain, any truce between the US and China at the G20 meeting could delay new tariffs.A new low point in trade tensions between the US and China was reached in September 2018 when the US placed an additional 10% duty on roughly USD200 billion of Chinese imports. However, since then, hints at a potential ‘détente’ have focused on the G20 summit in Buenos Aires at the end of November, with hopes that progress there could delay the setting of tariffs on all Chinese imports into the US by several months. This said, the risk that across-the-board tariffs are introduced next January are not completely off the table, in our view, and could resurface if talks break down.Indeed, it remains uncertain whether US President Donald Trump will strike a ‘deal’ with Chinese president Xi

Read More »Fresh tariffs should have limited impact on US economy for now

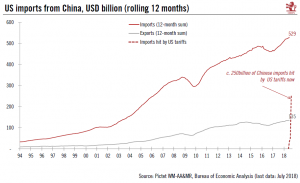

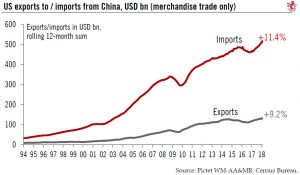

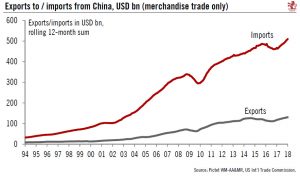

September 18, 2018The latest US levies on USD200bn of Chinese imports could leave some room for negotiation before the tariff rate is increased.The Trump administration has announced new tariffs on USD200 billion of Chinese imports, initially at a rate of 10%, rising to 25% in January. This new wave of tariffs comes on top of the USD50 billion taxed over the summer at a rate of 25%. Trump has also threatened to impose levies on all remaining imports from China (worth an additional USD276 billion) if China retaliates to the latest US salvo.The US economy is in strong shape, so the tariffs so far implemented and likely Chinese retaliation should have a limited impact for now (likely equivalent to around 0.2/0.3 percentage points). The US economy remains strong, with growth being powered by strong internal

Read More »Risk of trade war grows

July 11, 2018The new US tariffs threatening Chinese imports and probable retaliation could bite into US and Chinese growth. As US midterm elections approach, the situation could worsen before it gets better.The Trump administration has stepped up its trade actions further by increasing the net of Chinese imports that will be subject to US tariffs: on top of the USD50 billion of Chinese imports subject to a 25% tariff already announced, the US Trade Representative has prepared a list of a further USD200 billion of imports to be subject to a 10% tariff. After a brief consultation period, the tariffs could enter into force in September.Largely targeting Chinese consumer products that are not easily replaceable, the new 10% tariff looks like a consumption tax. A wide range of goods are being targeted by

Read More »China-US trade war on hold

May 22, 2018A significant softening of the US stance increases the likelihood of reaching a final agreement.Two weeks after the US-China talks in Beijing, the two countries held another round of trade negotiations in Washington DC on 17-18 May. After the meetings, delegations on both sides released a joint statement that was brief but constructive in tone. In essence, China has agreed to significantly increase its imports of American goods and services to reduce the US trade deficit with China, to improve its protection of intellectual property rights, and to create more favourable conditions to expand its trade with the US. While many details are still missing, it appears that the meetings have produced a framework in which both parties have agreed to work to reduce recent trade tensions. In a media

Read More »US-China trade tensions could last a while

April 10, 2018While our central scenario remains unchanged, we still see downside risks increasing from recent trade escalation.Following on from President Trump’s announcement of a 25% tariff on USD50bn of unspecified imports from China, the US Trade Representative (USTR) last week detailed the list of China-made goods that will be targeted. China reacted swiftly by detailing its own list of counter-tariffs on USD50bn worth of imports from the US. Trump then escalated the rhetoric further when he suggested the US could cast a wider net to include USD150bn of imports from China in the new tariffs (out of USD500bn in total imports from China).That said, President Trump subsequently seemed to back off over the weekend, using a Twitter message to highlight his friendship with President Xi Jinping. The

Read More »Impact of recent tariffs on US and China’s GDP should be limited for now

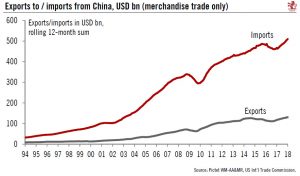

March 27, 2018Trump’s trade tariffs should have a very small impact and may be a ploy to reach a trade agreement.The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD 506bn of total Chinese merchandise imports). The list of products targeted still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn.But President Trump also sees the tariffs as a way to pressure the Chinese authorities into a ‘deal’, with the aim to reduce the bilateral trade deficit by USD 100bn. Such a deal would echo US trade policy towards Japan in the 1980s, when the US negotiated quotas on Japanese cars.Since the announcement, media

Read More »Impact of recent tariffs on US and China’s GDP should be limited for now

March 27, 2018Trump’s trade tariffs should have a very small impact and may be a ploy to reach a trade agreement.The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD 506bn of total Chinese merchandise imports). The list of products targeted still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn.But President Trump also sees the tariffs as a way to pressure the Chinese authorities into a ‘deal’, with the aim to reduce the bilateral trade deficit by USD 100bn. Such a deal would echo US trade policy towards Japan in the 1980s, when the US negotiated quotas on Japanese cars.Since the announcement, media

Read More »US trade policy update – Eyeing China

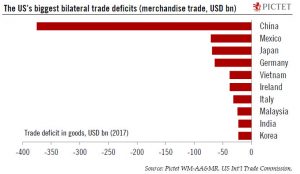

March 21, 2018US trade policy’s attention is now turning towards China, with a threat of new tariffs. But we see here a lot of political rhetoric.After the tariffs on steel and aluminium, the Trump Administration’s attention now seems to be focused on China as the US’s merchandise trade deficit with China rose to a new high of USD 375bn in 2017. The trade hawks close to Trump – Ross, Lighthizer and Navarro – seem to be having an increasing influence on Trump, and they seem eager to reach a new deal with China.According to media reports, there is an ongoing threat of USD 60bn of trade tariffs that could be applied on imports from China as the US believes that China is not playing by the rules of global trade, and is distorting fair competition – particularly with regard to intellectual property (IP).

Read More »