Welsh Gold Being Hyped Due To The Royal Wedding?

– Welsh gold and the misconceptions surrounding it – GoldCore speak to China Central Television (CCTV) – Welsh gold mired in misconceptions, namely that it is ‘rarest’ and most ‘sought after’ gold in world – Investors to be reminded that all mined gold is rare and homogenous – Nothing chemically different between Welsh gold and that mined elsewhere– Investors led to believe Welsh gold is more valuable, despite lack of authenticity in some Welsh gold products – Peak gold: We tell Beijing’s largest TV network that Welsh gold is limited but so too is gold everywhere

Editor: Mark O’Byrne

Is ‘Welsh gold’ more valuable than gold mined from anywhere else? Some believe it is.

Articles by Jan Skoyles

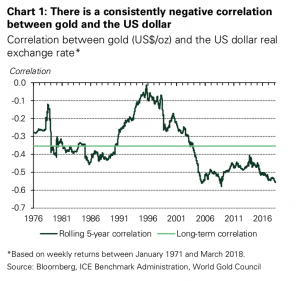

Gold Price Increasingly Influenced By Declining Dollar Rather Than Interest Rates

May 4, 2018Gold Price Gains Due To Declining Dollar Rather Than Interest Rates

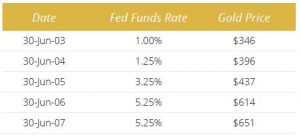

– Investors should not be put off by higher interest rates, World Gold Council research finds they do not always have a negative impact on gold

– Only short-term movements in gold are ‘heavily influenced by US interest rates’

– Correlation between US interest rates and gold is waning, with US dollar a better indicator of short-term gold price – New findings will reassure gold investors that there is no single driver of the gold price including interest rates and the myth of the “all powerful” central bank

Editor: Mark O’Byrne

What drives the gold price? There is no single answer to that question. It is a multiple of factors, all of which vary in

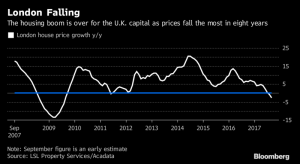

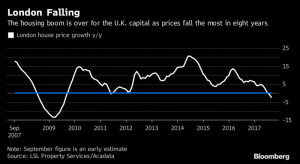

London House Prices See Fastest Quarterly Fall Since 2009 Crisis

May 2, 2018– London house prices fell by 3.2% in the first quarter – Halifax

– Brexit, financial and geo-political uncertainty lead to falls– Excluding sale of seven £10m-plus houses in London, prices were down 3.4% in the year– UK house prices climb by just 0.4% in April, the slowest increase since 2008 for same period– Sales transactions fall by 19% and asking versus selling prices show turning into buyers’ market– Homeowner or not, buy physical gold to hedge falls in physical property

Editor: Mark O’Byrne

London house prices declined at the sharpest pace in nine years during the first quarter of 2018, the latest data from Halifax shows.

London house prices fell by 3.2% in the first three months of the year according to the

London House Prices See Fastest Quarterly Fall Since 2009 Crisis

April 25, 2018– London house prices fell by 3.2% in the first quarter – Halifax

– Brexit, financial and geo-political uncertainty lead to falls– Excluding sale of seven £10m-plus houses in London, prices were down 3.4% in the year– UK house prices climb by just 0.4% in April, the slowest increase since 2008 for same period– Sales transactions fall by 19% and asking versus selling prices show turning into buyers’ market– Homeowner or not, buy physical gold to hedge falls in physical property

Editor: Mark O’Byrne

London house prices declined at the sharpest pace in nine years during the first quarter of 2018, the latest data from Halifax shows.

London house prices fell by 3.2% in the first three months of the year according to the

Silver Bullion Remains Good Value On Positive Supply And Demand Factors

April 24, 2018– Silver bullion remains good value on positive supply and demand factors– Industrial demand set to continue to climb from 2017, into 2018 and beyond– Speculators are bearish on silver as net short positions in silver futures reach record– Investment demand sees silver ETF holdings at eight-month high of 665.4 million ozs– 2017 saw fifth consecutive annual physical deficit in scrap silver, of 26 moz– Global silver mine production fell 4% last year, 2nd consecutive year of decline– Fundamentals and speculative positions suggest silver may soon see strong gains

Editor: Mark O’Byrne

It’s been tough going for many silver bullion investors who look back fondly on silver’s surge to nearly $50/oz in 2011. But things are set

Jamie Dimon Warns Of Potential ‘Market Panic’

April 8, 2018Jamie Dimon Warns Of Potential ‘Market Panic’

– JPMorgan Chase CEO Jamie Dimon sees ‘chance of market panic’ – In annual letter to shareholders Dimon warns of increased inflation and interest rates – Concerned QE unwinding could cause chaos as ‘markets will get more volatile’ – Hard to look at the last 20 years in America “and not think that it has been getting increasingly worse.” – Positive about US economy over next year, but ignores record levels of world and government debt – Believes major buyers of US debt (e.g. China) could reduce their purchases of US government debt – Investors can protect portfolios with gold and silver bullion – U.S. debt and dollar crisis coming which will propel gold higher (see chart)

Silver Bullion: Should We Be Worried About Silver?

April 7, 2018Silver Bullion: Should We Be Worried About Silver?

– Bloomberg’s Mike McGlone silver “set to test the $18 an ounce resistance level” – LBMA report: volume of silver ounces transferred in February fell by 24% – Standard Chartered: gold-silver ratio and supply/demand fundamentals favour silver – Gold/silver ratio at near two-year high on silver’s underperformance – Silver COT reports remain more bullish than at any time in history – Silver expected to outperform gold as macro and industrial factors begin to drive price

The silver price has perhaps disappointed many investors of late. Two key institutional metrics released in the last fortnight may have made things worse, however not all is at it seems.

The latest

Brexit, Stagflation Pressures UK High Street

April 6, 2018Brexit, Stagflation Pressures UK High Street

– UK high street and wider consumer market feeling effects of financial crisis, Brexit and inflation – 350,000 retails jobs expected to disappear between 2016 and 2020 – Centre for Retail Research predicts 9,500 shops to close this year and 10,200 in 2019 – UK is ‘worst performing’ European market for new car registrations – Moody’s – UK’s growth outlook is the ‘worst in the G20’ – Institute of Fiscal Studies – Consumer spending grow just 1.3% in 2018, a seven-year low – Spending growth dropped by 2.6% since 2016 contributing to UK high street bankruptcies

The eponymous British High Street is on the verge of its biggest crisis since 2008. According to The Centre for

Gold Outperforms Stocks In Q1, 2018

April 3, 2018Gold Outperforms Stocks In Q1, 2018

– Gold signs off Q1 2018 with best run since 2011 – Gold price supported by safe haven demand, interest-rate concerns and inflation – Trade wars and concerns over equity market have sent investors towards gold – ETF holdings highest in nearly a decade – Goldman Sachs: ‘The dislocation between the gold prices and U.S. rates is here to stay’

Gold ended March with it’s best performance since 2011. The safe haven asset completed a third-quarterly rise thanks to a weaker dollar, interest-rate concerns, inflation nervousness and geopolitical tensions.

Gold’s finish for the quarter was its lowest quarterly rise seven years but price-supporting factors present a bullish environment going

“Stars Are Slowly Aligning For Gold” – Frisby

April 1, 2018“Stars Are Slowly Aligning For Gold” – Frisby

– Gold ends March with a third-quarterly gain, a feat not seen since 2011

– Impressive gains seen despite tightening of monetary policy from Federal Reserve

– Frisby – gold is set to break through technical resistance of $1,360

– Gold’s safe haven role back in focus with Trump trade wars and increasing geopolitical tensions

– Now is opportune time for investors to buy gold, ahead of next quarter

Bullion’s wrapping up a third quarterly gain, a feat not seen since 2011, and exchange-traded fund holdings are near the highest in a half-decade. Haven demand may also get a boost with foreign-policy hawks in the ascendant in Washington.

Spot bullion was steady at $1,324.23

Eurozone Faces Many Threats Including Trade Wars and “Eurozone Time-Bomb” In Italy

March 31, 2018– Eurozone threatened by trade wars, Italy and major political and economic instability – Trade war holds a clear and present danger to stability and economic prospects – Italy represents major source of potential disruption for the currency union

– Financial markets fail to reflect the “eurozone time-bomb” in Italy – Financial volatility concerns in Brussels & warning of ‘sharp correction’ on horizon

– Euro and global currency debasement and bank bail-in risks

Editor: Mark O’Byrne

Donald Trump believes trade wars are easy to win. Winning depends on who your opponent is. At the moment Trump’s target is seemingly China but it is becoming increasingly clear that the Eurozone (and wider EU) is very much also at the top

Silver Futures Report and JP Morgan Record Silver Bullion Holding Is Extremely Bullish

March 29, 2018– Silver Futures Report, JP Morgan Record Silver Bullion Holding Is Extremely Bullish– JP Morgan Continues Adding To Massive Silver Bullion Holdings (see chart)– Silver Speculators Go Short – Which Is Extremely Bullish– Stunning Silver COT Report: One For the Ages (see chart)

The silver futures Commitment of Traders (COT) report released last Friday was extremely positive and has most silver analysts calling for higher silver prices in the near term.

The COT data signaled we are close to bottoming and suggest that both gold and silver should make gains in the coming weeks and months. The data showed that the hedge funds and “Managed Money traders,” the “dumb money” speculators now have record short positions in

London House Prices Falling Sharply – UK’s Much Needed Wake-Up Call

March 28, 2018– London house prices falling at fastest pace since 2009 – Values fell by 2.6% in year through January – London house prices likely to be weakest in UK over next five years – Inflated prices make London property more exposed to economic and political shocks – Worries over house prices are having a knock-on effect in wider economy– Physical gold to act as much needed hedge against falling property prices

A new study by Acadata as covered by Bloomberg has found house prices in London are falling at their fastest pace since 2009. In the year through to January, London house prices have fallen by 2.6%. In the Greater London area they are down 0.8% in the last month alone.

Excluding London and the South West, annual

Global Trade War Fears See Precious Metals Gain And Stocks Fall

March 25, 2018– Market turmoil as trade war concerns deepen and Trump appoints war hawk Bolton

– Oil, gold and silver jump as ‘Russia China Hawk’ Bolton appointed

– Oil up 4%, gold up 2.2% and silver up 1.6% this week (see table)

– Stocks down sharply – Nikkei down 4.5%, S&P 4.3% & Nasdaq 5.5% – Bolton scares jittery markets already shell-shocked by US’ tariffs against China – Currency wars and trade wars tend to proceed actual wars – Gold now outperforming stocks year to date (see table)

Editor: Mark O’Byrne

Gold and silver have gained another 1% today as market turmoil deepens on concerns about global trade wars and actual war after the appointment of uber hawk John Bolton as national security adviser.

In response to increasing

Gold +1.8percent, Silver +2.5percent As Fed Increases Rates And Trade War Looms

March 24, 2018– Gold gained 1.8% and silver 2.5% to $1,333/oz and $16.60/oz yesterday

– Gold climbs as Fed increases interest rates by 0.25% – now 1.5% to 1.75% range

– Dovish Fed Chair Powell plans fewer than expected rate hikes in 2018 – Markets disappointed at lack of hawkish comments from new Fed Chair

– Dollar LIBOR rises to highest level since November 2008 – $200 trillion worth of dollar-denominated financial products including mortgages based off LIBOR – Trade wars look set to escalate and Trump expected to announce tariffs on Chinese imports today

Editor: Mark O’Byrne

Gold gained 1.7% and silver 2.5% to $1,333/oz and $16.60/oz respectively yesterday after the Federal Reserve announced a 25 basis point increase in rates

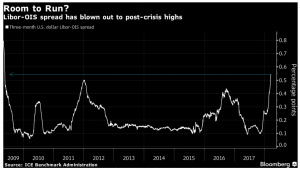

Credit Concerns In U.S. Growing As LIBOR OIS Surges to 2009 High

March 23, 2018Key Metric LIBOR OIS Signals Major Credit Concerns

– Widening of the spread between LIBOR OIS (overnight index swap) rate raises concerns – Spread jumped to 9 year widest spread, rising to 54.6bps, most since May 2009. – Libor recently moved to over 2% for first time since 2008 – Wider spread usually associated with heightened credit concerns

Editor: Mark O’Byrne

Major credit concerns are back as one of the key U.S. metrics, the LIBOR-OIS spread has been climbing sharply and is now higher than levels seen during the height of the eurozone sovereign debt crisis of late 2011 and early 2012. Indeed, it has risen to levels last seen at the height of the blogal financial crisis in 2009.

The spread has doubled since

Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony

March 15, 2018Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony

– Hungarian National Bank (MNB) to repatriate 100,000 ounces gold from Bank of England– Follows trend of Netherlands, Germany, Austria and Belgium each looking to bring gold back to home soil– Hungary one of the smallest gold owners amongst central banks, with just 5 tonnes– Central bank gold purchases continue to be major drivers of gold market– Russian central bank gold reserves now exceed those of China– Decisions to repatriate and increase gold reserves come as rifts between East and West widen

A country’s sovereignty is becoming the driving force of so many changes in the geopolitical sphere, today. Whether it is Brexit, surprise

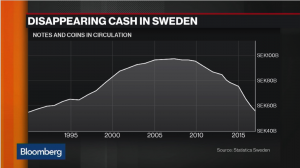

Gold Protects As Cashless Society Threatens Vulnerable

March 14, 2018Gold Protects As Cashless Society Threatens Vulnerable

– Swedish authorities concerned cashless society is happening ‘too quickly’ and heading into ‘negative spiral’– Only 25% of Swedes paid in cash at least once a week in 2017, 36% never use cash– Cash usage in Sweden falling both as share of GDP and in nominal terms– Sweden may be world’s first economy to introduce a cryptocurrency, the e-krona– Cashless is not a disincentive for illegal drug trade, Guardian finds– Gold in safe jurisdictions will protect against raids on cash and wealth

The total value of cash payments in Sweden is just 2% of GDP. Two-thirds of people rarely use cash and even homeless Big Issue sellers are accepting cards. These are the statistics

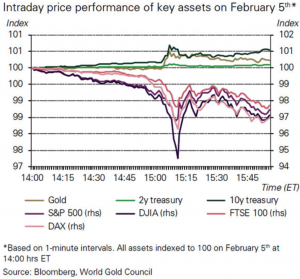

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

March 12, 2018Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

– Recent stock market selloff showed gold can deliver returns and reduce portfolio risk– Gold’s performance during stock market selloff was consistent with historical behaviour– Gold up nearly 10% in last year but performance during recent selloff was short-lived– The stronger the market pullback, the stronger gold’s rally– WGC: ‘a good time for investors to consider including or adding gold as a strategic component to their portfolios.’– Gold remains one of the best assets outperforming treasuries and corporate bonds

A recent World Gold Council (WGC) study has concluded that the market selloff on February 5th made the case for gold as both a diversifier and

Women’s Pension Crisis Highlights Dangers To Savers

March 11, 2018Women’s Pension Crisis Highlights Dangers To Savers

International Women’s Day highlights the underreported UK Women’s pension crisis

2.66 million affected by UK government’s change to state pension act

Women’s pension crisis is one of many in the UK, where there is a £710bn deficit for prospective retirees

Changes by government highlights the counterparty risks pensions are exposed to

Global problem as pensions gap of developed countries growing by $28B per day

Savers and investors should look to invest in gold as part of their pensions

– Click to enlarge

Imagine contributing to a pension throughout your working life only to be told that you won’t receive it when you expect to. When you receive this information

Gold Does Not Fear Interest Rate Hikes

March 9, 2018Gold Does Not Fear Interest Rate Hikes

– Gold no longer fears or pays attention to Fed announcements regarding interest rates

– Renewed interest in gold due to inflation fears and concern Fed won’t do enough to control it

– Higher interest rates on horizon will make debt levels unsustainable

– New Fed Chair warns “the US is not on a sustainable fiscal path” and could lead to an “unsustainable” debt load

– Higher interest rates are good for gold as seen in the 1970s and 2000s

– Gold markets aware that central banks are running out of financial weapons to deal with crises

You wouldn’t believe it by looking in the financial news but the price of gold has had a stellar run over the last few years. Since the beginning of

London Property Sees Brave Bet By Norway As Foxtons Profits Plunge

March 9, 2018London Property Sees Brave Bet By Norway As Foxtons Profits Plunge

– Sales in London property market at ‘historic lows’

– 65% fall in pre-tax profits in 2017 to £6.5m reported by London estate agents Foxtons

– Foxtons warns 2018 will ‘remain challenging’ for London property

– Norway’s sovereign wealth fund is backing London’s property market

– RICS: UK property stock hits record low as buyer demand falls

– Own physical gold to hedge falls in physical property

The world’s biggest sovereign state fund is backing the London property market. The news comes at a time when the UK capital’s real estate market is reportedly at ‘historic lows’ with conditions expected to remain challenging.

There is a risk that Norway’s

Digital Gold Provide the Benefits Of Physical Gold?

March 1, 2018– Will digital gold provide the benefits of physical gold?– Digital gold and crypto gold products claim to combine efficiencies of blockchain with value of gold– They are yet to provide the same benefits or safety as owning physical gold– National mints jumping in on the ‘sexy blockchain’ act – BOE declares bitcoin ‘not a currency;’ Royal Mint launches blockchain gold product– Digital gold, blockchain gold and crypto gold is frequently not fully backed, unallocated, pooled and unsecured gold holdings

Editor: Mark O’Byrne

At the beginning of last week Bank of England Governor Mark Carney claimed bitcoin was not a currency on the grounds that it is neither a medium of exchange or a store of value.

Scoffs aside about

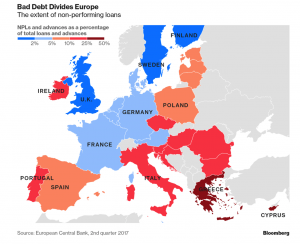

Bank Bail-In Risk In European Countries Seen In 5 Key Charts

February 22, 2018Bank Bail-In Risk In Europe Seen In 5 Charts

– Nearly €1 trillion in non-performing loans poses risks to European banks’– Greece has highest non-performing loans as a share of total credit

– Italy has the biggest pile of bad debt in absolute terms– Bad debt in Italy is still “a major problem” which has to be addressed – ECB– Level of bad loans in Italy remains above that seen before the financial crisis

– Deposits in banks in Greece, Cyprus, Italy, Ireland, Czech Republic and Portugal most at risk from bank bail-in

Editor: Mark O’Byrne

As reported by Bloomberg this week in an important article entitled ‘Five Charts That Explain How European Banks Are Dealing With Their Bad-Loan Problem’:

For European banks, it’s a

US-China Trade War Escalates As Further Measures Are Taken

February 21, 2018US-China Trade War Escalates As Further Measures Are Taken

– Trade war between two superpowers continues to escalate– White House likely to impose steep tariffs on aluminium and steel imports on ‘national security grounds’– US may impose global tariff of at least 24% on imports of steel and 7.7% on aluminium– China “will certainly take necessary measures to protect our legitimate rights.”– China is USA’s largest trading partner, fastest-growing market for U.S. exports, 3rd largest market for U.S. exports in the world.– If the U.S. continues to escalate its trade actions against China, experts say retaliation is likely.– Global markets are unprepared, investors should invest in gold to protect portfolios

–

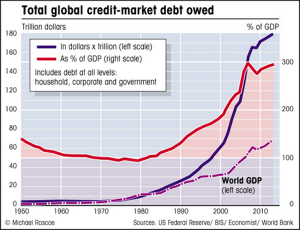

Read More »Global Debt Crisis II Cometh

February 18, 2018Global Debt Crisis II Cometh

– Global debt ‘area of weakness’ and could ‘induce financial panic’ – King warns– Global debt to GDP now 40 per cent higher than it was a decade ago – BIS warn

– Global non-financial corporate debt grew by 15% to 96% of GDP in the past six years

– US mortgage rates hit highest level since May 2014– US student loans near $1.4 trillion, 40% expected to default in next 5 years– UK consumer debt hit £200b, highest level in 30 years, 25% of households behind on repayments

Total Owed Global Credit Market Debt, 1950 – 2018 – Click to enlarge

The ducks are beginning to line up for yet another global debt crisis. US mortgage rates are hinting at another crash, student debt crises loom in both

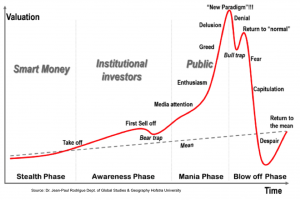

“This Is Where They Completely Lost Their Minds” – Hussman

February 11, 2018“This Is Where They Completely Lost Their Minds” – Hussman– Hussman warns ‘the S&P 500 to lose approximately two-thirds of its value over the completion of this cycle’– ‘the market has lost value, even since 2009, when overvalued, overbought, overbullish conditions were joined by divergent internals’– Believes the market is going to learn lessons about the crash ‘the hard way’

– Click to enlarge

In an almost prophetic blog post from John Hussman last week, we are warned about the bubble waiting to collapse in the US equity market and the hard lesson investors are about to learn.

Drawing on both his own experience and the work of the much revered Didier Sornette, Hussman looks at the current state of the US

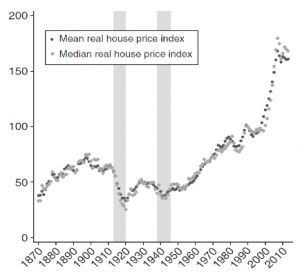

Brexit Risks Increase – London Property Market and Pound Vulnerable

February 9, 2018Brexit Risks Increases – London Property Market and Pound Vulnerable

– Brexit uncertainty deepens as UK government in disarray– BOE warns of earlier and larger rate hikes for Brexit-hit UK– UK property prices fall second month in row, London property under pressure

– No deal Brexit estimated to cost UK £80bn according to government analysis

– Transition period causing major uncertainty for UK and pound

– Pound expected to fall as Brexit fears remain into 2018

Editor: Mark O’Byrne

Real House Price Index, 1870 – 2018Source: VoxEU.org – Click to enlarge

Brexit risks have increased in recent days. A Reuters poll published on 8th February shows the pound is expected to fall this year as uncertainty around Brexit grows.

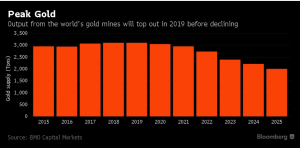

Peak Gold: Global Gold Supply Flat In 2017 As China Output Falls By 9 percent

February 8, 2018Peak Gold: 2017 Supply Flat As China Output Falls By 9%

– China gold production falls by 9% to 420.5t in 2017– Chinese gold demand rose 4% to 953.3t in same period– China is largest producer and accounts for 15% of global gold production– China does not export gold. Increasing foreign gold acquisitions to meet demand– Global gold production flat – 3,269t in ’17 from 3,263t in ’16, smallest increase since ’08– Peak Gold is here: supply set to fall gradually while global demand remains robust

Editor: Mark O’Byrne

World’s Gold Mines Futures, 2015 – 2025 – Click to enlarge

Financial markets are abuzz with how much money the global economy lost earlier this week when the Dow Jones Index had a bit of a crash – ahem –

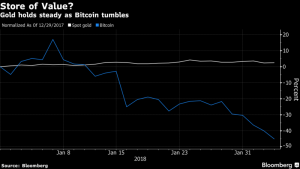

Crypto Currency Backlash Sees Flight From Cryptos and Bitcoin

February 7, 2018Crypto Currency Backlash Sees Flight From Cryptos and Bitcoin

– Bitcoin falls from $20,000 to below $6,000 and bounces back to $8000– Top 50 crypto currencies lost over 50% of value in 24 hours– Over $60 billion wiped off entire crypto currency market in 24 hours– Markets concerned about increased regulation, manipulation & country-wide bans– ‘Growing global unease about risks virtual currencies pose to investors and financial system’ – SEC– Gold acting as store of value from “correcting” stock markets & crashing cryptos

– Gold is essentially flat in recent days and building on its 11% gain in 2017

– Offline physical gold is safer than online digital gold

Editor: Mark O’Byrne

Gold Spot and Bitcoin Price, Jan

Read More »